Domestic silver price

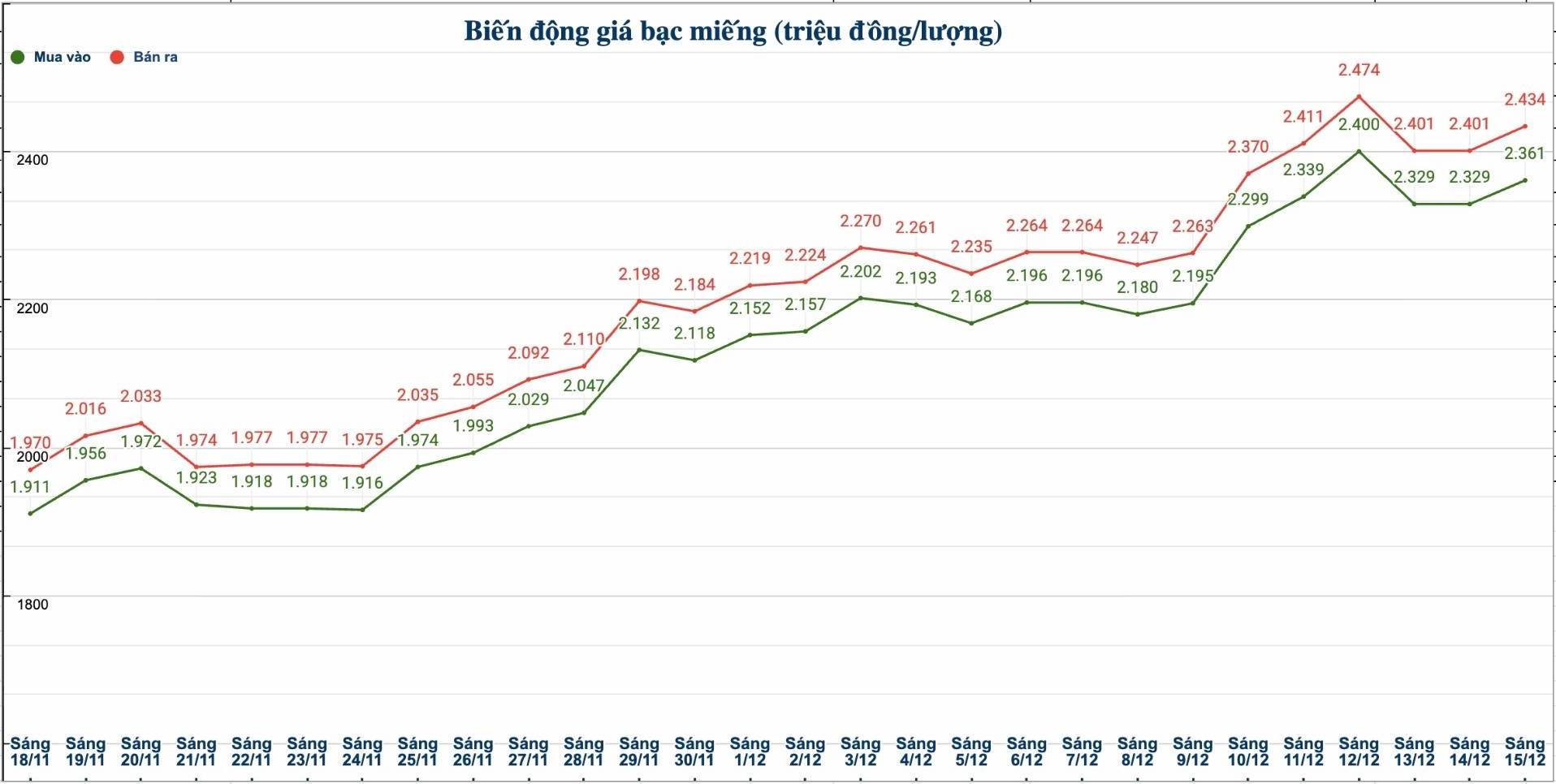

As of 10:10 on December 15, the price of 2024 Ancarat 999 silver bars (1 tael) at Ancarat Mineral and lunate Company was listed at VND 2.357 - 2.415 million/tael (buy - sell); an increase of VND 28,000/tael for buying and an increase of VND 29,000/tael for selling compared to yesterday morning.

The price of 999 Ancarat 999 (1kg) at Ancarat Petrochemical Company was listed at 62.010 - 63.900 million VND/kg (buy - sell); an increase of 744,000 VND/kg for buying and an increase of 774,000 VND/kg for selling compared to yesterday morning.

The price of 999 gold bars of the Golden Rooster Bank Limited (Sacombank-SBJ) is listed at 2.325 - 2.382 million VND/tael (buy - sell).

At the same time, the price of 999 999 coins (1 tael) at Phu Quy Jewelry Group was listed at VND 2.361 - 2.434 million/tael (buy - sell); an increase of VND 32,000/tael for buying and an increase of VND 33,000/tael for selling compared to yesterday morning.

The price of 999 taels of silver (1kg) at Phu Quy Jewelry Group was listed at 62.959 - 64.906 million VND/kg (buy - sell); an increase of 853,000 VND/kg for buying and an increase of 880,000 VND/kg for selling compared to yesterday morning.

World silver price

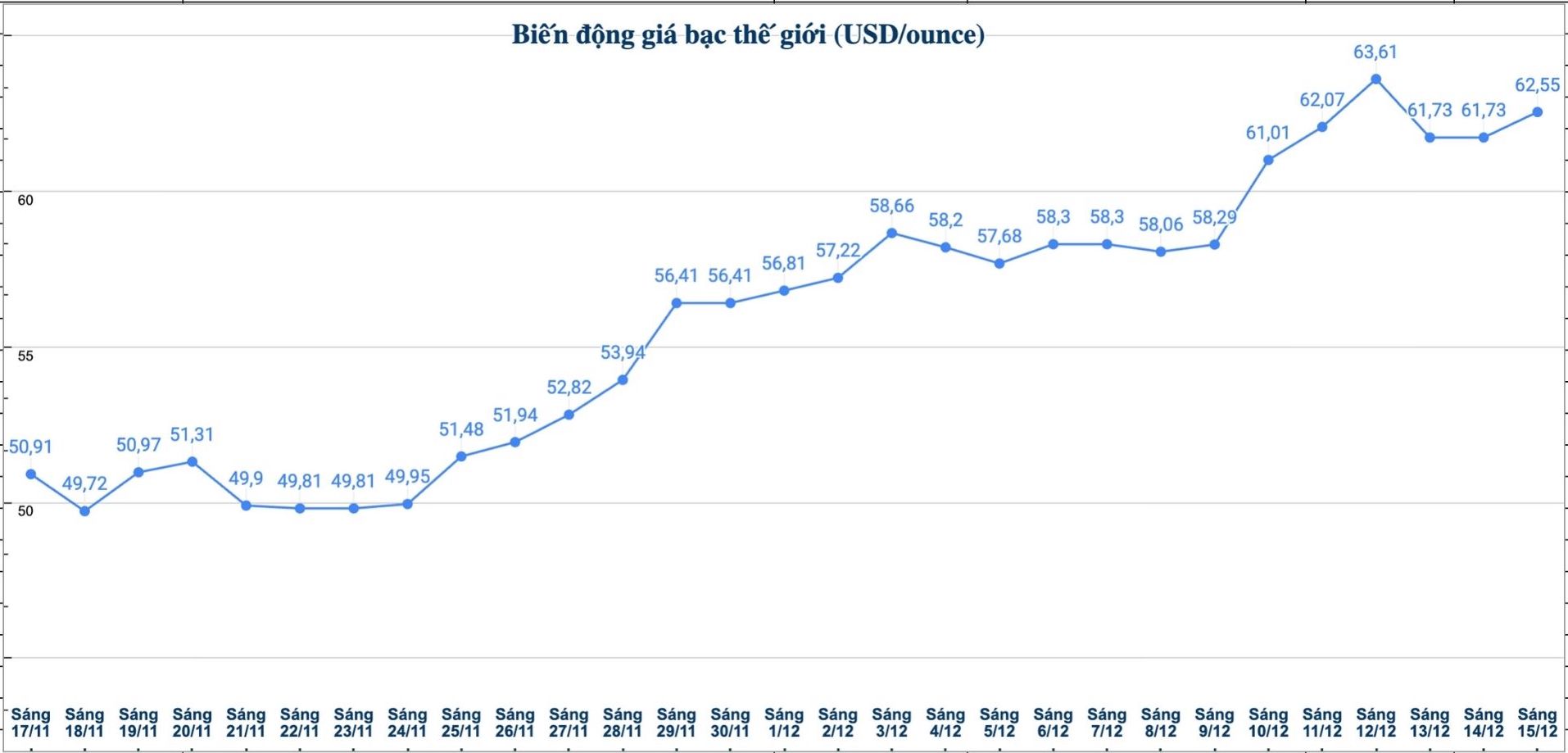

On the world market, as of 10:20 a.m. on December 15 (Vietnam time), the world silver price was listed at 62.55 USD/ounce; up 0.82 USD compared to yesterday morning.

Causes and predictions

According to precious metals analyst James Hyerczyk at FX Empire, despite profit-taking activities last weekend, silver prices still maintained a high level after surpassing the $60/ounce mark - an important psychological barrier that has existed for a long time.

He said that the increase in silver shows the increasingly clear role of this metal, not only as a currency risk-off asset but also an important raw material in industrial production.

"Notably, current buying power does not only come from short-term investors, but also extends to long-term cash flow" - he said.

James Hyerczyk said that the policy of the US Federal Reserve (Fed) continues to be a key factor in driving the market. The Federal Open Market Committee (FOMC) voted to cut interest rates by 25 basis points, bringing the federal funds rate down to 3.5 - 3.75%.

"The speech of Fed Chairman Jerome Powell, which excludes the possibility of interest rate increases in the coming time, is considered by the market as a positive signal for non-yielding assets such as gold and silver" - James Hyerczyk emphasized.

Regarding supply-demand factors, James Hyerczyk said that the silver market is facing a prolonged tightening situation. The 2025 World Silver Survey report forecasts that the market will record a supply shortage for the fifth consecutive year, with an estimated deficit of hundreds of millions of ounces.

"Remarkably, demand for silver in the industrial sector is increasing strongly and is less affected by short-term price fluctuations. Silver is an indispensable raw material in the production of solar panels, electric vehicles, artificial intelligence infrastructure and data centers - rapidly growing fields globally" - he said.

In addition, silver prices are also supported by the weakening of the USD after the Fed's policy decision. The USD index fell below the 100-point mark, making greenback-denominated commodities more attractive.

"In the short term, silver prices are expected to continue to fluctuate according to important US economic data, especially employment data and consumer price index (CPI). Signs of high inflation or a weak labor market could reinforce expectations that the Fed will continue to ease monetary policy in the coming time, thereby supporting silver prices," said James Hyerczyk.

See more news related to silver prices HERE...