Update SJC gold price

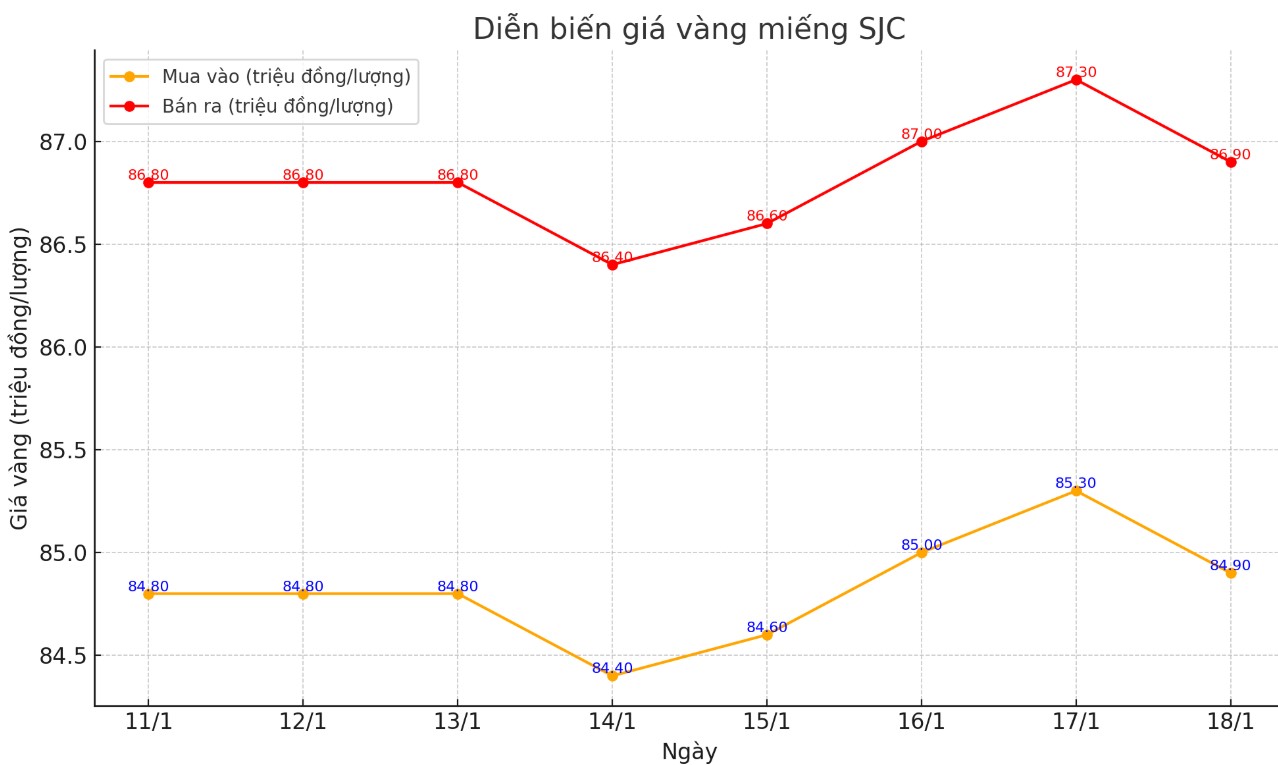

As of 11:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND84.9-86.9 million/tael (buy - sell); down VND400,000/tael for both buying and selling.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 2 million VND/tael.

Meanwhile, the price of SJC gold bars listed by DOJI Group is at 84.9-86.9 million VND/tael (buy - sell); down 400,000 VND/tael for both buying and selling.

The difference between buying and selling price of SJC gold at DOJI Group is at 2 million VND/tael.

Bao Tin Minh Chau listed SJC gold price at 84.9-86.9 million VND/tael (buy - sell); down 400,000 VND/tael for both buying and selling.

The difference between buying and selling price of SJC gold at Bao Tin Minh Chau is at 2 million VND/tael.

Currently, the difference between buying and selling gold prices is listed at around 2 million VND/tael. Experts say this difference is still very high. The difference between buying and selling prices is a factor that investors need to consider when participating in the gold market. It directly affects the ability to make a profit, especially in the short term.

9999 round gold ring price

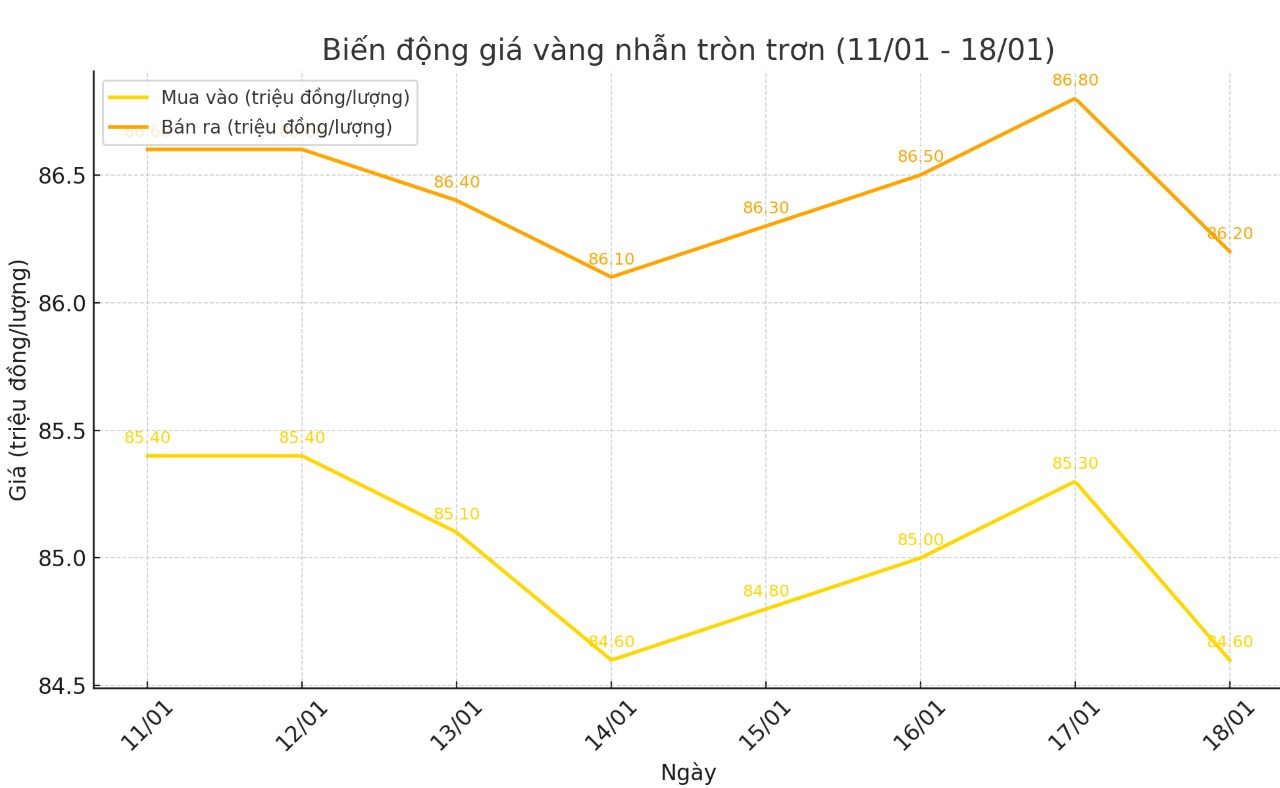

As of 11:00 a.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 84.6-86.2 million VND/tael (buy - sell); down 700,000 VND/tael for buying and down 600,000 VND/tael compared to early this morning.

Bao Tin Minh Chau listed the price of gold rings at 85.05-86.85 million VND/tael (buy - sell), down 700,000 VND/tael for buying and down 400,000 VND/tael for selling compared to early this morning.

World gold price

As of 11:00 a.m., the world gold price listed on Kitco was at 2,703.1 USD/ounce, down 13 USD/ounce compared to the beginning of the previous trading session.

Gold Price Forecast

World gold prices fluctuated sharply as the USD increased. Recorded at 11:10 a.m. on January 18, the US Dollar Index, which measures the greenback's fluctuations against six major currencies, was at 109,200 points (up 0.35%).

Gold prices fell as investors took profits after a recent rally, pushing the precious metal to a four-week high on Thursday, according to Kitco.

Asian and European stock markets edged higher overnight, while US indexes are expected to open higher at the start of the New York session. US indexes have rallied this week on the back of benign inflation reports released earlier in the week.

In a recent update, Kavita Chacko, Head of India Research at the World Gold Council (WGC), highlighted that gold is the “winner” in 2024 in India: “Despite the correction in gold prices in November and December, gold remains the top-performing asset class in India with a 21% YoY growth. However, gold’s return in INR terms is lower than the 26% gain in USD terms.”

Gold prices continued to decline in December, losing 2% after a 4% decline in November, to close at $2,610 an ounce. However, Chacko said this was largely a USD-related phenomenon, with gold prices in India much more stable. “In the domestic market, gold ended December down 0.4% amid volatile prices. Domestic jewelry demand has been sluggish since December.

Consumers are hesitant to buy gold jewellery due to high and volatile prices, as well as the unfavourable period in the Hindu calendar (mid-December to mid-January). The purchases are mainly linked to the wedding season. However, market reports show that investment demand for physical gold such as bars and coins remains strong, underscoring the investment appeal of gold," Chacko said.

David Meger, director of metals trading at High Ridge Futures, told CNBC that the weekend correction was largely profit-taking. Uncertainty over the policies that President Donald Trump is about to bring is one of the factors supporting gold.

There are a lot of questions about the status of tariffs and how they will be implemented, and many investors are looking to gold as a way to hedge against some downside risks if these new policies hurt growth, said Nitesh Shah, commodity strategist at WisdomTree.

See more news related to gold prices HERE...