USD Index

On November 15, in the US market, the USD Index (DXY) measuring the fluctuations of the greenback against 6 major currencies decreased by 0.12%, down to 99.30 points.

Mr. Juan Perez - Trading Director at Monex USA (W Washington) - commented: "The government has reopened, but when will everything return to normal? When will we have reliable US data from September and October to conduct an accurate analysis? That is still a question mark."

White House economic adviser Kevin Hassett said the government will release an October jobs report, but there will be a shortage of unemployment rates, as household surveys were not conducted during the closure period. These data could influence the Federal Reserve's (Fed) policy, although the outlook for interest rates is still unclear.

With inflation concerns and signs of relative stability in the labor market after two interest rate cuts this year, more and more Fed officials are cautious about further policy easing, causing the probability of the Fed cutting interest rates in December to fall below 50%.

VND vs USD exchange rate

In the domestic market, at the beginning of the trading session on November 15, the State Bank announced that the central exchange rate of the Vietnamese Dong decreased by 3 VND, currently at 25,122 VND.

The reference USD exchange rate at the State Bank's Buying - Selling Transaction Office is currently at: 23,916 VND - 26,328 VND, down 3 VND in both directions.

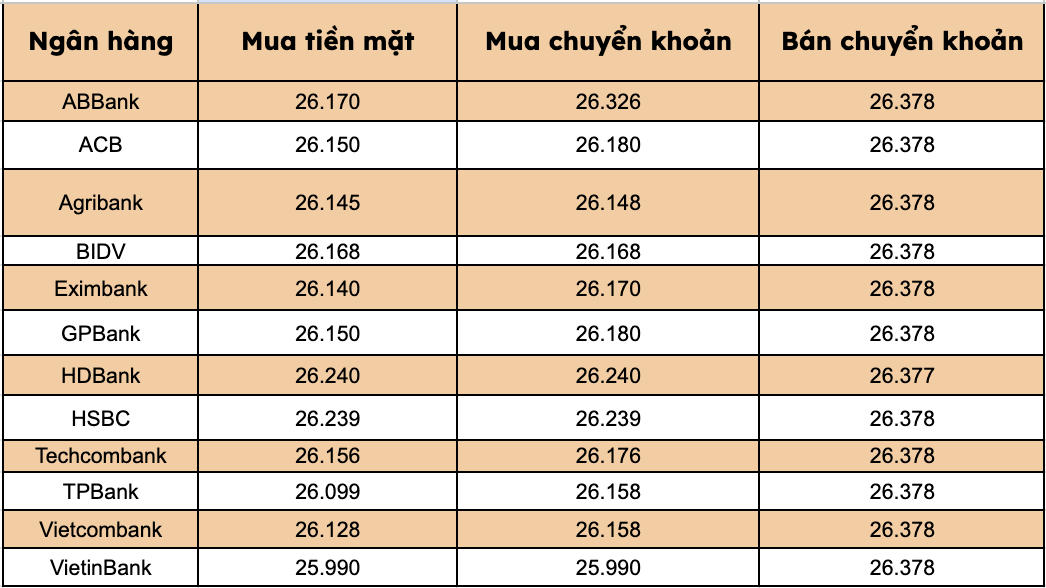

At commercial banks, USD prices have been adjusted to increase and decrease in different directions.

Most banks listed USD selling prices at VND26,378/USD.

Bank with the highest cash and bank transfer price: HDBank (26,240 VND/USD).

The difference between buying and selling prices at banks ranges from 138-388 VND/USD.