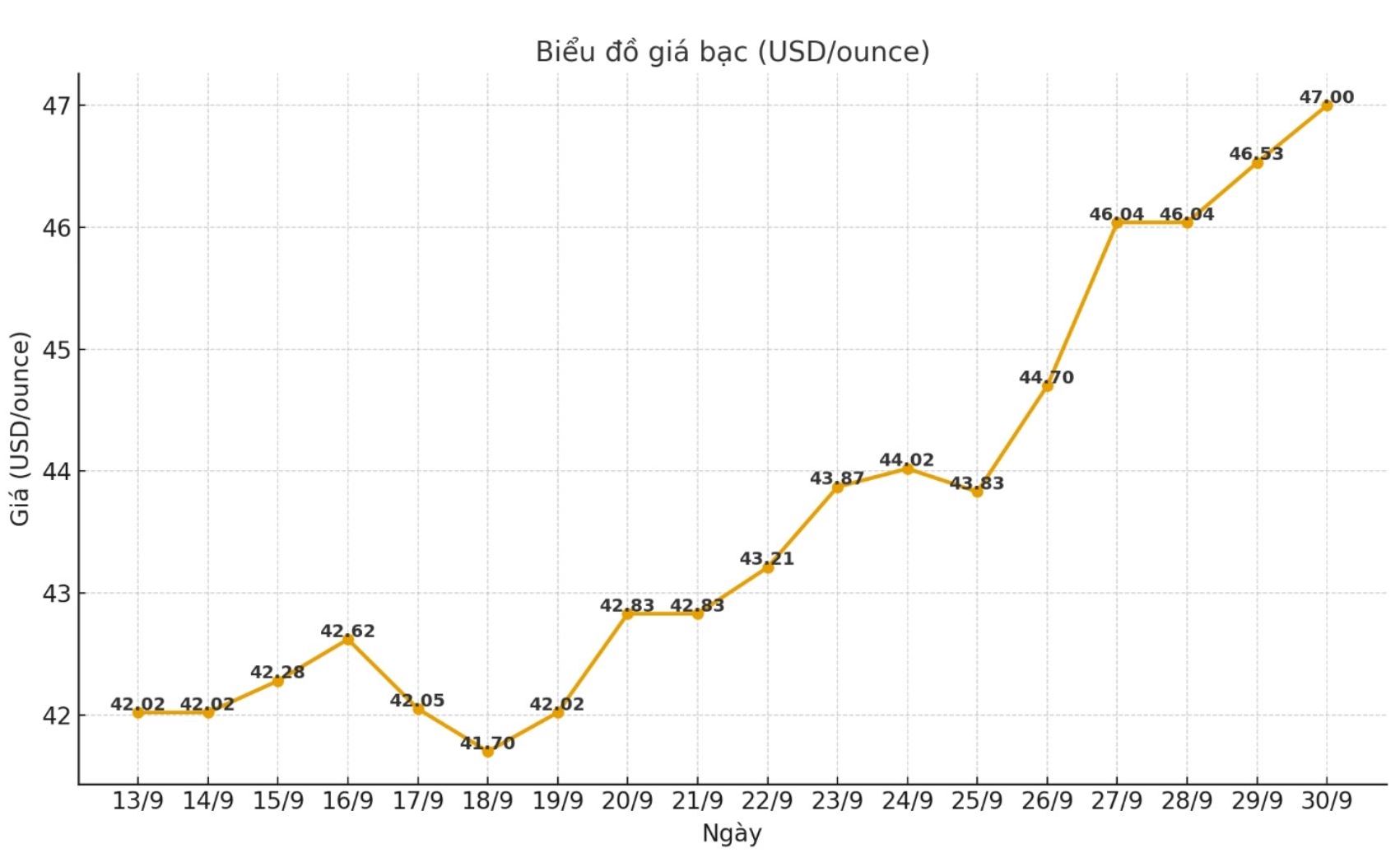

Silver fluctuates strongly but the upward trend has not stopped

According to Christopher Lewis - an exclusive trader with more than 20 years of experience - a senior analyst at FXEmpire since its inception, the silver market continues to attract buyers, prices are still increasing despite strong fluctuations.

"However, I am worried that silver is being bought too much. On Monday, silver may increase slightly and then decrease. In fact, this is still a long-term uptrend, and this increase is just a continuation. Most indicators show that they are overbought, so if you don't buy early, you should not rush to buy.

The reasonable thing is to wait for the price to decrease before taking orders. Previously, the technical model set a target of $46/ounce, then the price increased to $47/ounce - which is often the case because prices often exceed the original target."

Christopher Lewis believes that any short-term decline is a buying opportunity. "It is best to retreat to around $44/ounce. The next strong support zone is around $42/ounce, and certainly $40/ounce. The 50-day moving average is also heading towards $42/ounce, so there is a possibility of a price correction here.

In short, silver is still likely to increase further, but I do not want to buy at this time when the price has far exceeded the reasonable buying price of 3-4 USD".

Sharp decline in inventory is driving prices up

In the latest report, experts from Heraeus (a high-tech corporation headquartered in Germany) said that sharp declines in inventories are driving prices up.

Cold-fide futures have surpassed $46 an ounce last week, near a 14-year high, thanks to the US Federal Reserves decision to cut interest rates by 0.25 points and strong industrial demand, leading to a decline in ground-based silver prices, experts said.

LBMAs Treasury stock has fallen sharply, losing 7.5% year-on-year to 792 million ounces in August 2025, a multi-year low, as a large proportion of metals are on the stock of COMEX due to the risk of tax. Although COMEX's inventory is still more than 500 million ounces, only a small portion - about 193 million ounces, or 36% of registered silver ready for immediate delivery, limiting food supply".

ETF holdings also rose 10 million ounces for the week to 820 million ounces - still below the 1.021 billion ounce peak in February 2021, showing investors have not been too active. Silver prices also started the new week positively, at 46.691 USD/ounce, up 1.39% on the day.

In other developments, the platinum market - another precious metal is also very vibrant. The price has surpassed $1,500/ounce, setting a new peak for the year and higher than the $1,519/ounce in 2014 the report said.

Platinum rental rates remain high, suggesting the market continues to be scarce, although not to the extreme level of when prices peaked lower in July. Mining output in South Africa may have returned to normal, but not enough to cool down this situation; in the long term, increased exports will improve liquidity. In the short term, the price increase is still strong and can continue".

Update on domestic silver prices

As of 10:50 on September 30, the price of 999 999 coins (1 tael) at Phu Quy Jewelry Group was listed at VND1.805 - 1.861 million/tael (buy - sell).

The price of 999 taels (1kg) at Phu Quy Jewelry Group was listed at 48.133 - 49.626 million VND/kg (buy - sell).

At the same time, the price of 2024 Ancarat 999 silver bars (1 tael) at Ancarat Golden Rooster Company was listed at VND1,800 - 1.838 million/tael (buy - sell).

The price of 999 999 Ancarat silver bars (1kg) at Ancarat Metallurgy Company is listed at 47.184 - 48.434 million VND/kg (buy - sell).