Mr. Daniel Pavilonis - senior commodity broker at RJO Futures - commented that the impact of the US Government's closure on the Fed's ability to assess employment data is insignificant.

I dont think the Fed depends entirely on government data, which has recently tended to be significantly different from forecasts. The Fed will definitely have its own data set to monitor, he said.

He said the market had a slight reaction to the cautious statements of FED officials over the weekend, but only for a short time. Gold prices fell slightly after FED Chairman Dallas Lorie Logan said they did not want to cut interest rates too strongly and then had to raise them again. But overall, everything is accumulating for a bounce.

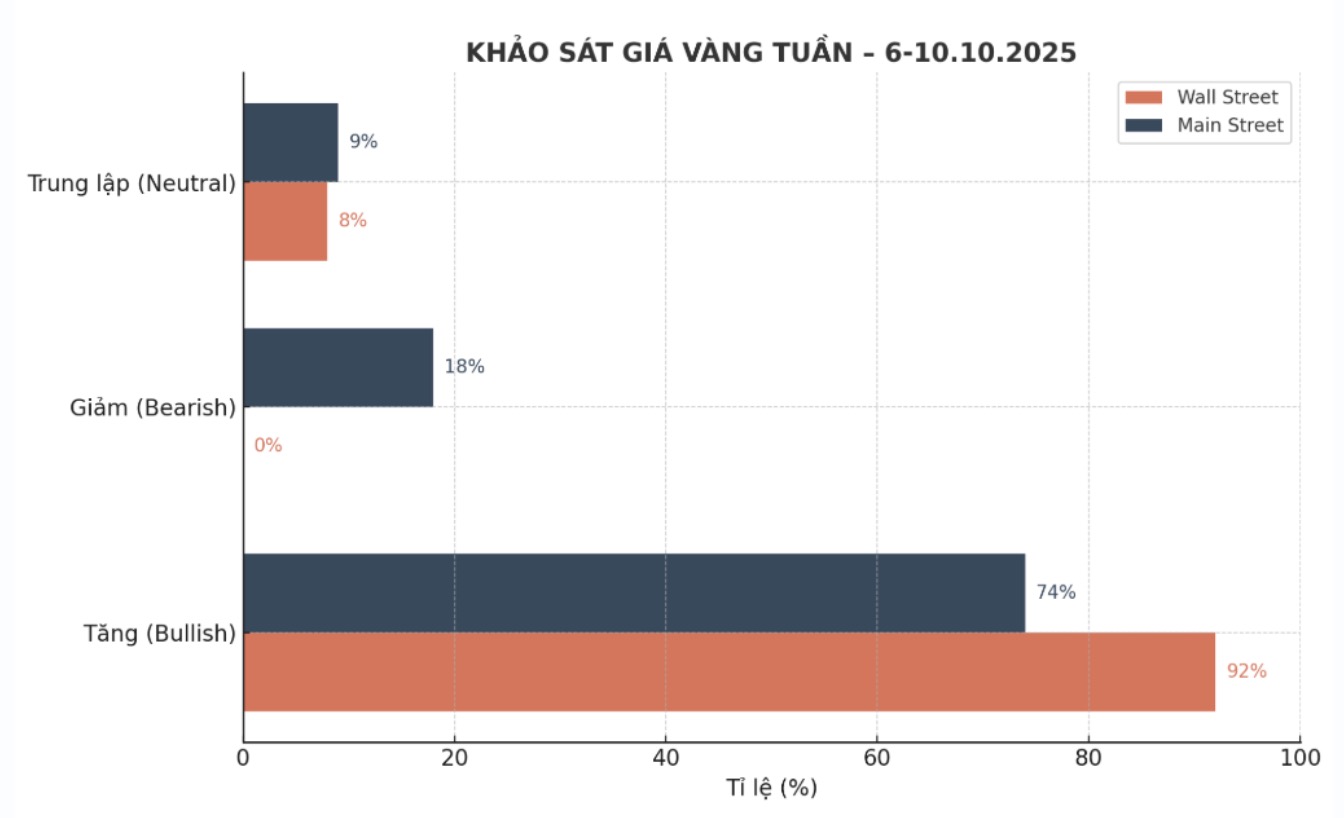

In the current price range, there is always a group of investors loyal to gold. But now new cash flow from outside is starting to pour in, looking for a stronger breakthrough. I think the "fear of missing out" (FOMO) mentality is gradually emerging, which could push prices higher," said Pavilonis.

According to him, this is also clearly shown in the silver market. Crybery prices are hitting $48 an ounce, just about $2 away from a historical peak. If this mark is broken, there will be a lot of room to increase.

As for gold, a huge market that is unlikely to rotate quickly, long-term cash flow is still persistently accumulating, Pavilonis commented.

He recounted the story to a veteran trader who witnessed the US separating the US dollar from gold, when gold prices increased from 35 to 300 USD/ounce. If we look at Elliott wave models and current conditions, the possibility of gold prices reaching $8,000 to $10,000/ounce by 2030 is possible, he added.

Alex Kuptsikevich - senior analyst at FxPro, predicted that gold prices will increase for the 8th consecutive week. The US governments closure is becoming a new driver for the rally, as disagreements between the two governments of the Democratic and Republican governments have further strained the situation. The decline in the USD index and Treasury yields, along with increased demand for safe-haven assets, are creating a "custom" for gold in the context of expectations of the FED to cut interest rates more deeply and for a longer time," he said.

He said that in September, ETFs specializing in gold recorded the largest capital increase in three years.

Thanks to rising prices, gold reserves of exchange-traded funds have reached record highs in USD. The strong increase in investment demand, along with the fact that central banks in many countries are actively buying physical gold, is fueling this increase. Some major banks such as Deutsche Bank and Goldman Sachs also predict that gold prices could reach 4,000, even 5,000 USD/ounce.

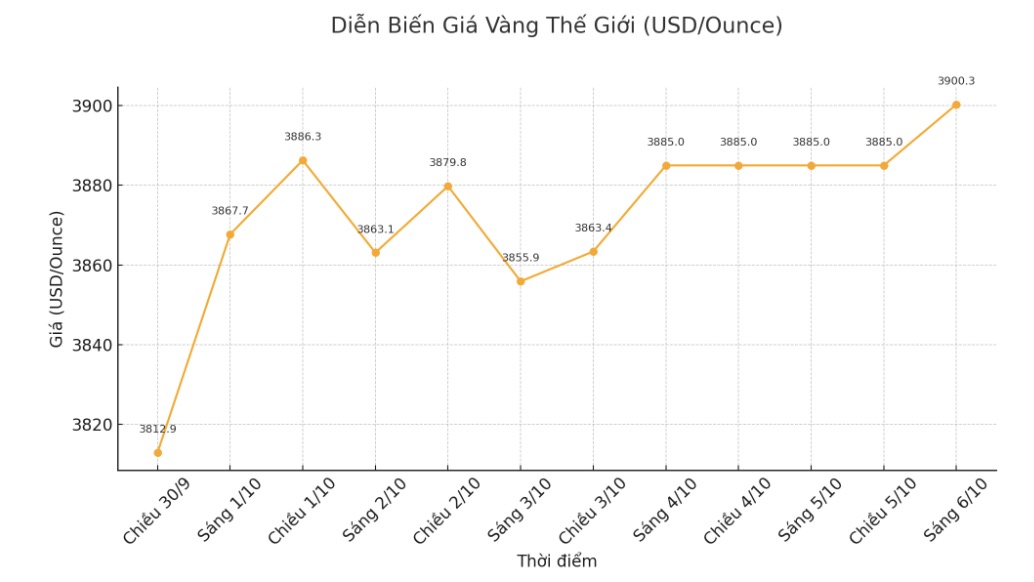

Kuptsikevich wrote: Gold prices have just ended their 7th consecutive week of increase, after 18 weeks of accumulation. Technically, the market is forming an upward triangle model with the goal of surpassing the threshold of 4,000 USD/ounce. The strong rally of other precious metals shows that investors are taking this trend very seriously.

Michael Moor - founder of Moor Analytics - also believes that gold prices will continue to increase next week. "Gold prices will rise, unless prices return to break the pattern mentioned in the low time frame," he said, citing the technical thresholds he has been monitoring since 2018, showing that gold is still maintaining a strong trend over many time frames.

Jim Wyckoff - senior expert at Kitco also believes that gold prices are still going up: "The chart for sustainable increase signals, safe-haven purchasing power remains stable".

See more news related to gold prices HERE...