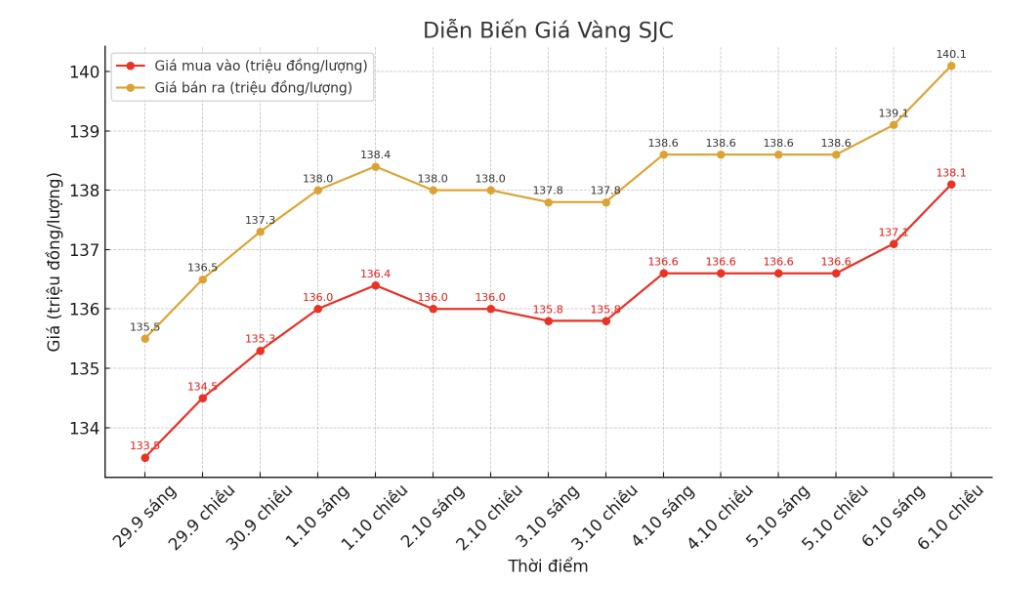

SJC gold bar price

As of 6:00 a.m., the price of SJC gold bars was listed by DOJI Group and Bao Tin Minh Chau at 138.1-140.1 million VND/tael (buy in - sell out), an increase of 1.5 million VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at 137.5-140.1 million VND/tael (buy - sell), an increase of 1.5 million VND/tael for buying and an increase of 1.3 million VND/tael for selling. The difference between buying and selling prices is at 2.6 million VND/tael.

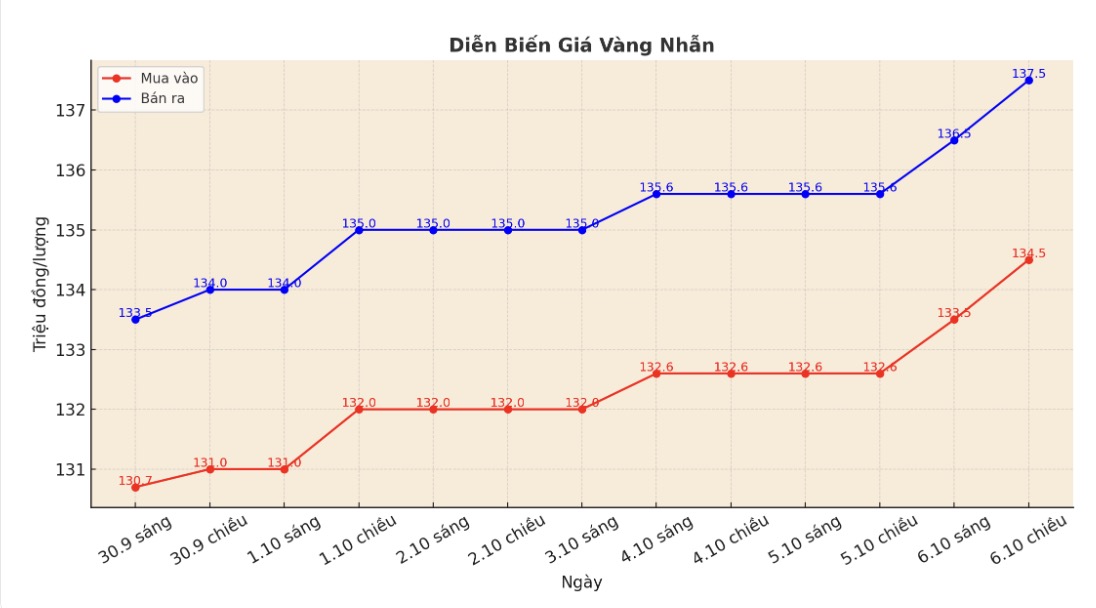

9999 gold ring price

As of 6:00 a.m., DOJI Group listed the price of gold rings at 134.5-137.5 million VND/tael (buy - sell), an increase of 1.9 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 135.3-138.3 million VND/tael (buy - sell), an increase of 1.7 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 134.5-137.5 million VND/tael (buy in - sell out), an increase of 2 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

The buying-selling gap is pushed up too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

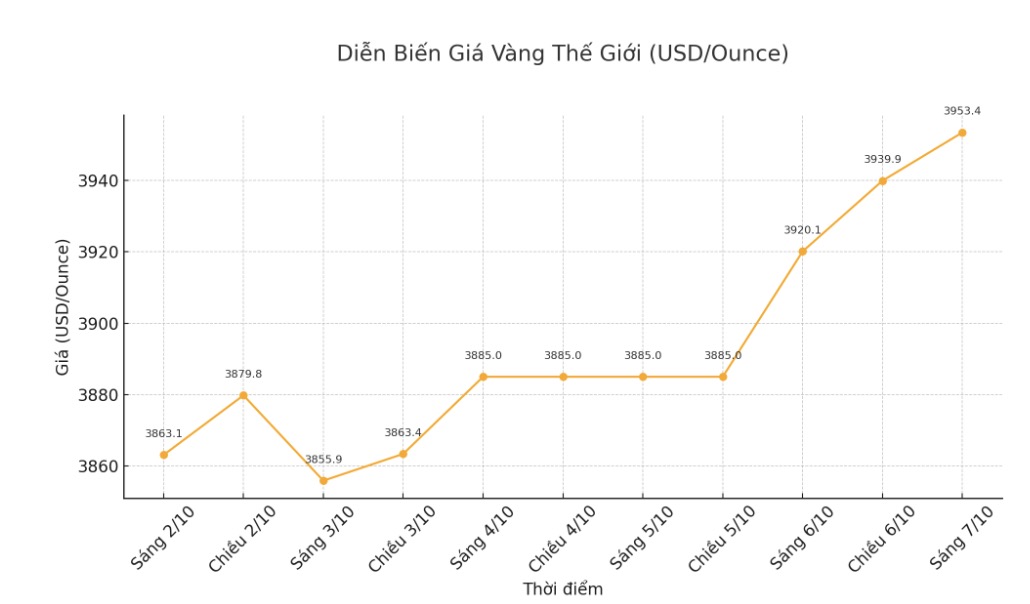

World gold price

The world gold price was listed at 0:40 at 3,953.4 USD/ounce, up 68.4 USD.

Gold price forecast

Mr. Lukman Otunuga - senior analyst at FXTM commented: "Considence in gold is still being strongly strengthened thanks to the prolonged US government shutdown".

There may be a wave of buying under the fear of missing out (FOMO) at current prices, but for many others, it may feel like the financial boat has left the dock, independent expert Ross Norman said.

Investors are now predicting the Fed will cut interest rates by 0.25 percentage points at its meeting this month, and another 0.25 percentage points in December.

We see both fundamental factors and technical drivers supporting golds rally, and now forecast prices to reach $4,200/ounce by the end of the year, UBS Bank wrote in a report.

Technically, December gold futures are maintaining a strong near-term technical advantage. The next upside target for buyers is to close above the solid resistance zone of $4,000/ounce.

On the contrary, the seller will need to push the price below the support zone of 3,750 USD/ounce to regain the advantage. The immediate resistance level is 3,973.7 USD/ounce and then 4,000 USD/ounce; the closest support is 3,925 USD/ounce and 3,900 USD/ounce.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...