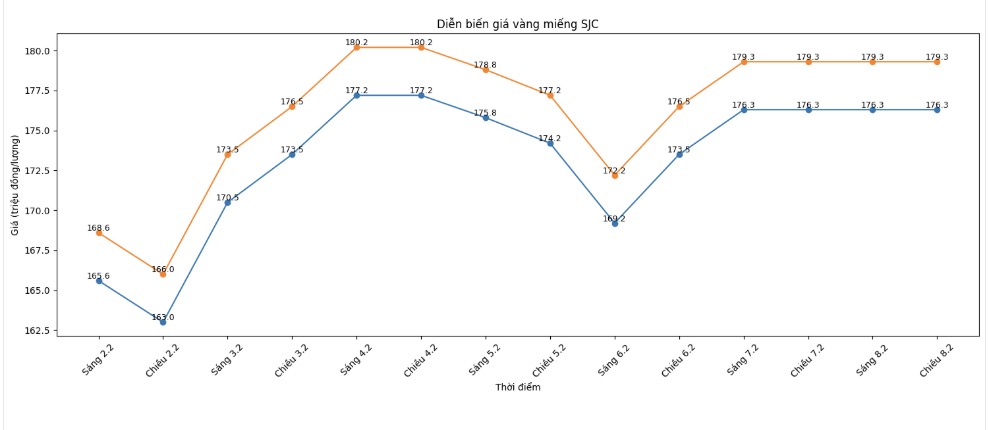

SJC gold bar price

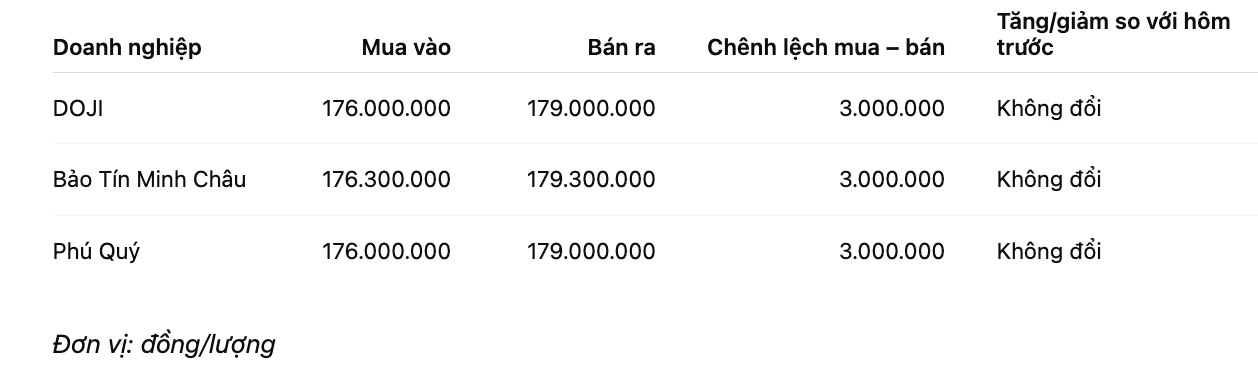

As of 6:00 AM, SJC gold bar prices were listed by DOJI Group at 176.3-179.3 million VND/tael (buying - selling). The difference between buying and selling prices is at 3 million VND/tael.

SJC gold bar price is listed by Bao Tin Minh Chau at the threshold of 176.3-179.3 million VND/tael (buying - selling). The difference between buying and selling prices is at the threshold of 3 million VND/tael.

Phu Quy Jewelry Group listed SJC gold bar prices at 176.3-179.3 million VND/tael (buying - selling). The difference between buying and selling prices is at 3 million VND/tael.

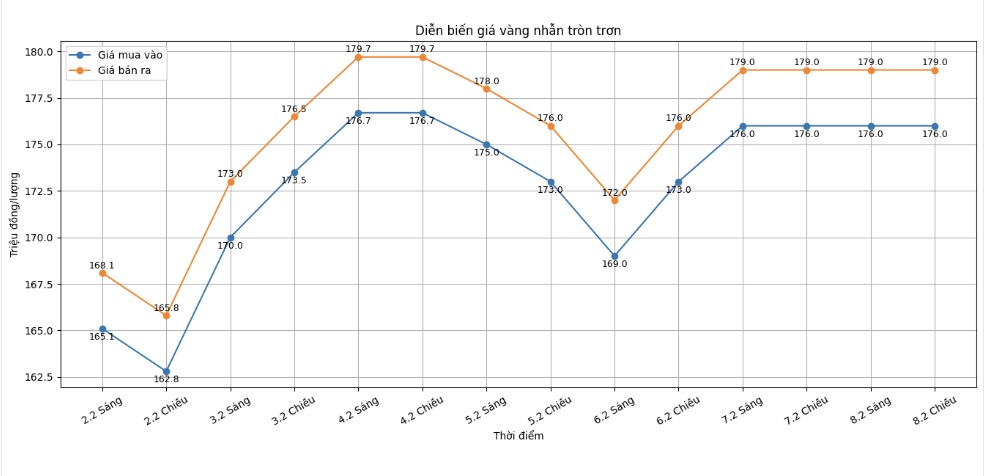

9999 gold ring price

As of 6:00 AM, DOJI Group listed the price of gold rings at 176-179 million VND/tael (buying - selling). The buying - selling difference is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 176.3-179.3 million VND/tael (buying - selling). The buying - selling difference is at 3 million VND/tael.

Phu Quy Gold and Gems Group listed the price of gold rings at 176-179 million VND/tael (buying - selling). The buying - selling difference is at 3 million VND/tael.

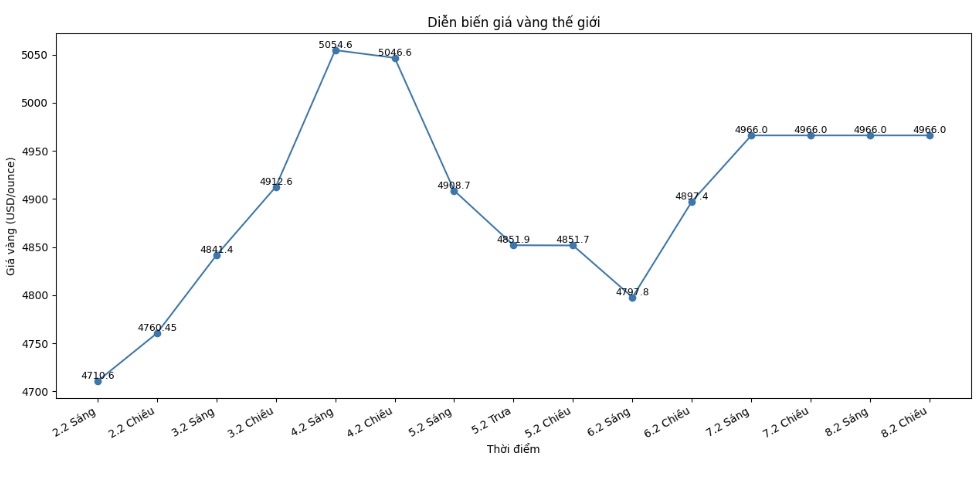

World gold price

At 6:00 AM, world gold prices were listed around the threshold of 4,966 USD/ounce.

Gold price forecast

Kitco News' latest weekly gold survey shows that market sentiment has improved significantly after a week of strong fluctuations. Notably, Wall Street analysts are clearly leaning towards a positive scenario for gold prices this trading week, while individual investors still maintain a dominant optimistic view, although sentiment is still affected by previous losses.

In a survey with 18 Wall Street experts participating, up to 12 people, equivalent to 67%, predict that gold prices will return above the 5,000 USD/ounce mark this week. Only 2 experts (11%) believe that gold prices may continue to fall, while the remaining 4 opinions (22%) assess that the risk of increase - decrease is in a balanced state.

On the side of individual investors, Kitco's online survey results with 329 votes showed that 64% of participants expect gold prices to continue to rise. However, the forecast rate of decrease and sideways is still relative, reflecting a cautious sentiment after a rare period of volatility in the precious metals market.

According to assessments by Wall Street experts, the strong recovery of gold prices from the recent bottom has significantly improved the technical structure in the short term. The 5,000 USD/ounce mark continues to play an important psychological threshold, both as a price increase target and as a zone that can activate profit-taking pressure if the recovery momentum is not sustainable enough.

Some analysts believe that after a strong correction, the market needs more time to consolidate the price base. However, the main trend still leans towards the possibility of upward accumulation, as fundamental drivers such as the central bank's gold buying demand, geopolitical risks and medium-term interest rate expectations have not changed significantly.

This week, the gold market is forecast to be affected by a series of important economic events. First is the election in Japan, which could strongly affect the Yen and the bond market. Next, the US will announce retail sales, delayed non-farm payrolls, weekly unemployment claims and the consumer price index (CPI). These data will play a key role in shaping the interest rate expectations of the US Federal Reserve (Fed), thereby directly impacting gold price trends in the short term.

Gold price data is compared to the previous day.

See more news related to gold prices HERE...