Gold price developments last week

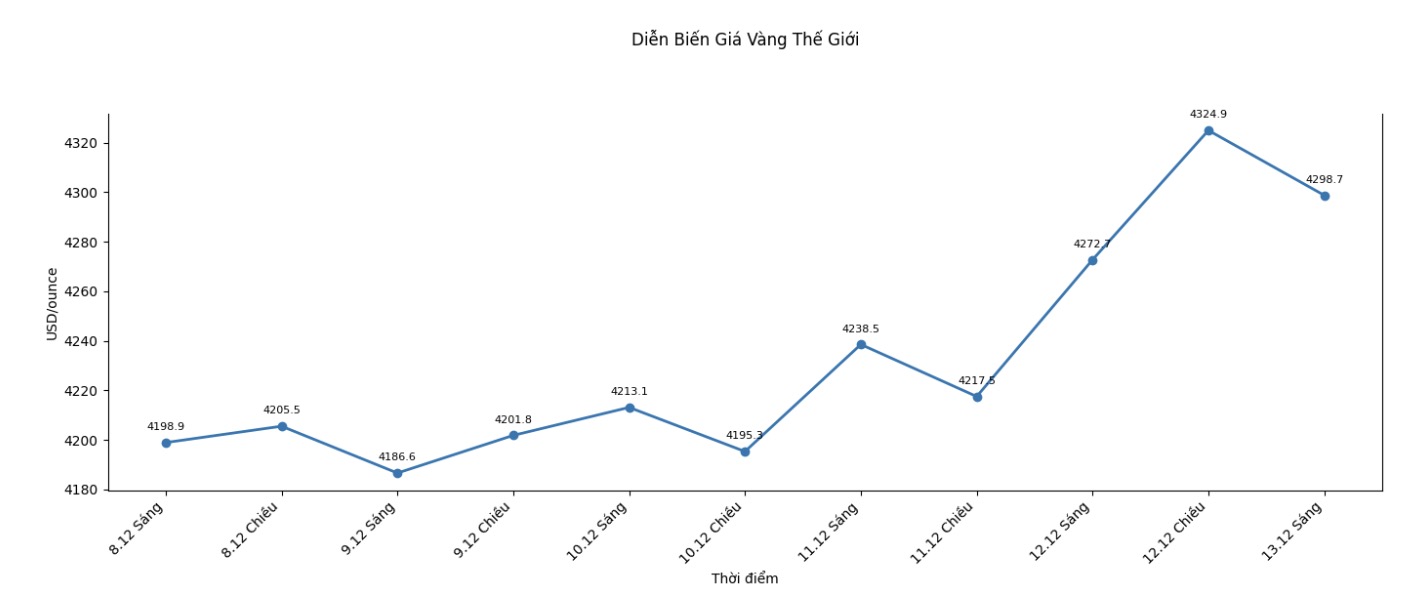

Spot gold prices opened the week at $4,198.68 an ounce, with $4,200 continuing to act as a "magnet" to attract price action as the market awaits an orientation signal from the Fed.

Gold fell to re-essence the support zone around $4,180 on Monday morning, while the $4,200 mark became resistance. In the Asia session, the precious metal set a weekly low of nearly $4,174 an ounce just after 1 a.m. (Eastern time).

However, by 4:00 a.m. on Tuesday, spot gold prices had returned to $4,200, and by 11:00 a.m. on the same day, gold had set a new peak for the week at $4,220/ounce.

With a narrow range of about 30 USD formed, gold traders are almost in a "winter sleep" state as the market awaits the decision on the interest rate roadmap from the central bank.

When the decision to cut interest rates by 25 basis points was announced on Wednesday afternoon, gold prices initially only fluctuated to check both sides of the price channel.

However, after Federal Reserve Chairman Jerome Powell ended his prepared speech and began answering press questions about the US economy, spot gold surged by $50 in less than 30 minutes, surpassing $4,235/ounce. By 7:00 p.m. the same day, the precious metal had set a new peak for the week, surpassing $4,243/ounce.

Trading sessions in Asia and Europe then saw gold fall into a state of stagnation, with prices returning to the support zone to check around 4,215 USD/ounce. However, when the North American market opened on Thursday, gold prices were immediately pushed back to the peak of the week, and by 1:00 p.m., spot gold was trading around $4,285/ounce.

This paved the way for a final breakout, starting shortly after 1:30 a.m. when gold surpassed a weekly peak of $4,285. Two hours later, the precious metal was trading above $4,300 an ounce, and just 15 minutes after North American markets opened, spot gold prices set a weekly high of $4,353.55 an ounce.

A strong sell-off in the silver market followed, dragging other metals down. However, after forming a two-bottom model, gold prices quickly recovered, regaining the 4,300 USD/ounce mark and remaining around this level until the market closed for the week.

Gold price forecast for next week

The latest weekly gold survey with Wall Street experts shows many optimistic forecasts for the short-term outlook for gold prices, while individual investors also slightly increased their uptrend rate.

There were 13 Wall Street experts participating in the survey. There are 11 experts, equivalent to 85%, who believe that gold prices will continue to increase next week, while no one predicts that prices will decrease. The remaining two analysts, accounting for 15% of the total, said the precious metal will trade sideways next week.

The online survey with individual investors recorded a total of 237 votes, with the optimistic sentiment of investors on Main Street continuing to improve.

168 individual traders, or 71%, expect gold prices to increase higher next week, while another 27 people, or 11%, predict the precious metal will weaken. The remaining 42 investors, or 18% of the total, see gold prices entering an accumulation phase next week.

Economic data to watch next week

The economic news announcement schedule next week will record a series of interest rate decisions from central banks, along with some US economic data that have been delayed for a long time.

On Monday, the market will receive a Empire State manufacturing survey. On Tuesday morning, the US will release the non-farm Payrolls report for both October and November, along with retail sales in November, followed by the US preliminary PMI for December.

By Thursday, traders will focus on monitoring the monetary policy decision of the Bank of England (BoE), followed immediately by the interest rate announcement of the European Central Bank (ECB). On the same day, the market will also receive a series of important US data including the consumer price index (CPI) in November, weekly jobless claims and the Fed Philadelphia (Phyilly Fed) manufacturing survey.

The trading week will close on Friday morning with a report on US existing home sales in November.

See more news related to gold prices HERE...