Gold's unsuccessful efforts to surpass the $4,200/ounce mark this week have created a pessimistic short-term sentiment. Although the general sentiment in the market is quite gloomy, some experts still consider the declines as a strategic buying opportunity. Meanwhile, retail investors remain bullish on the precious metal.

The latest weekly gold survey by an international financial information platform shows that negative sentiment continues to cover the market

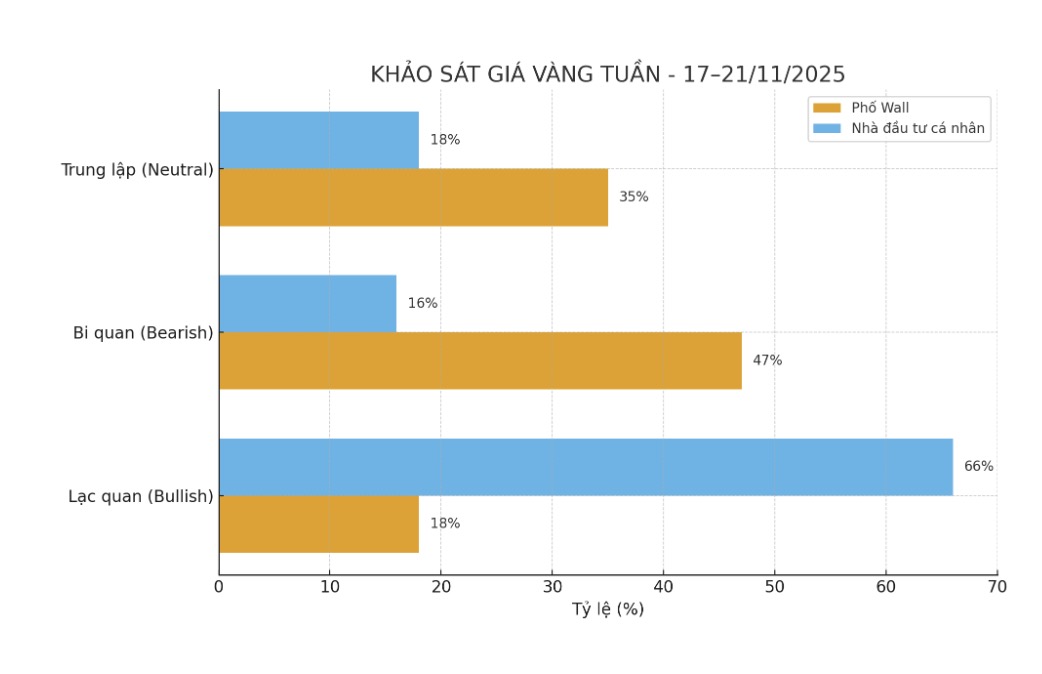

This week, 17 Wall Street experts participated in a gold price survey. Of these, eight (47%) predict gold prices will fall in the short term. Six experts (35%) are neutral for next week, while only three (18%) see prices continuing to rise.

Meanwhile, an online survey on social media recorded 230 votes. Of these, 151 people (65.7%) expect gold prices to rise next week. 38 (16.5%) forecast prices to fall and 41 (17.8%) remained neutral in the short term.

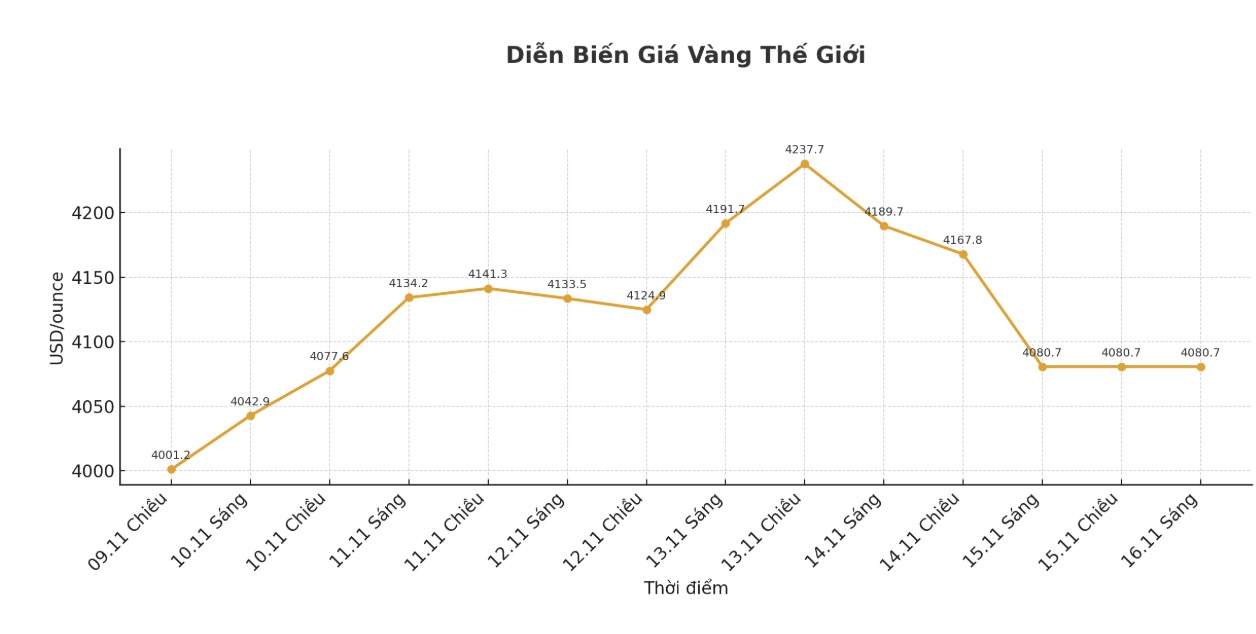

The caution of Wall Street analysts appeared after gold prices held the important support level of 4,000 USD/ounce on Friday, thereby creating strong buying momentum in the first half of the week. On Thursday, spot gold climbed to $4,245 an ounce before falling under strong selling pressure.

Some experts believe that the gold sell-off last weekend stemmed from expectations of changing interest rates, leading to a wide-ranging adjustment of the market, from Bitcoin to stocks.

Although the US government's 43-day closure has ended, many economists are concerned that economic data collection will be seriously disrupted. The lack of quality data forces the Federal Reserve to maintain a neutral stance, most likely not adjusting interest rates next month.

According to the CME FedWatch tool, the market now rates the possibility of the Fed cutting interest rates in December as less than 50%, while last month the figure was more than 90%.

Mr. Jim Wyckoff - senior analyst at Kitco.com is leaning towards the scenario of gold prices falling next week: "Buyers' momentum has run out very quickly and short-term technical indicators have deteriorated a bit".

Meanwhile, Mr. Alex Kuptsikevich - senior analyst at FxPro, commented: "The weakening of the USD and the rumor that the FED could resume the asset purchase program have been the main drivers of gold prices to increase since the beginning of the week; but the developments on Thursday and Friday showed that the market is no longer one-sided."

Kuptsikevich predicts gold prices will fall next week and believes that investors are likely to sell as prices increase: Gold has been continuously sold strongly after each increase since the end of last month, as an effort by the selling side to prove that they have broken the buying side.

Like other risky assets, gold weakened over the weekend due to a sharp decline in the probability of the Fed cutting interest rates in December. If FOMC members continue to orient the market in this direction, the USD will certainly increase and gold will decrease, he said.

However, we also see a greater risk that upcoming US economic data will show a worsening economic picture. At that time, the USD will strengthen and the risk-off sentiment will increase. In such scenarios, gold often spikes in the early stages, but can then plummet," the expert added.

Economic data to watch next week

Monday: Empire State Production Survey.

Wednesday: Minutes of the Federal Open Market Committee (FOMC) meeting.

Thursday: Philly FED Production Survey, Weekly Unemployment claims, existing home sales.

Friday: S&P's preliminary PMI, University of Michigan Consumer Confidence Index.

See more news related to gold prices HERE...