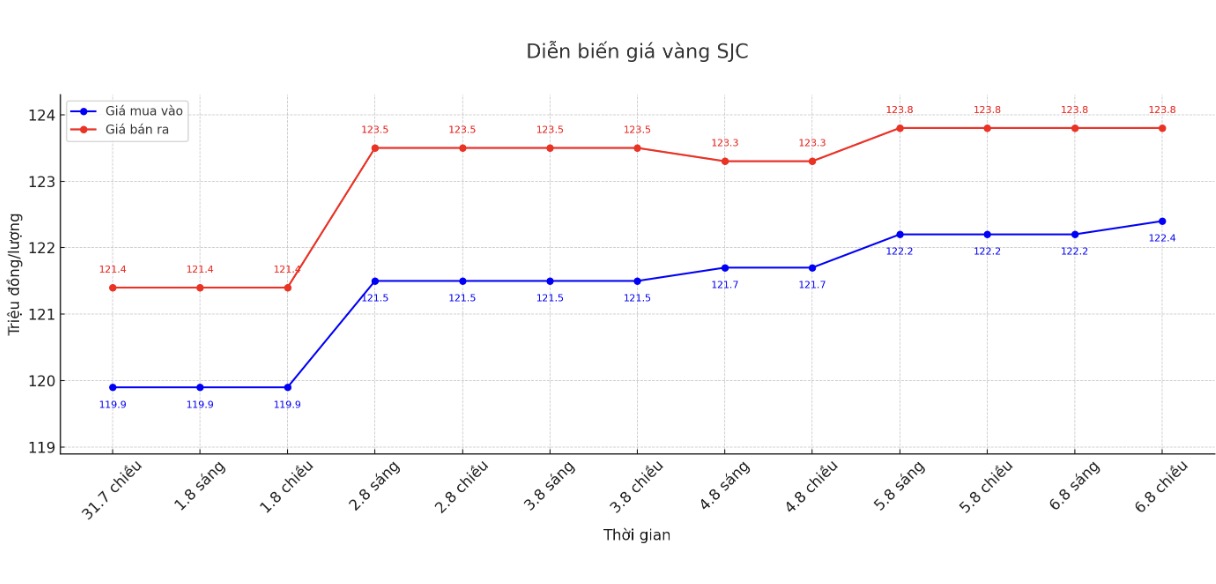

SJC gold bar price

As of 6:00 a.m. on August 7, the price of SJC gold bars was listed by Saigon Jewelry Company at VND122.4-123.8 million/tael (buy - sell), an increase of VND200,000/tael for buying and unchanged for selling. The difference between buying and selling prices is at 1.4 million VND/tael.

DOJI Group listed at 122.2-123.8 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling prices is at 1.6 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 122.4-123.8 million VND/tael (buy - sell), an increase of 200,000 VND/tael for buying and kept the same for selling. The difference between buying and selling prices is at 1.4 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 121.2-123.8 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling prices is at 2.6 million VND/tael.

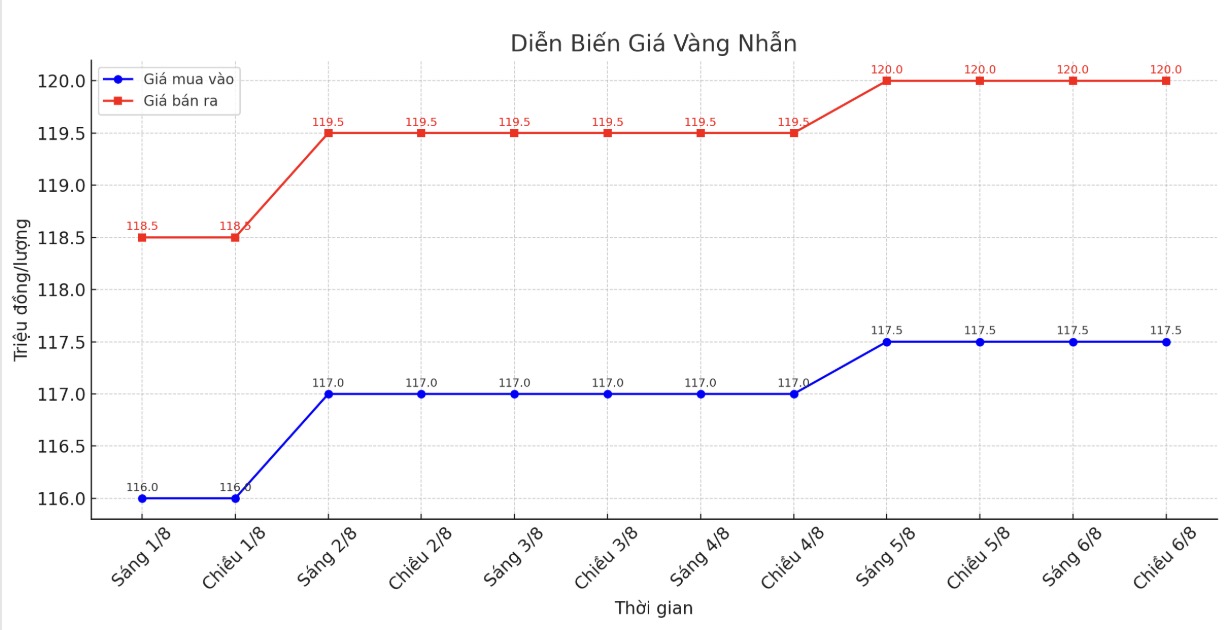

9999 gold ring price

As of 6:00 a.m. on August 7, DOJI Group listed the price of gold rings at 117.5-120 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling is 2.5 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 117.8-120.8 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 116.5-119 seven million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling is 3 million VND/tael.

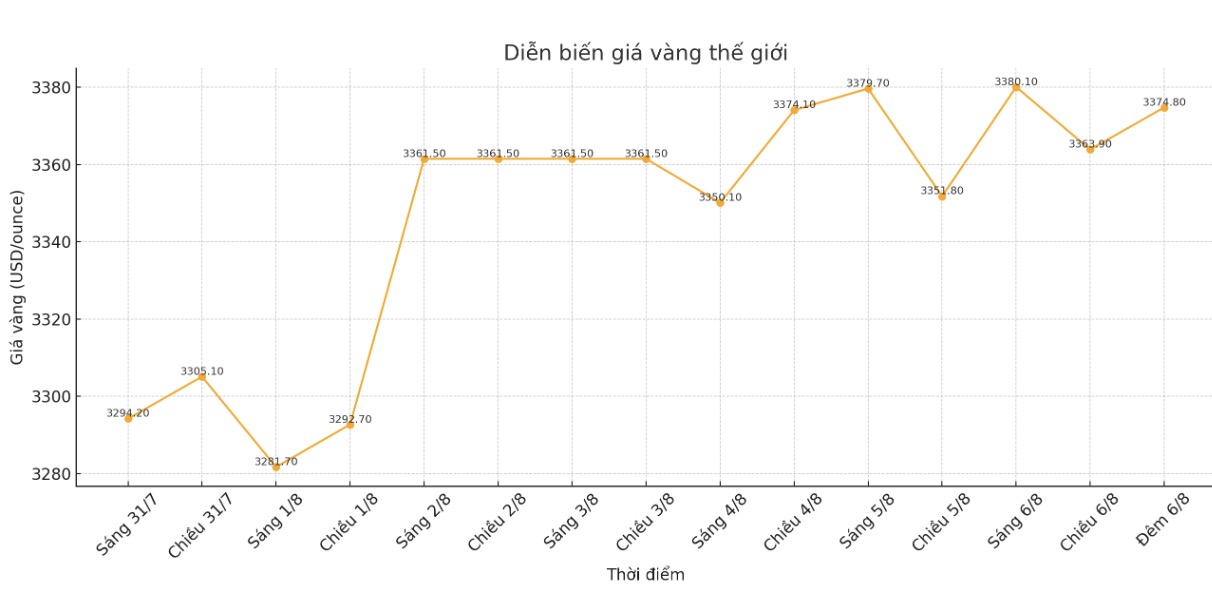

World gold price

The world gold price was listed at 22:30 on August 6 at 3,374.8 USD/ounce, down slightly compared to a day ago.

Gold price forecast

World gold prices are under pressure to take profits and sell activities from investors surfing the short-term market. In addition, a slight improvement in risk-off sentiment in the middle of the week is also a disadvantage for safe-haven metals such as gold.

December gold futures fell $12.7 to $3,422 an ounce. September silver futures rose $0.057 to $17.88/ounce.

The European and Asian stock markets mostly increased their points during the overnight session. US stock indexes are also expected to open slightly higher when entering the trading session in New York.

Some news agencies said that the amount of physical gold stored at warehouses linked to the Shanghai Stock Exchange has increased to an all-time high, showing that demand for gold in China is still strong.

More than 36 tons of gold have been registered for delivery to futures contracts, as traders and banks take advantage of the price difference between gold futures and physical gold.

Mr. John Reade - senior market strategist of the World Gold Council commented: "This shows that the demand for gold trading in China is currently very strong".

Technically, December gold buyers are still holding a short-term advantage. The next upside target for buyers is to get the closing price above the strong resistance level at the July peak of 3,509 USD/ounce.

The next downside target for the bears is to push prices below the solid technical support level at $3,300/ounce. The first resistance seen at the peak of the week was $3,444.9/ounce, followed by $3,450/ounce. First support at the bottom of this week is $3,397.9/ounce, then $3,350/ounce.

For outside markets, the USD index is weakening. Nymex crude oil futures increased and are currently trading around 66.25 USD/barrel. The yield on the US 10-year Treasury note is around 4.236%.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...