Central exchange rate of VND/USD

This morning (October 15), the State Bank of Vietnam announced the central exchange rate at VND 25,114/USD.

With an margin of plus/ minus 5%, commercial banks today are allowed to trade USD in the range of VND 23,909 - VND 26,317/USD.

At the State Bank of Vietnam Transaction Office, the reference exchange rate today is as follows:

Buying: VND23,909/USD (up VND2/USD).

Selling: VND26,319/USD (up VND2/USD).

Domestic bank USD price reverses to increase

At commercial banks, the USD price today increased after a series of days of depreciation. In the same direction, the black market USD price moved in an upward trend, fluctuating between 27,130 - 27,250 VND/USD, increasing by 100 VND/USD.

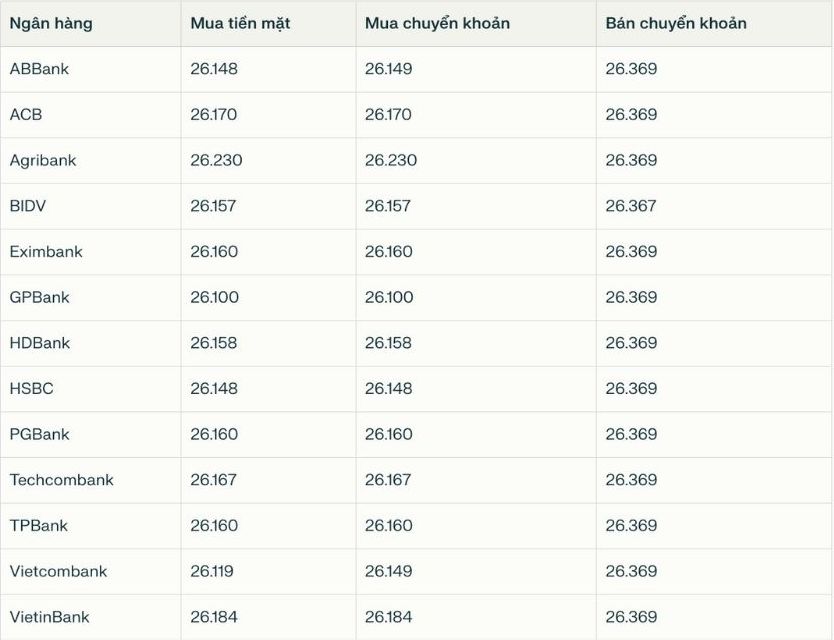

Banks simultaneously listed USD selling prices at VND26,369/USD.

Bank with the highest cash and bank transfer price: Agribank (26,184 VND/USD).

The difference between the buying and selling prices at banks is 221 VND/USD.

Yen exchange rate against USD

Reversing to decrease, the Yen exchange rate against the USD is currently trading at 151.85 USD/JPY, continuing to reach its lowest level since February 2025. Meanwhile, in the free market, this pair of exchanges is mixed with green and red when exchanged between 175.96 - 177.8 USD/JPY (buy - sell).

Market analysis

The recovery of the USD is expected to be difficult to prolong. When it comes largely from temporary adjustments due to short-term factors such as the interruption of the release of US economic data due to the US government's closure, along with political fluctuations in countries with competing currencies.

The greenback has gained about 3% against other currencies since mid-September, recovering from a more than three-year low after falling nearly 11% at the start of the year.

According to data from the US Securities and Exchange Commission (CSTC), speculators' net selling position for USD has fallen to 9.86 billion USD from a two-year high of 20.96 billion USD during this period, before the government shutdown disrupted data release.

The options market also showed a positive shift in the USD's direction, with EUR/USD option contracts for 1 and 3 months reaching the most pessimistic level for the Euro since mid-June.

However, analysts are still skeptical about the USD's recovery outlook.

Mr. Marc Chandler - Chief Strategist at Bannockburn Capital Markets commented: "In the next 3-6 months, I think the USD will decrease, because the US economy is likely to weaken and interest rates will go down". A large part of the USD's recent recovery is believed to come from investors buying back to close on fake selling positions.

"What is happening in the market is mainly positioning adjustments," added Jayati Bharadwaj, global foreign exchange strategist at TD Securities.

Some other experts believe that the USD's rally is gradually losing momentum, Mr. Joel Kruger, market strategist at LMAX Group ( London) commented: "We have seen a period of strong USD price increase". At the same time, he warned of the risk of a weakening USD in the short term.

However, due to the disruption of economic data release in the US and the political crisis abroad - especially in Japan and France - investors' attention has temporarily shifted away from the risks of the USD.

For the Japanese Yen, in October alone, it lost nearly 3% of its value compared to the greenback.

Chaos and instability in France, the second largest economy in the Eurozone, have weakened the Euro. Meanwhile, political changes in Japan have changed investors' expectations about the fiscal and monetary policies of the Bank of Japan (BoJ), putting pressure on the yen.

However, experts warn that investors' reaction to recent international fluctuations may be "too strong".

Morgan Stanley strategists wrote in a report last weekend: "The surprise election results of the Liberal Democratic Party (LDP) leadership have sent the yen down sharply, as investors bet on the BoJ's ability to expand finances and loose monetary policy."