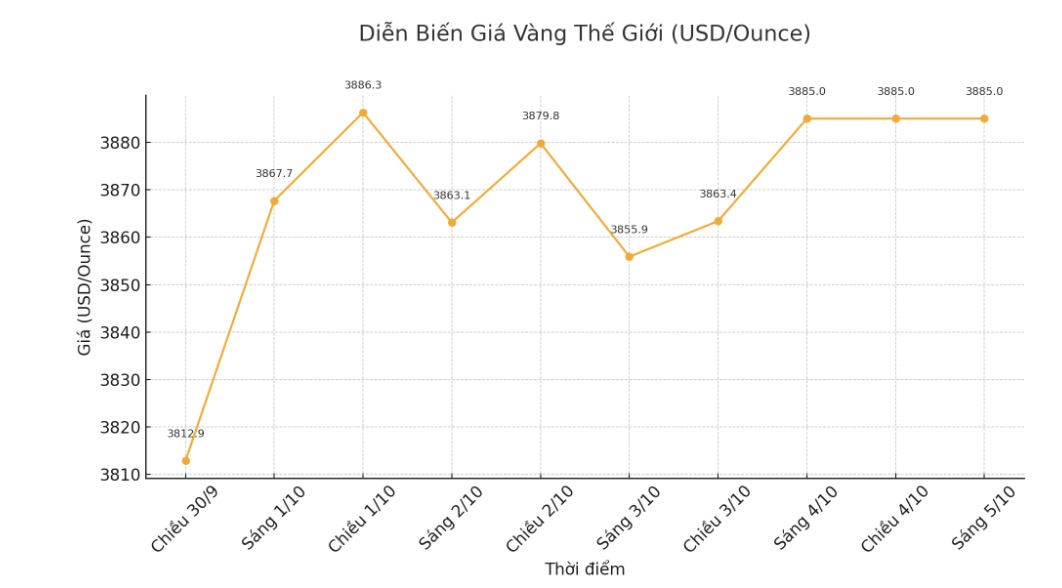

After a strongest month of increase in decades, investors' profit-taking caused gold prices to close the trading week below $3,900/ounce - at least temporarily.

However, it is difficult to see any significant downside risks for gold, as the fundamental supporting factors remain extremely solid. The drivers have helped gold prices increase by more than 40% since the beginning of the year - the best annual increase since 1979 that is still increasing.

In fact, a new element could be added to the list, which is the US government's shutdown.

The US Congress's failure to unanimously pass a new budget bill has only been short-lived, so the immediate economic impact is unclear. However, if this deadlock continues, the consequences for the US economy will become increasingly serious.

According to initial estimates, the US economy could lose about $7 billion a week if this situation continues. A note from the White House Economic Advisory Council (ked by Politico) even said the figure could reach $15 billion/week.

Some predict the closure could last for about 11 days. However, even if the country's parliament reaches an early agreement, the budget deadlock could still affect the US's international reputation.

In the context of the US having applied many tough tax and trade policies under President Donald Trump, maintaining international trust becomes even more important.

Last month, the market recorded a wave of divestment from the USD and a shift to gold. In this week's report, JPMorgan (one of the largest banks in the US) called this trend "the debasement trade".

According to this bank, individual investors are gradually losing confidence in legal documents, worrying about long-term inflation and the situation of currency depreciation due to prolonged high budget deficits in many major economies.

They arrived a little late, as central banks have been doing this for the past three years - quietly diversifying reserves away from the US dollar and into gold.

However, JPMorgan believes that gold's rally has now entered a new phase, as private equity begins to pour into the market. Data shows that investment demand in gold ETFs increased to a record level in September.

Mr. Aakash doshi - Head of Gold Strategy at State Street Investment Management said that September was a record month for SPDR Gold Shares (NYSE: GLD) - the world's largest gold ETF fund. The GLD recorded a surge of 35.2 tonnes in gold in September, with net capital flow of 18.9 tonnes in September 19 alone the largest one-day increase in history.

It is noteworthy that despite a spectacular increase in September, the total amount of gold held by global ETFs has not yet surpassed the record reached in 2020.

See more news related to gold prices HERE...