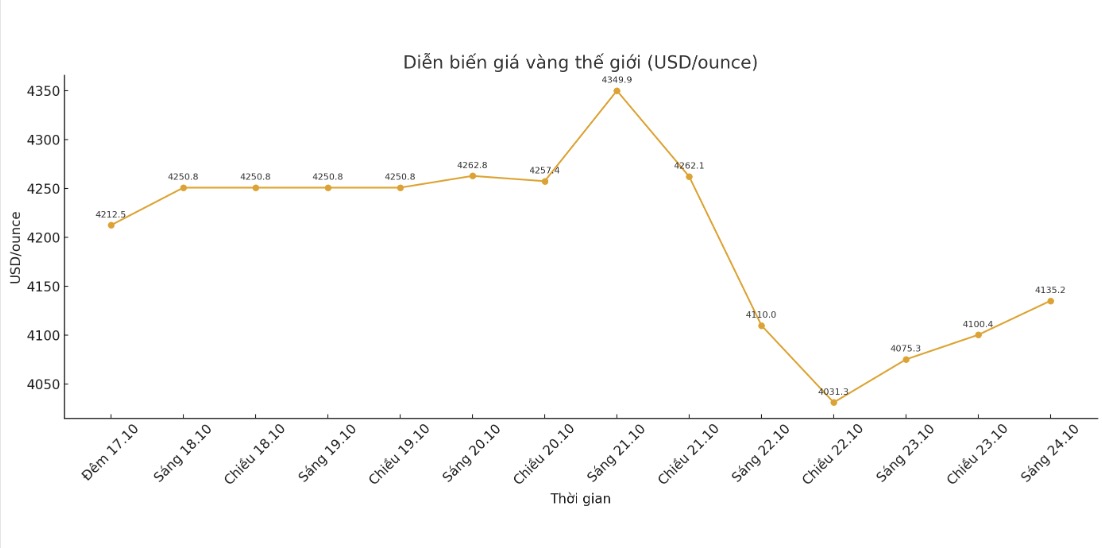

Ms. Carley Garner - co-founder of brokerage firm DeCarley Trading - who still maintains the view that gold prices have created a peak - said that she started predicting gold reversal since the price exceeded 3,000 USD/ounce, but the market has gone back: in just 30 weeks, gold has continuously set new peaks above 4,000 USD/ounce. The strong increase has led to large fluctuations, as reflected in recent strong trends.

Garner admitted that prices had not decreased as she expected, but the strong fluctuations caused many risks to the selling position. She is using small-scale gold futures (micro gold) as a defense, to limit losses until the market is more stable.

We try to weather the big waves. When the market is less hot, we may get rid of orders without doing too much damage," said Garner.

However, she affirmed that the view that gold is being overbought is correct. According to Garner, the recent increase of 1,000 USD is unreasonable, showing that investors are relying on a crowd psychology rather than the real value of gold.

Many people no longer consider gold as an asset for storage but only consider it as a surfing tool, buying because they see prices rising, she said.

Garner also said that small-cap inflows into small-cap gold futures have increased strongly. Data from CME shows that the trading volume of these products has recently consecutively set records.

Usually investors with a few thousand USD will not change the price. But when thousands of people buy together, the push becomes huge. Gold has been inflated like speculative stocks in a movement and that cannot be prolonged," she added.

Garner gave an example of an investor who spent $10,000 to buy gold at a performance price of $5,000/ounce for an April term. They only make a profit if they keep it until maturity and gold prices still have to increase above $5,100/ounce. This reflects a very high risk-taking mentality".

According to Garner, although the FED is expected to continue cutting interest rates until the first half of 2026, inflation is still under control and at risk of recession. This is not enough to explain the strong increase in gold in recent times.

The market has reflected all the supporting factors in advance. Now everything needs to return to balance. The scenario we aim for is to sell when prices increase sharply" - she commented.

See more news related to gold prices HERE...