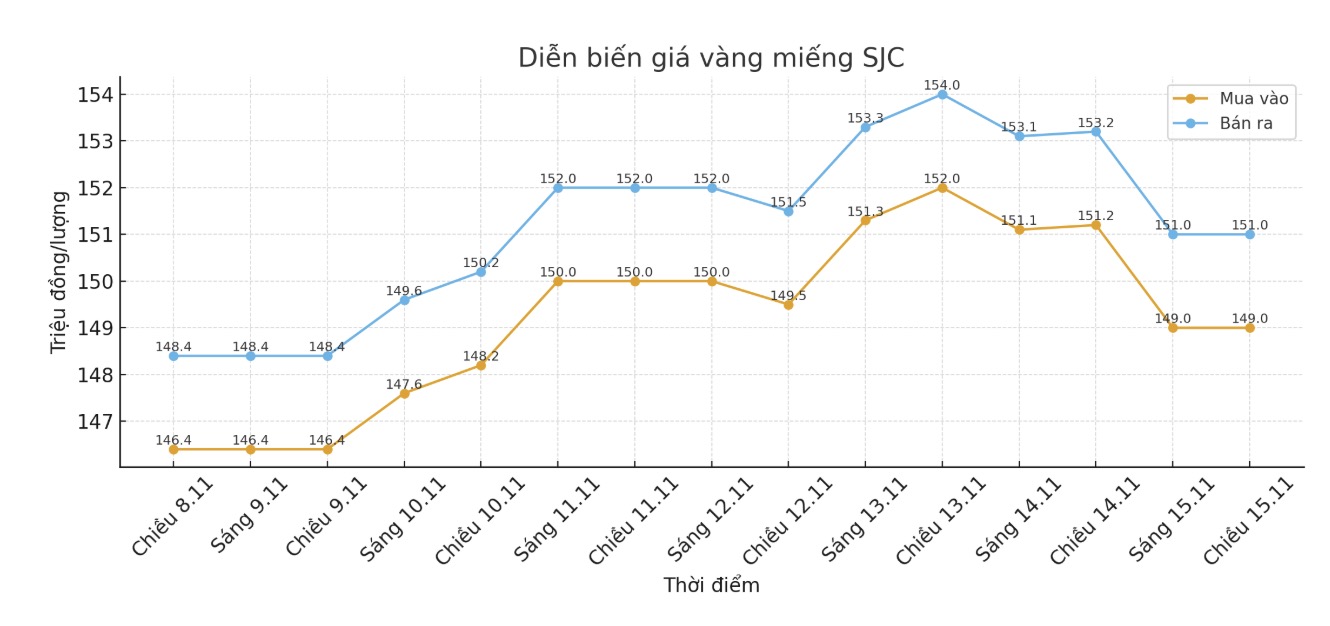

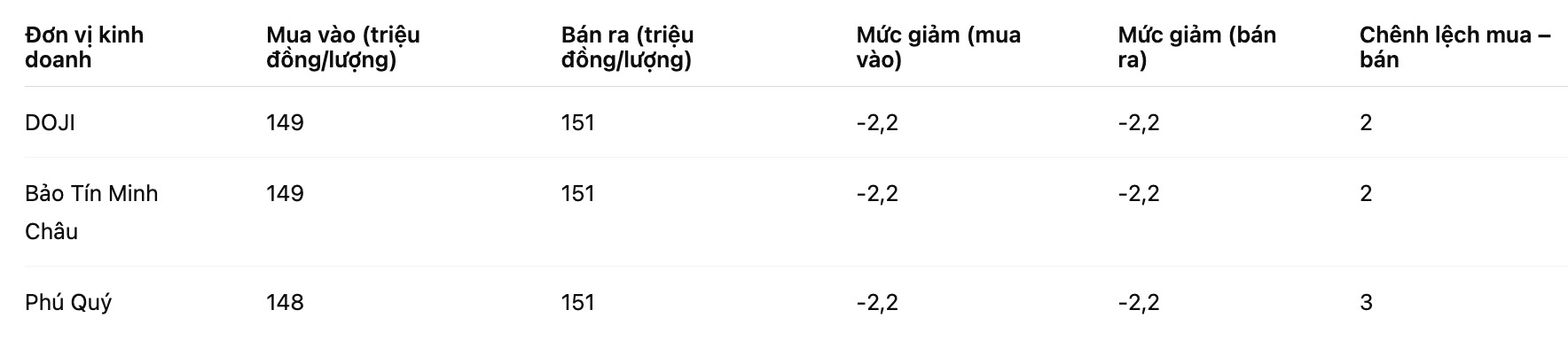

SJC gold bar price

As of 5:20 p.m., DOJI Group listed the price of SJC gold bars at 149-151 million VND/tael (buy - sell), down 2.2 million VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 149-151 million VND/tael (buy - sell), down 2.2 million VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 148-151 million VND/tael (buy - sell), down 2.2 million VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

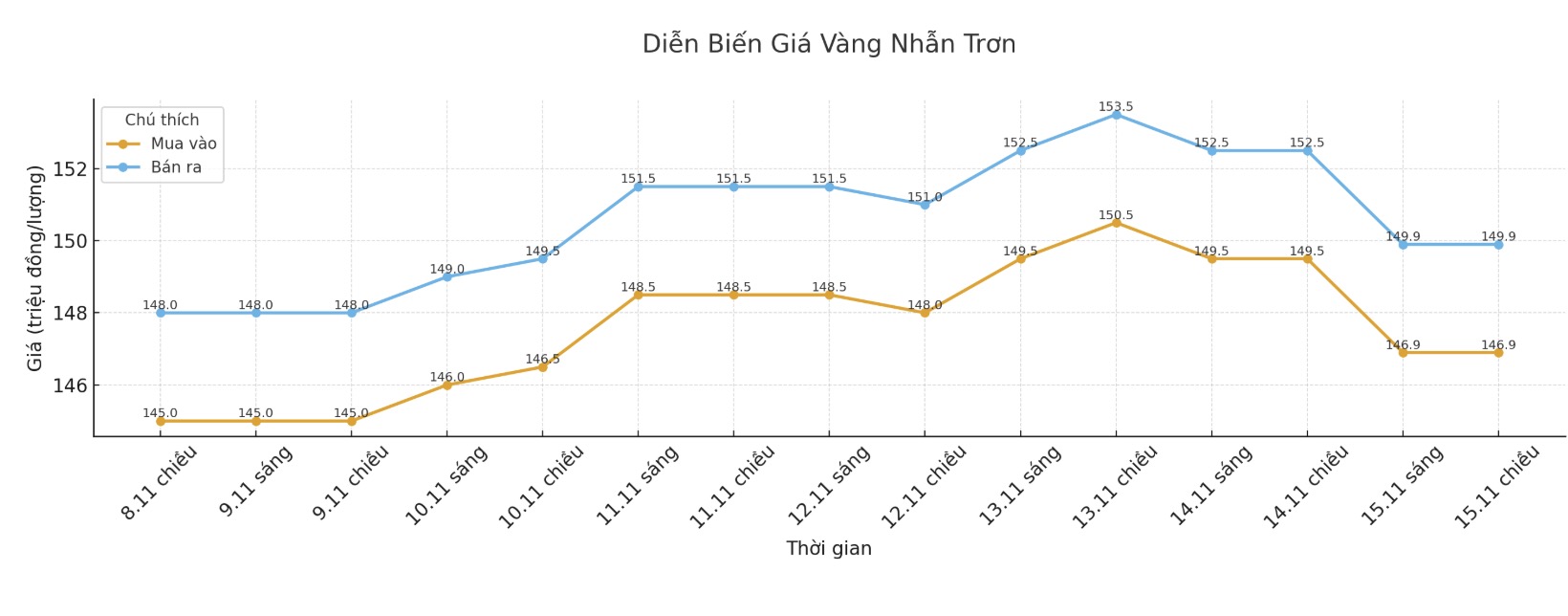

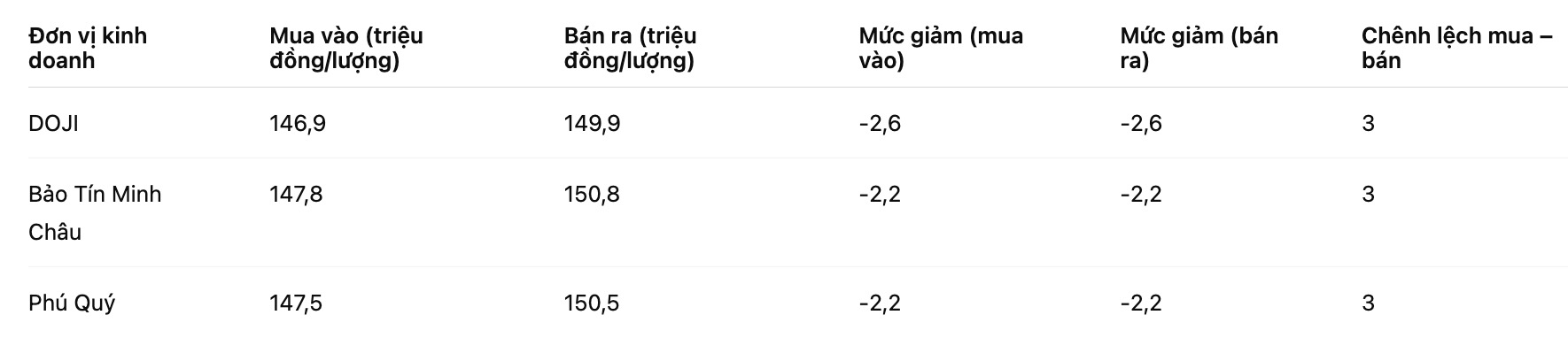

9999 gold ring price

As of 5:20 p.m., DOJI Group listed the price of gold rings at 146.9-149.9 million VND/tael (buy - sell), down 2.6 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 147.8-150.8 million VND/tael (buy - sell), down 2.2 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 147.5-150.5 million VND/tael (buy - sell), down 2.2 million VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

The high buying and selling distance increases the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

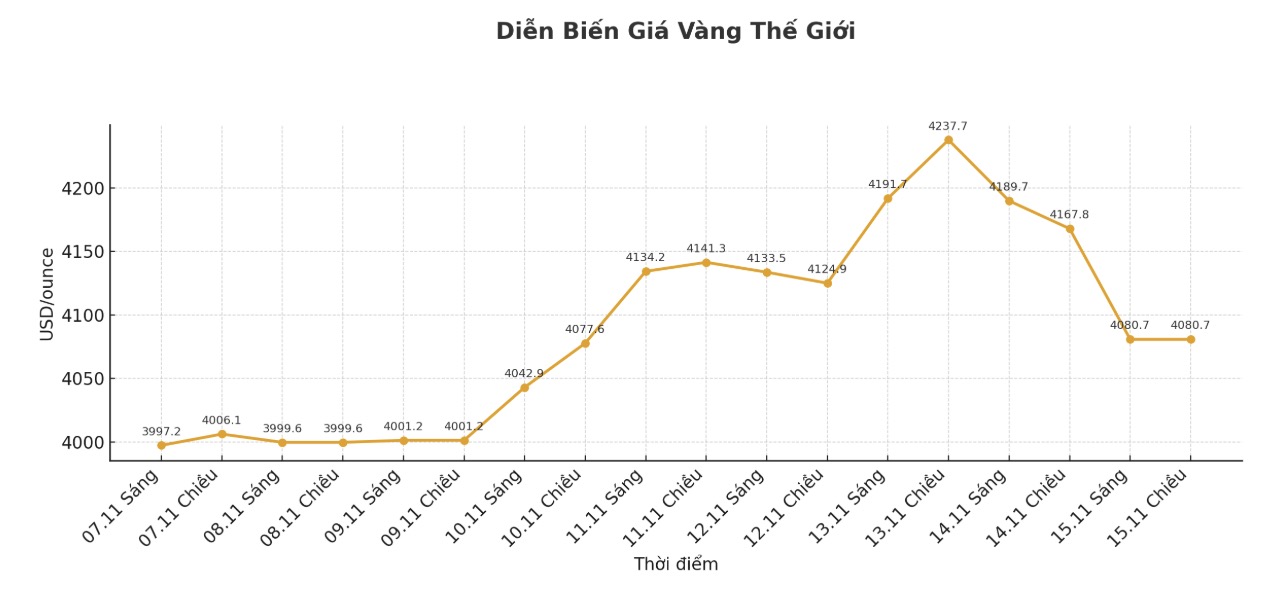

World gold price

The world gold price was listed at 5:20 p.m., at 4,080.7 USD/ounce, down 87.1 USD compared to a day ago.

Gold price forecast

According to Reuters, the market crash stems from tough statements by US Federal Reserve (FED) officials, weakening expectations of a possible interest rate cut in December.

The expectation of a gradual decline in the possibility of the Fed cutting interest rates in December has caused the gold and silver markets to lose momentum, said David Meger, Director of Metals Trading at High Ridge Futures.

The stock market plummeted after a wave of global sell-offs were triggered by the tightening signal from the FED.

The prolonged US government shutdown, which ended on Thursday, created a huge data void, leaving the Fed and traders in a "dilemma" ahead of next month's policy meeting.

Investors expect the new data to show a slowing economy, creating room for the FED to cut interest rates in December, thereby increasing the attractiveness of gold.

However, these expectations have faded as many Fed officials have become more cautious about easing monetary policy.

According to CME Group's FedWatch tool, the probability of the market predicting the Fed will cut 25 basis points next month has dropped to nearly 46%, from 50% at the beginning of the week.

When a deposit call occurs and a liquidation is required, traders will pay all positions to release the deposit... This is part of the reason why even gold is falling in the current risk-off environment, Fawad Razaqzada, market analyst at City Index and FOREX.com, said in a note.

Neil Welsh - Head of metals at Britannia Global Markets - said: "Gold's momentum is being tested strongly, with a decrease of more than 3% today and a sell-off spread in the metals, securities and cryptocurrency markets as skepticism about the possibility of interest rate cuts increased.

This shows the level of dependence of short-term psychology on central bank policy signals. However, with gold still rising strongly compared to a year ago, the long-term story remains solid, supported by persistent macro risks, central bank demand and the trend of asset diversification despite continued short-term fluctuations."

He noted that while gold maintains a near-term support zone of over $4,000 an ounce, it is difficult to determine whether this rally will hold firm amid uncertainty over US monetary policy.

Notable US economic data next week

Monday: Empire State Production Survey.

Wednesday: Minutes of the Federal Open Market Committee (FOMC) meeting.

Thursday: Philly FED Production Survey, Weekly Unemployment claims, existing home sales.

Friday: S&P's preliminary PMI, University of Michigan Consumer Confidence Index.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...