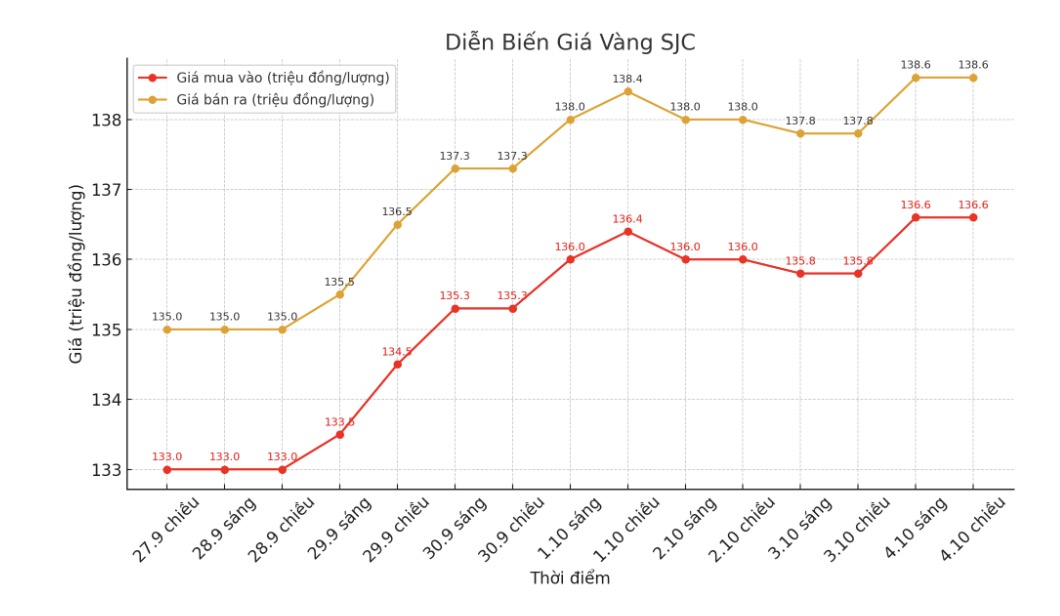

SJC gold bar price

As of 7:00 p.m., the price of SJC gold bars was listed by DOJI Group and Bao Tin Minh Chau at 136.6-138.6 million VND/tael (buy in - sell out), an increase of 800,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at 136-138.8 million VND/tael (buy - sell), an increase of 900,000 VND/tael for buying and an increase of 1 million VND/tael for selling. The difference between buying and selling prices is at 2.8 million VND/tael.

9999 gold ring price

As of 7:00 p.m., DOJI Group listed the price of gold rings at 132.6-135.6 million VND/tael (buy - sell), an increase of 600,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 133.6-136.6 million VND/tael (buy - sell), an increase of 800,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 132.5-135.5 million VND/tael (buy in - sell out), an increase of 500,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

The buying-selling gap is pushed up too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

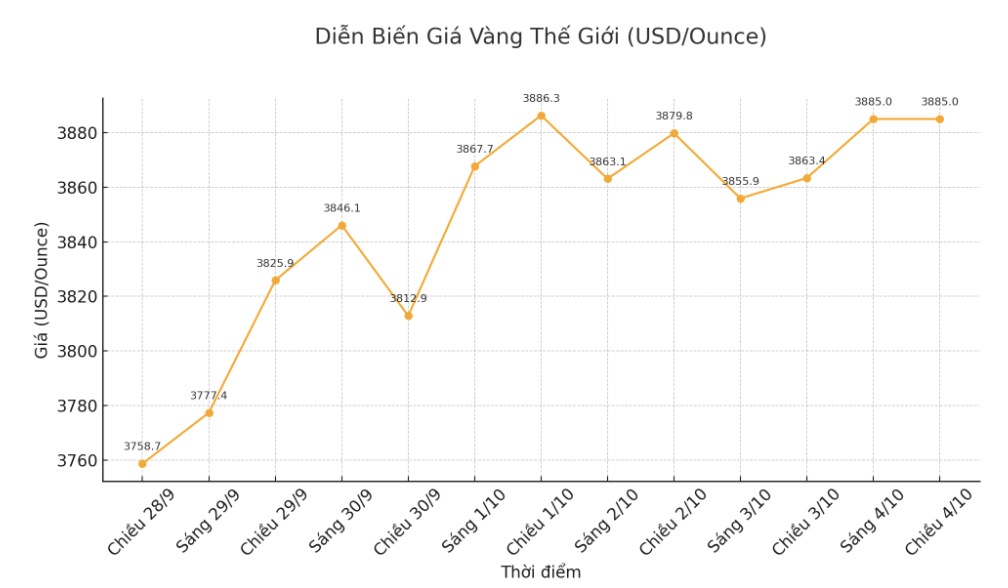

World gold price

The world gold price was listed at 19:00 at 3,885 USD/ounce, up 21.6 USD compared to a day ago.

Gold price forecast

Gold prices are under selling pressure when they are stopped at the threshold of 3,900 USD for two consecutive days, but experts say that the precious metal still has many upward motivations in the fourth quarter of 2025.

In the Q4/2025 outlook report, Fawad Razaqzada - Market Analyst at City Index and FOREX.com commented that gold prices could reach 4,000 USD/ounce by the end of this year, but did not rule out risks.

With an increase of more than 40% since the beginning of the year and on track to record the best annual increase since 1979, Mr. Razaqzada said it was difficult to ignore the increase in gold, despite emphasizing that the precious metal was in a state of extremely overbought.

"The signs of overbought are flickering, but price action is still steady in the uptrend. When there is no clear sign of reversal on the chart, it can be considered a confirmation of what we already know: the trend is very strong" - he wrote.

Notably, Mr. Krishan Gopaul - Senior analyst for EMEA at the World Gold Council (WGC) said that in August, central banks net bought 15 tons of gold after suspending them in July. Kazakhstan leads with 8 tons, increasing reserves to 316 tons; Bulgaria and China, Turkey, Uzbekistan, the Czech Republic, and Myanmar all buy about 2 tons more each country.

China recorded the 10th consecutive month of gold purchases, bringing total reserves to over 2,300 tons.

Bulgaria currently has 43 tons and is expected to partially shift to the ECB when it joins the eurozone in early 2026. Turkey increased its reserves to 639 tons, the Czech Republic to 65 tons after 30 consecutive months of purchase. Ghana reached 36 tons. Russia (3 tons) and Indonesia (2 tons) are the two banks that only sell gold.

Although Poland has temporarily stopped buying, it still holds the position of the largest buyer this year with 67 tons, bringing the total reserve to 515 tons and aiming to increase the gold ratio from 20% to 30% in total foreign exchange reserves.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...