Gold prices may continue to see short-term profit-taking as US consumers seem to be returning to the housing market, easing concerns that the economy may fall into recession.

According to the report released on Wednesday by the US Bureau of Population and the Department of Housing and Urban Development, new home sales increased by 20.5% last month, reaching an annual adjustment of 800,000 units, compared to the adjustment of 664,000 units in July.

New home sales rose 15.4% year-on-year and are currently at their highest level since February 2022.

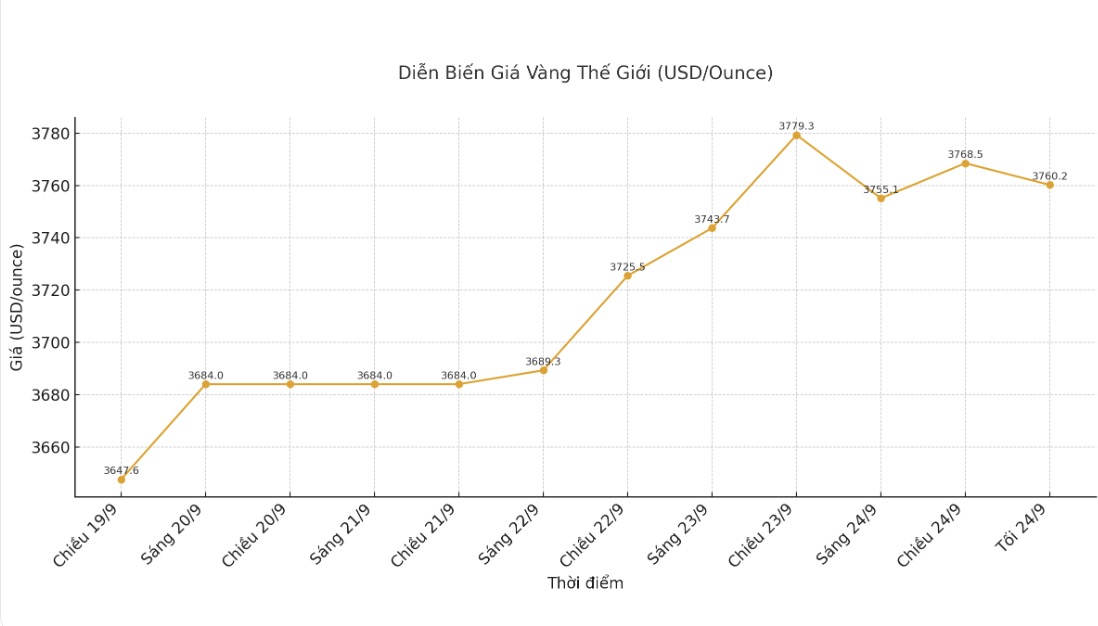

The gold market reacted slightly to the positive data of the housing market. Gold recorded some technical profit-taking after approaching $3,800/ounce in the overnight trading session.

In another development, Federal Reserve Chairman Jerome Powell said the US labor market and inflation outlook was facing risks, calling it a challenging situation.

He stressed upside inflation risks and downside employment risks a difficult situation and double-sided risks mean no perfectly safe path.

Mr. Powell denied that the Fed is politically dominated in its policy decisions, asserting that we only look at the best for the people we serve. He did not disclose his likely support for a rate cut at the October FOMC meeting.

See more news related to gold prices HERE...