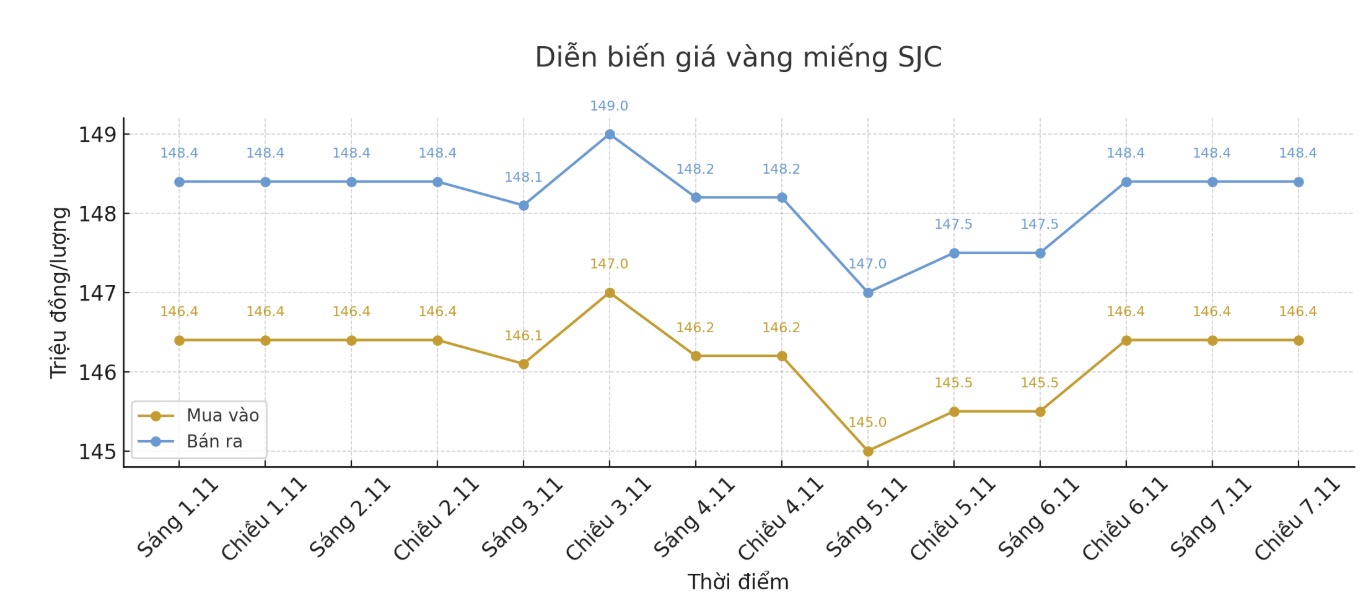

SJC gold bar price

As of 6:00 a.m., the price of SJC gold bars was listed by DOJI Group at 146.4-148.4 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling prices is at 2 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 146.9-148.4 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling prices is at 1.5 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 145.4-148.4 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling prices is at 3 million VND/tael.

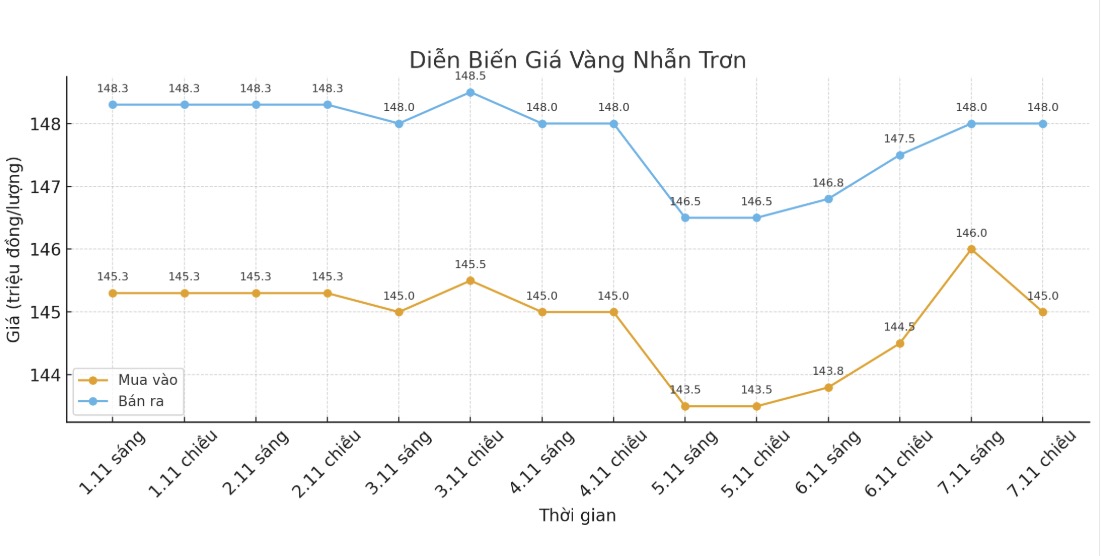

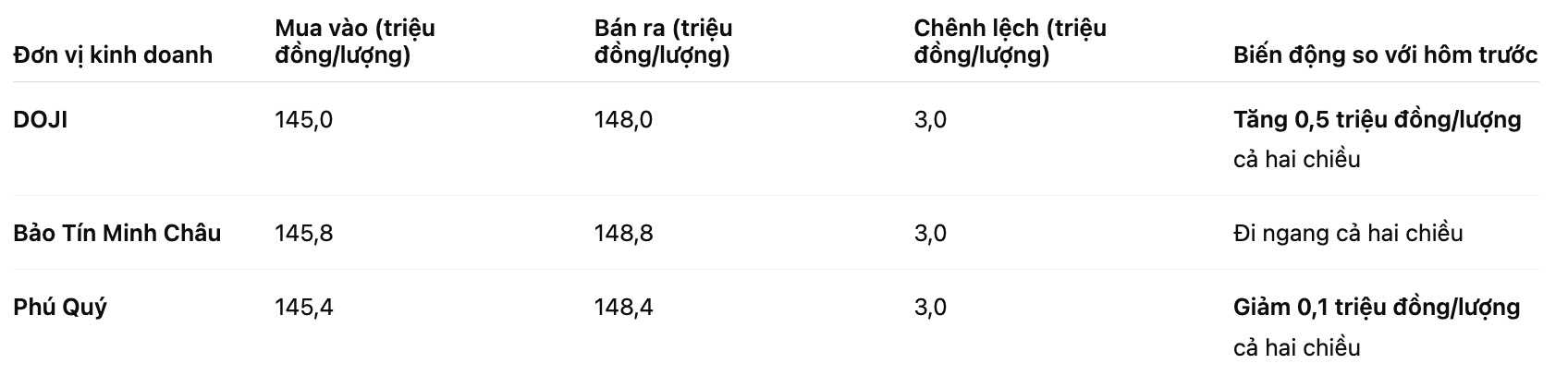

9999 gold ring price

As of 6:00 a.m., DOJI Group listed the price of gold rings at 145-148 million VND/tael (buy - sell), an increase of 500,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 145.8-148.8 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 145.4-148.4 million VND/tael (buy - sell), down 100,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

The high buying and selling distance increases the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

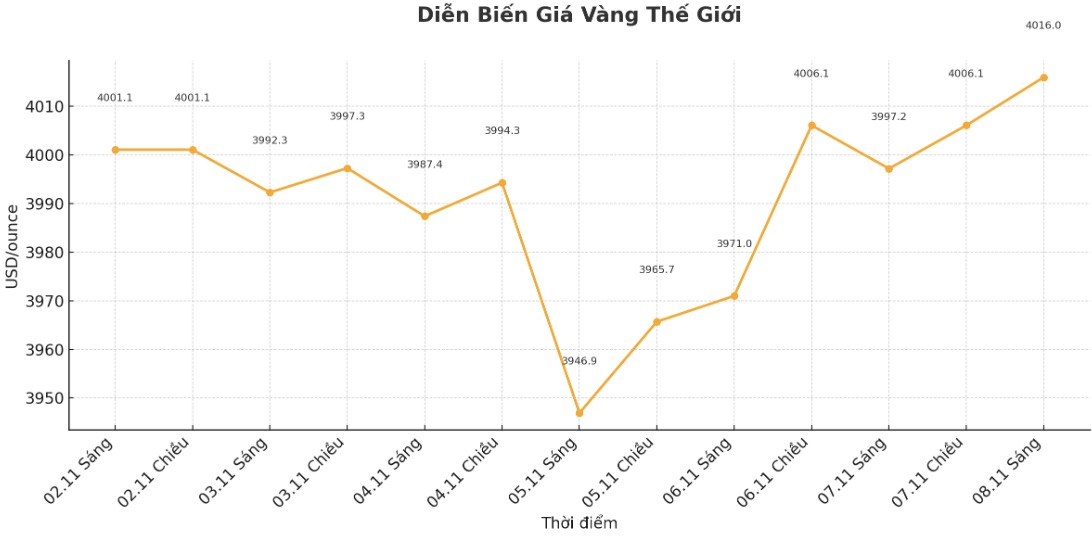

World gold price

The world gold price was listed at 0:00 at 4,016 USD/ounce, up 46.8 USD.

Gold price forecast

Gold prices increased, supported slightly by the weaker USD index and more stable crude oil prices. Investors and traders are watching US stock indexes, which have shown signs of weakening recently. If the US stock market is under strong selling pressure today, gold and silver - which are safe-haven assets - may be bought more.

The global stock market had mixed movements last night. US stock indexes are expected to open down in the New York session.

In India, gold exchange-traded funds (ETFs) are heading for record capital flows, with purchases this year reaching nearly 3 billion USD, equivalent to about 26 tons of gold, according to a report by the World Gold Council. The amount of investment in gold from the beginning of 2025 is nearly equal to the total net purchase value in the 2020-2024 period combined.

In China, exports unexpectedly fell in October due to global demand not being enough to offset the decline in goods exported to the US, according to Bloomberg.

China's exports fell 1.1% year-on-year, the first time in eight months. deliveries to all markets except the US increased by 3.1%, but not enough to cover the decrease of more than 25% to the US.

In October, China's crude oil imports generally decreased, reflecting a difficult economic environment, except for crude oil - the only commodity that recorded clear growth.

On the 34th day of a record-long US government shutdown, the US Federal Aviation Administration (FAA) has issued an order to cut flights nationwide. The order affects 40 airports in more than two dozen states, including major centers such as Atlanta, Dallas, Denver, Los Angeles and Charlotte (North Carolina). Some urban areas such as New York, Houston, Chicago and Washington have many affected airports, and the chain effect may extend to smaller airports.

External factors showed the USD index decreased slightly; crude oil prices increased and traded around 60 USD/barrel. The yield on the 10-year US Treasury note is currently at 4.1%.

The gold market operates through two main mechanisms: spot market, spot buying and selling prices; and futures market (futures), setting future delivery prices. December gold contract is currently the most actively traded on the CME exchange due to the liquidity characteristics at the end of the year.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...