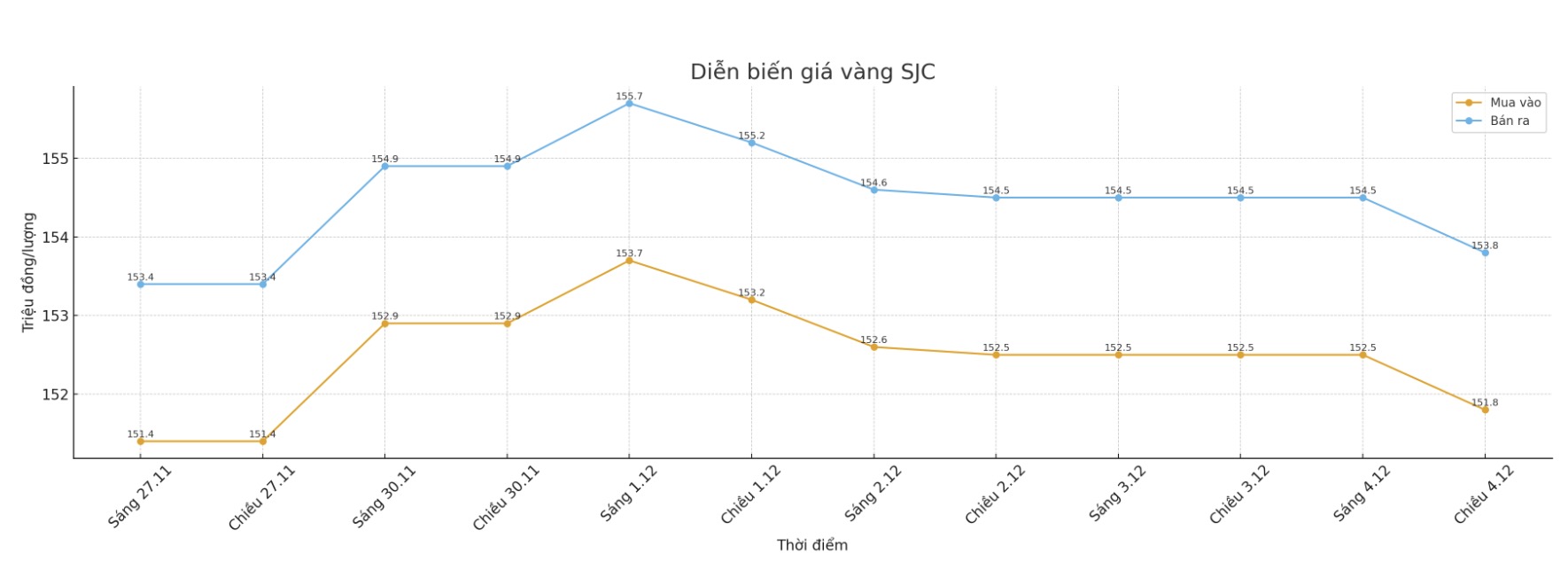

SJC gold bar price

As of 6:00 p.m., DOJI Group listed the price of SJC gold bars at 151.8 - 153.8 million VND/tael (buy - sell), down 700,000 in both directions. The difference between buying and selling prices is at 2 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 152.3- 153.8 million VND/tael (buy - sell), down 700,000 in both directions. The difference between buying and selling prices is at 1.5 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 150.8-153.8 million VND/tael (buy in - sell out), down 700,000 VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

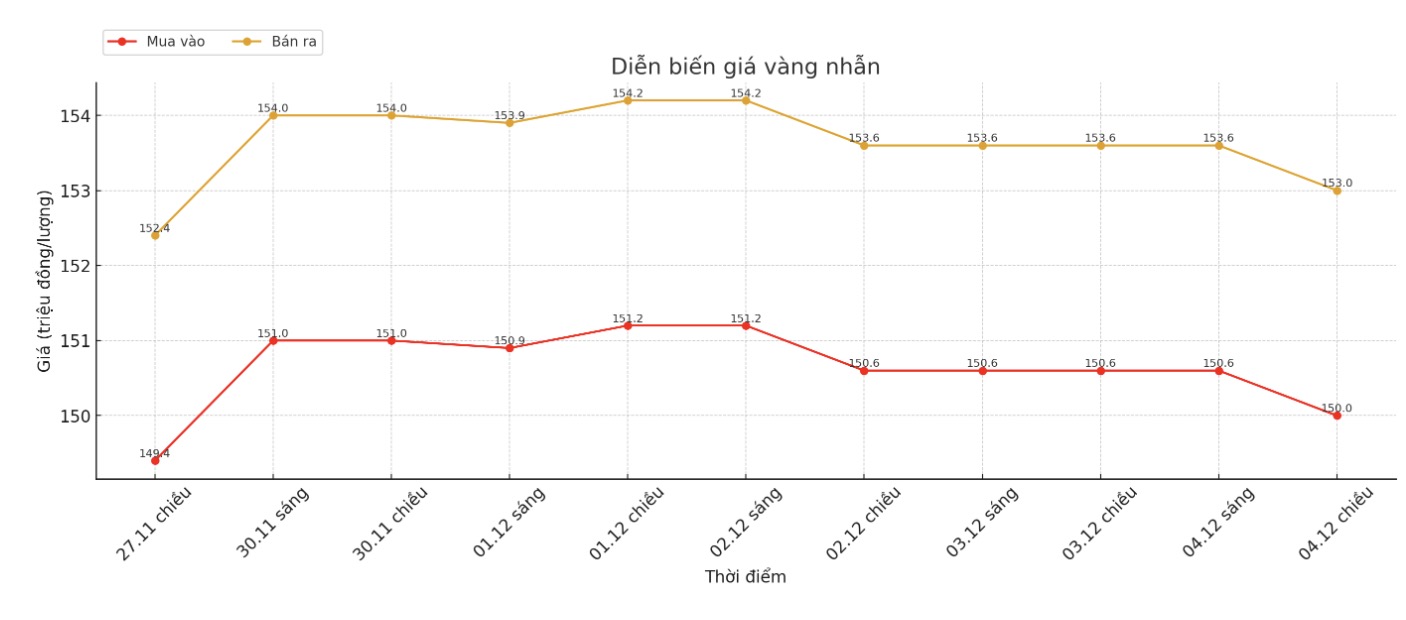

9999 gold ring price

As of 6:00 p.m., DOJI Group listed the price of gold rings at 150-153 million VND/tael (buy in - sell out), down 600,000 in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 150.3-153.3 million VND/tael (buy - sell), down 500,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 150-153 million VND/tael (buy - sell), down 600,000 VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

The high buying and selling distance increases the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

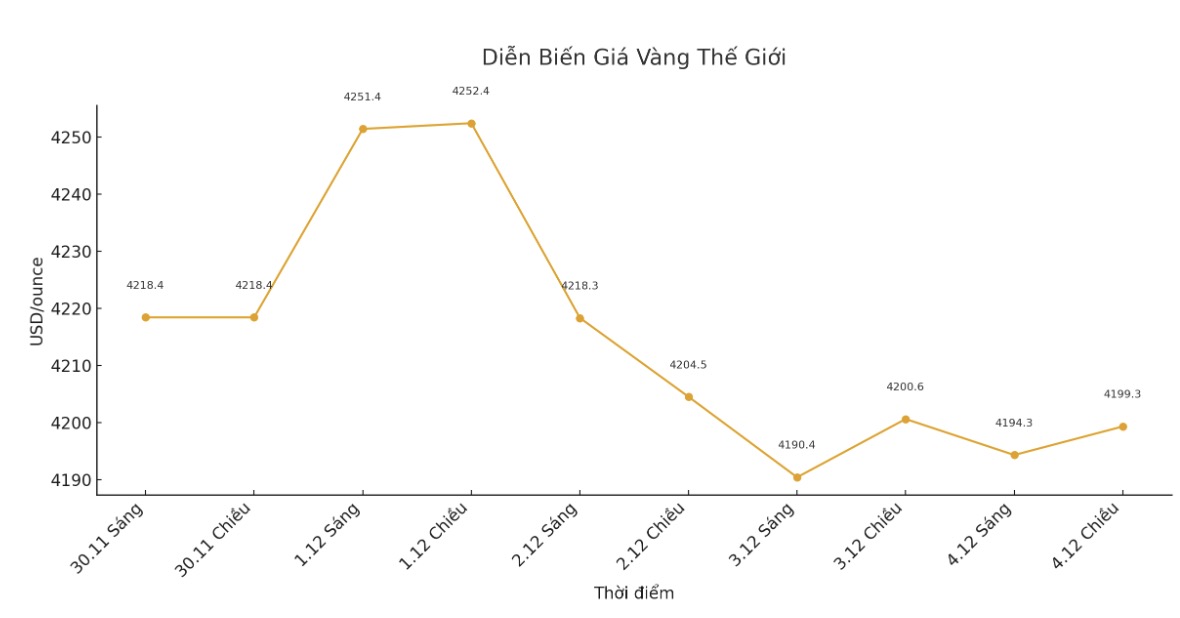

World gold price

The world gold price listed at 6:00 p.m., at 4,199.3 USD/ounce, decreased slightly by 0.9 USD compared to a day ago.

Gold price forecast

World gold prices fell slightly in Thursday's session as investors took profits and became cautious ahead of the US Federal Reserve's (Fed) meeting next week, in the context of the market waiting for more data to have clearer signals about the interest rate outlook.

As investors are somewhat hesitant ahead of the FOMC meeting, the general market is pricing in the possibility of a 25 basis point Fed rate cut... What the market needs right now is a new catalyst for gold prices to continue to rise, said Soni Kumari, commodity strategist at ANZ.

Ms. Kumari added that profit-taking activities continue and any decline around the $4,000/ounce threshold is likely to attract new buyers, given gold's solid foundation.

Although gold prices have not been able to hit the record in October (over 4,360 USD/ounce), the precious metal is currently trading "nearly at a reasonable value".

In a recent interview, Nitesh Shah - Head of Commodity & Macroeconomic Research at WisdomTree - said that with so much widespread instability in the global economy, it is no surprise that the gold market - despite strong fluctuations - continues to set higher support levels after each breakthrough.

After the strong rally in October, we saw a healthy correction, and I think the current rate is almost reasonable. Gold is doing exactly what people expect in a world with increased government debt and reduced interest rates," he said.

Although many investors focus on upside potential, Shah spent more time simulating the downside scenario.

He said gold is at risk of falling to $3,800 an ounce, but his model shows that the market is still well supported around this level.

The price could fall below $4,000/ounce, but that would require a huge effort. It is almost impossible," he said.

See more news related to gold prices HERE...