Full set of current Vietcombank interest rates

According to the latest interest rate schedule, Vietcombank applies diverse savings interest rates depending on the deposit term. Specifically:

No term: 0.1%/year.

Short term (1 month, 2 months): 1.6%/year.

3 month term: 1.9%/year.

6 month and 9 month terms: 2.9%/year.

12 month term: 4.6%/year.

Long term (24 months, 36 months, 48 months, 60 months): 4.7%/year.

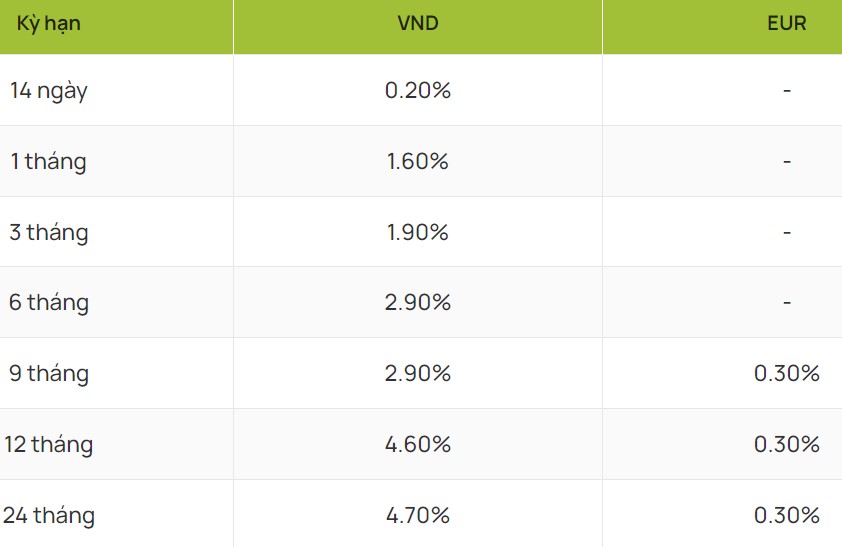

Online savings interest rates

Saving online via Vietcombank's digital banking application offers many conveniences. The online deposit process is quite quick, without having to go to the transaction counter, customers can deposit money anytime, anywhere via the digital banking application.

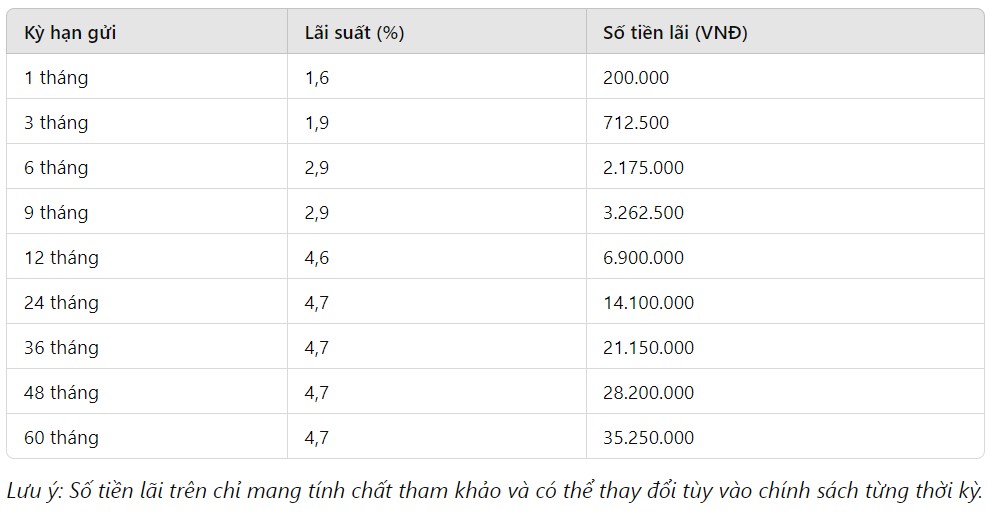

Calculate Vietcombank savings interest rate

With a deposit of 150 million VND, the amount of interest you receive will depend on the deposit term and applicable interest rate.

Although the current interest rate is somewhat lower than previous years, Vietcombank is still one of the safe and reliable choices with a diverse portfolio of savings products.

To optimize profits, you can choose the appropriate term. Longer terms of 12 months or more have higher interest rates, up to 4.7%/year. Readers can also use online services to take advantage of preferential interest rates when saving online.

In addition, you can learn about Vietcombank's preferential programs to receive higher interest rates. This bank often implements promotional programs for customers who deposit savings during holidays and Tet.

In addition, readers can refer to the interest rates of some other banks.

Many banks are listing interest rates at high levels, from 7% to 9%, but to enjoy this interest rate, customers must meet special conditions.

PVcomBank leads with a special interest rate of 9%/year for a 12-13 month term when depositing money at the counter. The condition is that customers must maintain a minimum balance of VND2,000 billion.

HDBank applies an interest rate of 8.1%/year for a 13-month term and 7.7%/year for a 12-month term, with the condition of maintaining a minimum balance of VND500 billion. In addition, an interest rate of 6% is applied for an 18-month term.

MSB listed interest rates of 8%/year for 13-month terms and 7%/year for 12-month terms. The condition is a minimum deposit of VND500 billion from newly opened or automatically renewed savings accounts from January 1, 2018.

Dong A Bank applies an interest rate of 7.5%/year for deposits with a term of 13 months or more, with a minimum amount of VND 200 billion. A 24-month term applies an interest rate of 6.1%/year.

Bac A Bank has the highest interest rate of 6.2%/year for terms of 18-36 months, with deposits of over 1 billion VND.

Interest rate information is for reference only and may change from time to time. Please contact the nearest bank transaction point or hotline for specific advice.