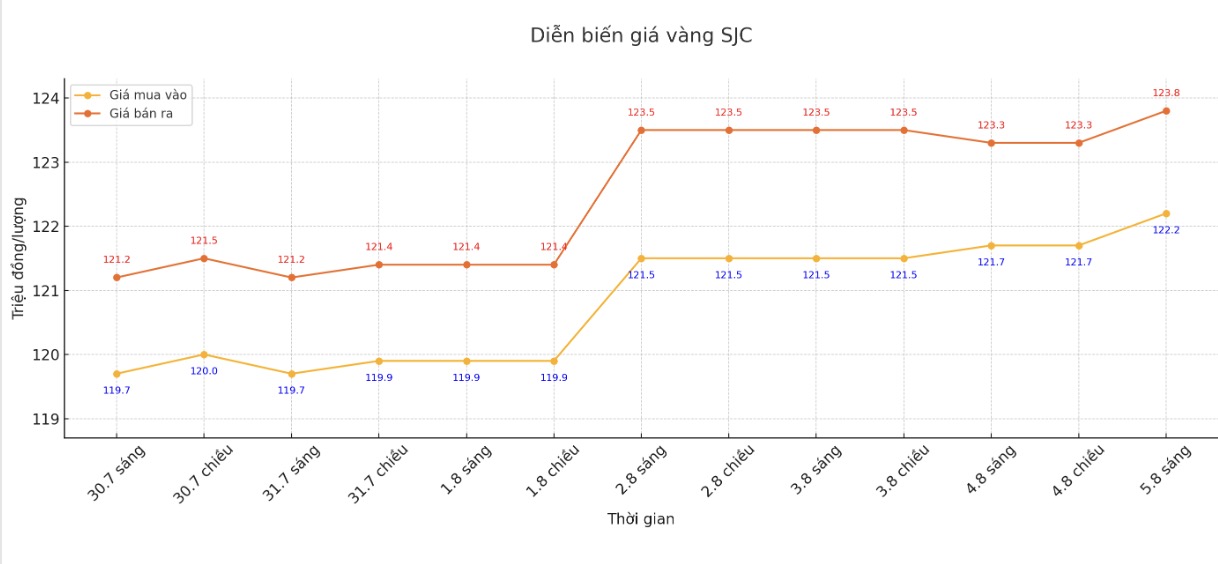

Updated SJC gold price

As of 9:00 a.m., DOJI Group listed the price of SJC gold bars at VND122.2 - 123.8 million/tael (buy - sell), an increase of VND500,000/tael in both directions. The difference between buying and selling prices is at 1.6 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 122.2-123.8 million VND/tael (buy - sell), an increase of 500,000 VND/tael in both directions. The difference between buying and selling prices is at 1.6 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 121.2-123.8 million VND/tael (buy - sell), an increase of 500,000 VND/tael in both directions. The difference between buying and selling prices is at 2.6 million VND/tael.

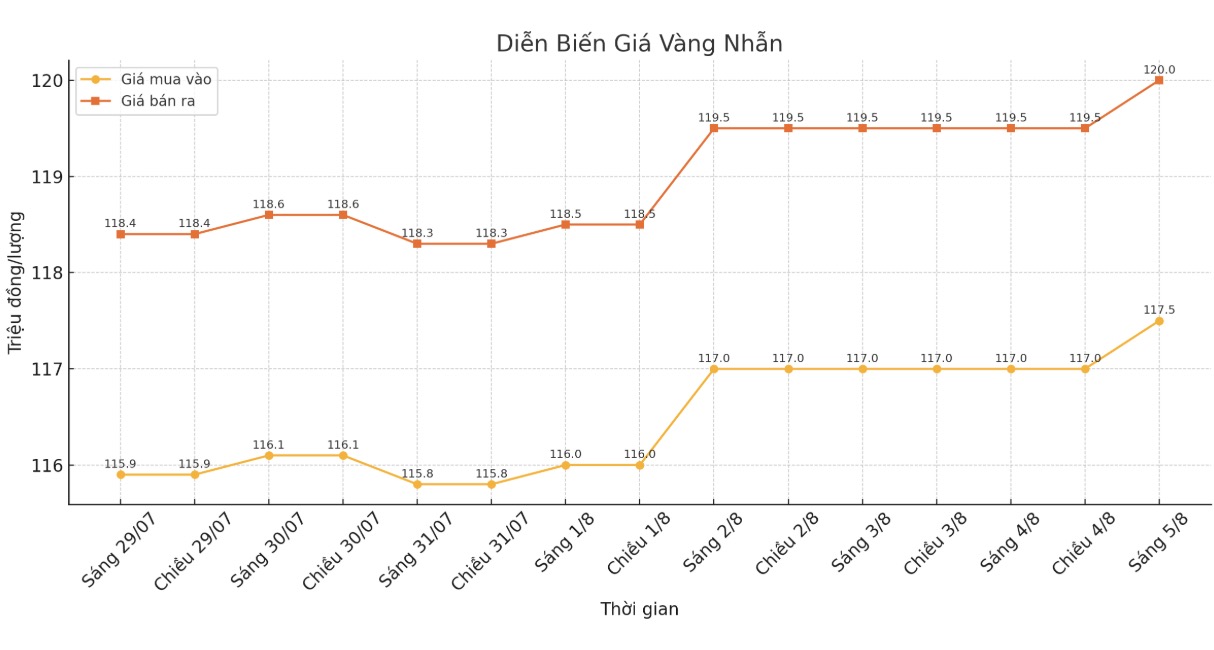

9999 round gold ring price

As of 9:00 a.m., DOJI Group listed the price of gold rings at 117.5-120 million VND/tael (buy in - sell out), an increase of 500,000 VND/tael in both directions. The difference between buying and selling is 2.5 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 117.8-120.8 million VND/tael (buy - sell), an increase of 600,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 116.5-119 seven million VND/tael (buy in - sell out), an increase of 700,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

The buying-selling gap is pushed up too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

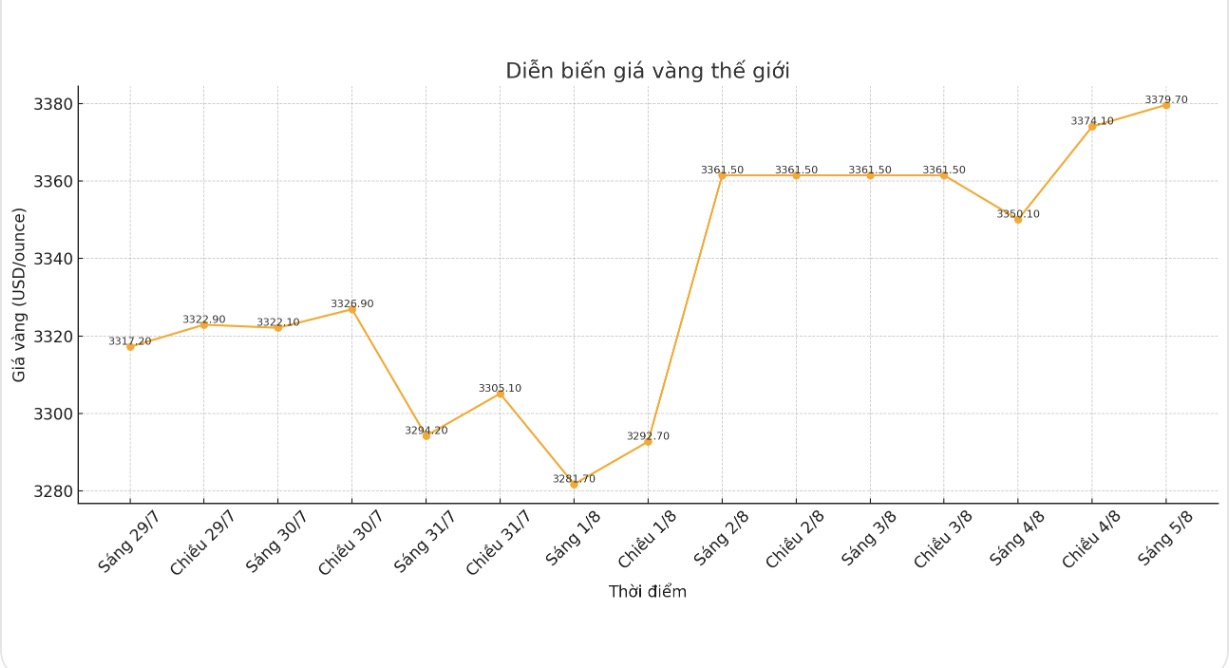

World gold price

At 9:00 a.m., the world gold price was listed around 3,379.7 USD/ounce, up 29.6 USD/ounce.

Gold price forecast

Gold prices increased near the middle of the second trading session of Monday, supported by expectations that the US Federal Reserve (FED) will cut interest rates in September, after the gloomy US economic report released last Friday - a clear signal of loose monetary policy trends.

Despite the price increase, gold is facing strong competition from stocks, reducing the increase of gold and silver. At the end of the previous trading session, the Dow Jones index increased by 585.06 points (equivalent to 1.34%) to 44,173.64 points, erasing the sharp decline in the session on August 1. The S&P 500 index increased by 1.47% to 6,329.94 points, ending a streak of 4 consecutive sessions of decline and recording the best increase since May 2025. Nasdaq composite index increased by 1.95%, up to 21,053.58 points.

According to the World Gold Council, gold prices are likely to increase sharply in the context of complicated global geopolitical and economic situations. If risks such as inflation and economic recession become more obvious, investors will turn to gold as a safe haven.

Conversely, if global trade improves in a stable and sustainable direction, this could increase yields and promote risk-off sentiment, thereby weakening the role of gold. In addition, if central bank buying pressure decreases, this will also be a factor that puts pressure on the price of this precious metal.

Citi Financial Group has just raised its gold price forecast to $3,500/ounce in the next 3 months, a sharp increase compared to the forecast in June. The reasons come from concerns about the US economic downturn, inflation due to tariffs, a weakening USD and geopolitical tensions.

Citi also raised its expected trading range to $3,300 - $3,600/ounce. The bank said demand for gold has increased by more than 33% since mid-2022, largely thanks to investment cash flow, central bank purchases and durable jewelry consumption. This is a reversal compared to the optimistic forecast six weeks ago.

Technically, December gold buyers are dominating in the short term. The next upside target for buyers is to close above the strong resistance level at the July peak of 3,509 USD/ounce.

Meanwhile, the downside target for the bears is to pull prices below strong technical support at $3,300/ounce. The first resistance level was seen at $3,450/ounce, followed by $3,480/ounce. First support was at last night's low of $3,397.9, followed by $3,350/ounce.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...