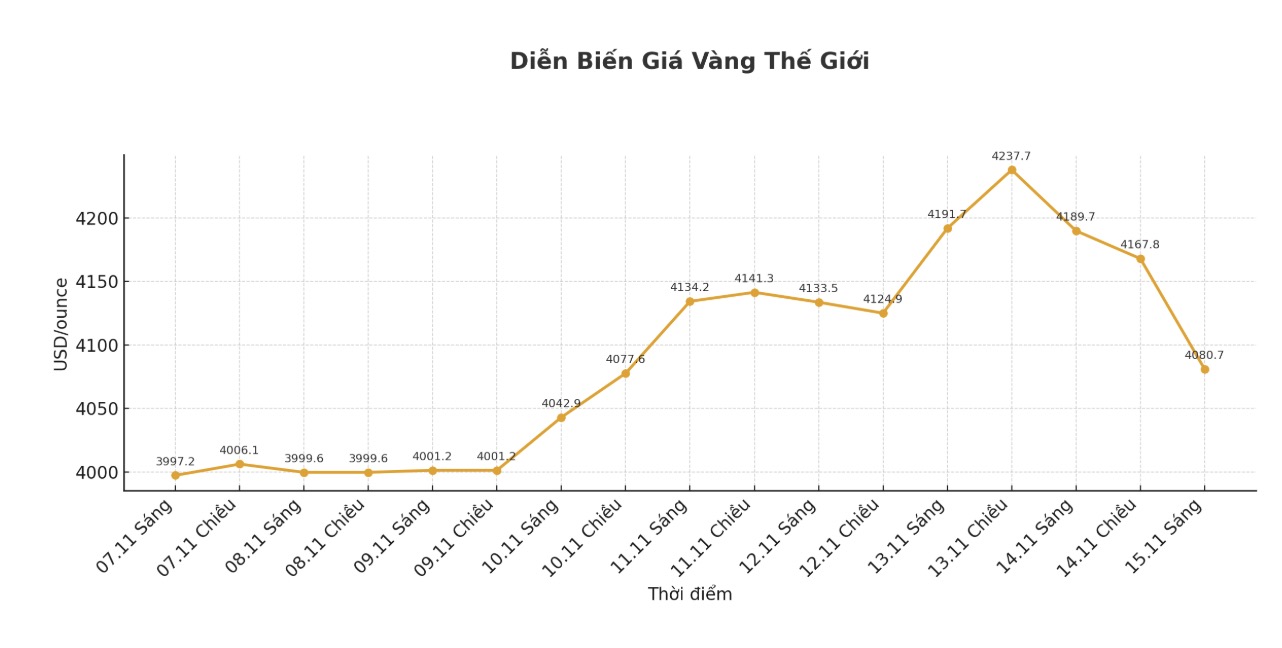

While the gold market appears to be forming a new price level above $4,000/ounce, analysts note that the unsuccessful breakthrough above $4,200/ounce could suggest the market needs to accumulate longer before there is enough momentum to retest last month's record high.

Experts say gold is still maintaining a long-term uptrend but is stuck in the sideways zone, especially as the market begins to doubt the possibility of the Fed cutting interest rates next month.

Thursday marks the official end of the 43-day US government shutdown - the longest in history. Economic data will start to be updated again next week, but analysts and economists do not expect these figures to be reliable enough to assess the health of the economy. In particular, some data on inflation and the labor market has been lost due to the closing time.

Due to the lack of quality data, economists are starting to be more cautious ahead of the Fed's next monetary policy meeting. Some central bank officials said they do not want to cut interest rates next month because they do not have a clear view of inflation trends and the labor market.

Ahead of the weekend, the CME FedWatch tool shows that the market rates the probability of the Fed cutting interest rates in December below 50%. A month ago, the market bet more than 90% on the possibility of further easing.

Market analysts said that this uncertainty is putting pressure on gold, with prices preparing to end the week significantly lower than the peak. Spot gold was recorded to be trading at 4,095.80 USD/ounce, up 2.4% for the week; however, prices have fallen nearly 3.5% compared to the peak on Thursday.

Neil Welsh - Head of metals at Britannia Global Markets, said: "Gold's momentum is being tested strongly, with a decrease of more than 3% today and a sell-off spread in the metals, securities and cryptocurrency markets as skepticism about the possibility of interest rate cuts increased.

This shows the level of dependence of short-term psychology on central bank policy signals. However, with gold still rising strongly compared to a year ago, the long-term story remains solid, supported by persistent macro risks, central bank demand and the trend of asset diversification despite continued short-term fluctuations."

He noted that while gold maintains a near-term support zone of over $4,000 an ounce, it is difficult to determine whether this rally will hold firm amid uncertainty over US monetary policy.

The hawkish sound from the Fed, which refers to the possibility of a temporary suspension of interest rate cuts next month, could continue to hinder golds short-term gains. You can see gold falling nearly 3% today; if prices penetrate the $4,000/ounce mark - a widely followed figure - and the entire bottom of $3,886/ounce formed at the end of October, this could trigger a sell-off to $3,748/ounce. So while the long-term trend is still on the buyer's side, we could see some further negative volatility, especially if buying pressure around $3,886 an ounce is absorbed, he said.

However, not everyone is so cautious, as gold has recovered strongly after a sell-off in October. Christopher Vecchio - Head of futures and Forex Strategy at Tastylive.com - said that the shortage of economic data will not necessarily significantly affect the US's long-term monetary policy.

Vecchio said gold could see short-term profit-taking when prices are high, but he is still looking for buying opportunities when prices correct.

Phillip Streible, chief strategist at Blue Line Futures, also said he will continue to buy gold on dips. He stressed that as long as gold holds above $3,900 an ounce, the uptrend remains strong.

In the end, investors have realized that gold is a strategic asset and should be owned, he said.

Although the government has reopened, more time is needed before economic data is released. However, regional production reports, preliminary data and US home sales figures will provide some insight into the health of the economy.

Notable US economic data next week

Monday: Empire State Production Survey.

Wednesday: Minutes of the Federal Open Market Committee (FOMC) meeting.

Thursday: Philly FED Production Survey, Weekly Unemployment claims, existing home sales.

Friday: S&P's preliminary PMI, University of Michigan Consumer Confidence Index (edited version).