Gold and silver have had a remarkable reversal this week, going against common expectations and bringing outstanding profits to investors in the opposite direction of the crowd.

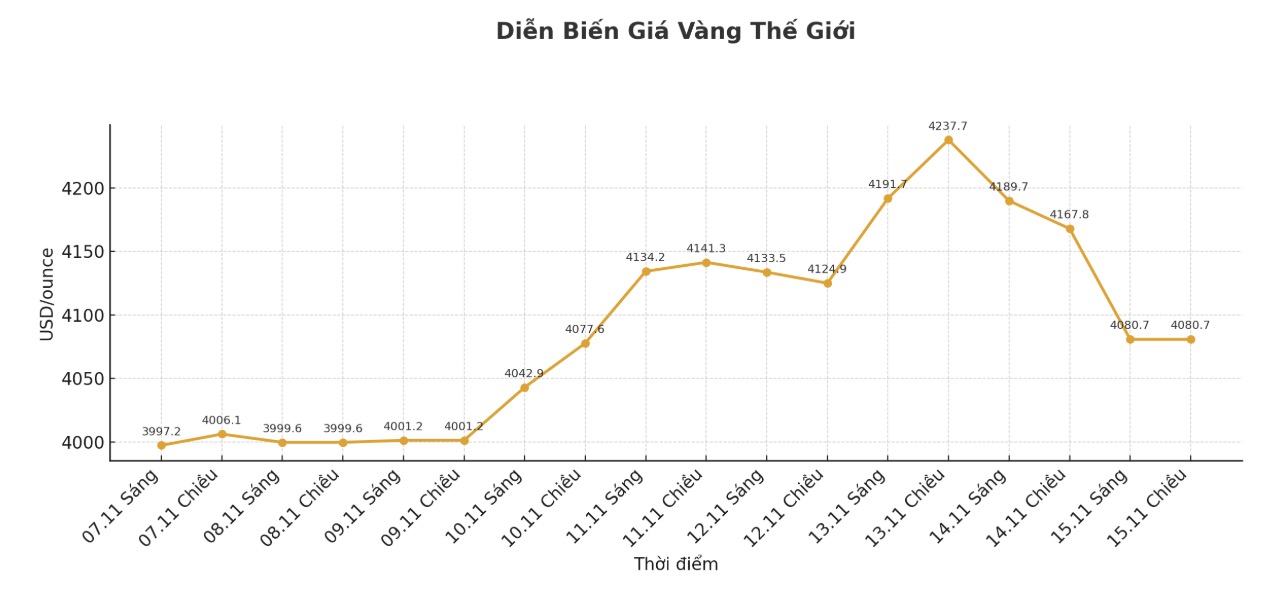

While the majority of investors have almost eliminated gold's short-term prospects - predicting a sideways range of $4,000 - $4,200/ounce by the end of the year, both metals have unexpectedly broken out for three consecutive days from Monday to Wednesday.

This increase will change direction to Thursday with the first red candle of the week, followed by a sharp decline on Friday. Despite the decline in the two weekends, gold still closed the week in green.

Friday's reversal came after Federal Reserve officials made "hawlish" comments, undermining expectations for a rate cut in December.

Inflation concerns and less positive signals from the labor market make the outlook unpredictable, with the CME FedWatch tool now showing only a 49% chance of a 0.25 percentage point cut in December - a big change from almost absolute optimism at the beginning of the week. If it happens, it will be the third cut this year.

An important factor that caused gold prices to fall on Friday was the resumption of US government operations after 43 days of closure, which disrupted the release of economic data. The latest employment data shows that the labor market is deteriorating.

According to Ricardo Evangelista - senior analyst at ActivTrades: "Gold prices are being supported by the cautious sentiment covering financial markets... however, the room for growth is still limited by growing doubts about the possibility of the FED cutting interest rates in December, especially when there is a lack of new economic data."

The bigger message has become clear: The market has spoken out strongly, completely rejecting the pessimistic view of the majority. As analysts predict gold will move sideways or down, we remain bullish on the continued uptrend.

With the common thinking that the government's reopening will put pressure on safe-haven assets, the market has ignored short-term disruptions to focus on long-term supporting factors.

With the majority considering silver as a "follower" for gold, technical and fundamental analysis has shown the ability to outperform significantly - a prediction that is being clearly demonstrated in real time.

See more news related to gold prices HERE...