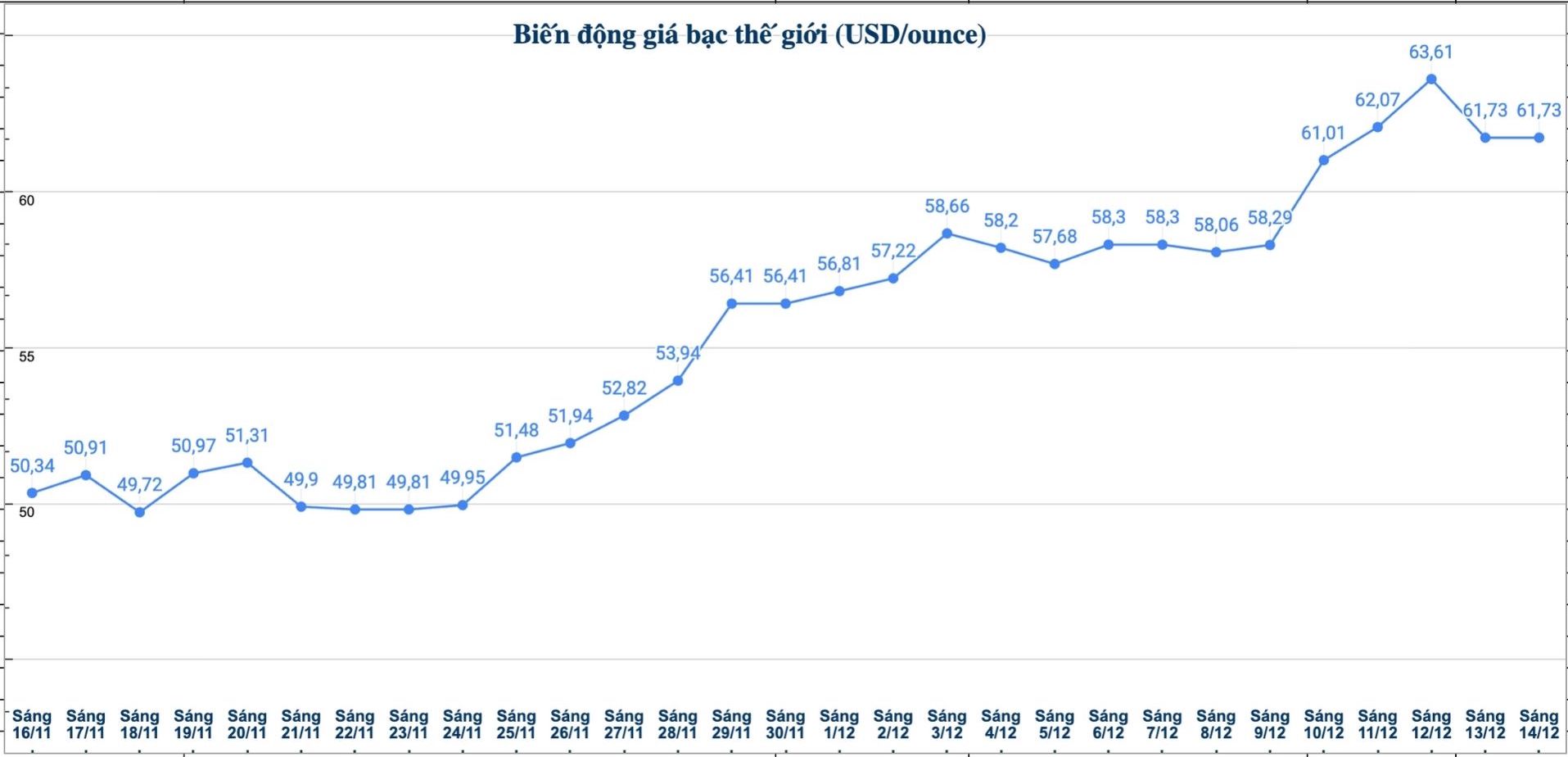

After reaching a record high of more than 63 USD/ounce last week, silver is becoming a precious metal of special interest to investors. According to experts, there is still a lot of room for price increases for this gray metal, in the context of high demand while supply is increasingly limited.

Michele Schneider - Chief Market Strategist at Market Gauge - said that she has returned to the silver market after the gold-esilier ratio could not maintain above the threshold of 80 points. She previously withdrew from the gold and silver markets in October to wait for clearer signals.

Looking at the medium and long term, Ms. Schneider is particularly optimistic about the outlook for silver, saying that the current price has not fully reflected the fundamental factors.

"It's surprising that silver prices haven't risen any higher. The shortage of supply is becoming increasingly serious. Meanwhile, demand will certainly continue to increase, while supply will be limited" - she commented.

According to her, silver is increasingly playing a key role as an industrial metal, especially in the context of the strong electrification and technology transformation process globally.

"Not only attractive in terms of supply and demand, silver is still undervalued against gold, despite the sharp increase in prices in recent times," said Ms. Schneider.

According to historical data, the ratio of gold - silver often fluctuates between 50 - 60 points. However, in the 1970s, this ratio had dropped sharply to around 20 points. In the current context, Ms. Schneider believes that the gold- silvery ratio could well hit rock bottom at 40 points.

"When comparing silver prices to most other assets, it is still quite cheap. If the gold- silver ratio continues to decrease, it means that silver prices will increase even more. With the current supporting factors, I predict that silver prices could reach $75/ounce by 2026," said Ms. Schneider.

In addition to industrial demand, she also expects investment demand from individual investors to continue to be an important driving force for silver's increase.

Last week, the US Federal Reserve (Fed) cut interest rates by 25 basis points, bringing the federal funds rate to the 3.50 - 3.75% range, as the market forecast. Although the Fed has not yet given a clear signal of strong steps in 2026, Ms. Schneider believes that monetary policy will likely continue to move in a more loose direction in the coming time.

"We don't know exactly what the Fed will do next year, but inflationary pressures are something that cannot be underestimated," she analyzed.

According to her, the risk of super inflation needs to be taken into account, thereby creating a solid foundation for support for tangible assets such as gold and silver.

Ms. Schneider also believes that if inflation continues to escalate, real yields will decrease, putting pressure on the USD, while the USD index is still unable to surpass the 100 point mark.

"Because of these factors, I am still very optimistic about the precious metal," she concluded.

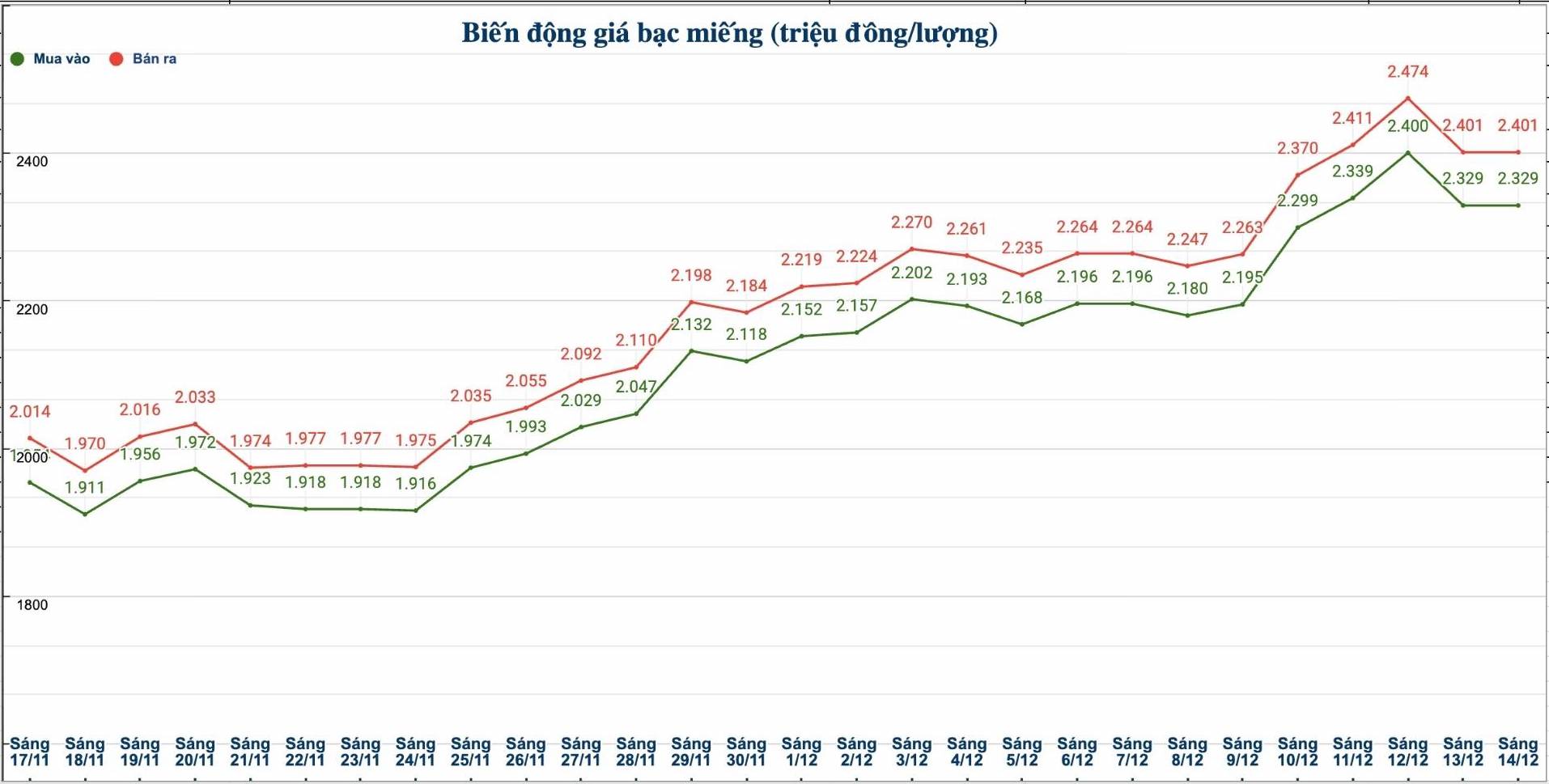

Updated silver price

As of 6:00 a.m. on December 15, the price of 2024 Ancarat 999 silver bars (1 tael) at Ancarat Metallurgy Company was listed at VND2.329 - 2.386 million/tael (buy - sell).

The price of 999 999 Ancarat silver bars (1kg) at Ancarat Metallurgy Company is listed at 61.266 - 63.126 million VND/kg (buy - sell).

At the same time, the price of 999 coins (1 tael) at Phu Quy Jewelry Group was listed at 2.329 - 2.401 million VND/tael (buy - sell).

The price of 999 taels (1kg) at Phu Quy Jewelry Group was listed at VND62.106 - 64.026 million/kg (buy - sell).

See more news related to silver prices HERE...