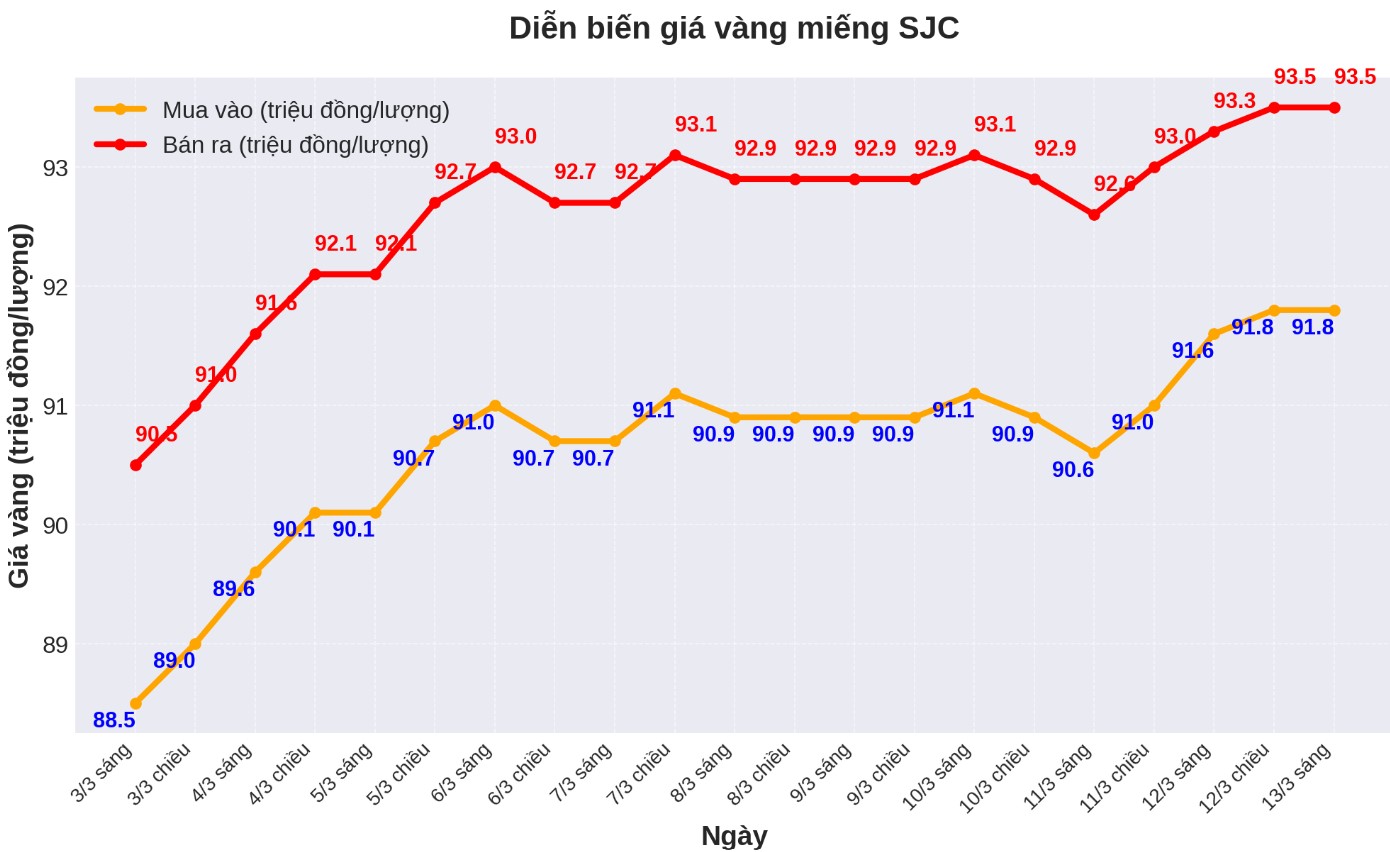

Updated SJC gold price

As of 6:30 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND91.8-93.5 million/tael (buy - sell), an increase of VND800,000/tael for buying and VND500,000/tael for selling. The difference between buying and selling prices is at 1.7 million VND/tael.

At the same time, the price of SJC gold bars was listed by DOJI Group at VND91.8-93.5 million/tael (buy - sell), an increase of VND800,000/tael for buying and an increase of VND500,000/tael for selling. The difference between buying and selling prices is at 1.7 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 92-93.5 million VND/tael (buy - sell), an increase of 1.2 million VND/tael for buying and an increase of 700,000 VND/tael for selling. The difference between the buying and selling prices of SJC gold is listed at 1.5 million VND/tael.

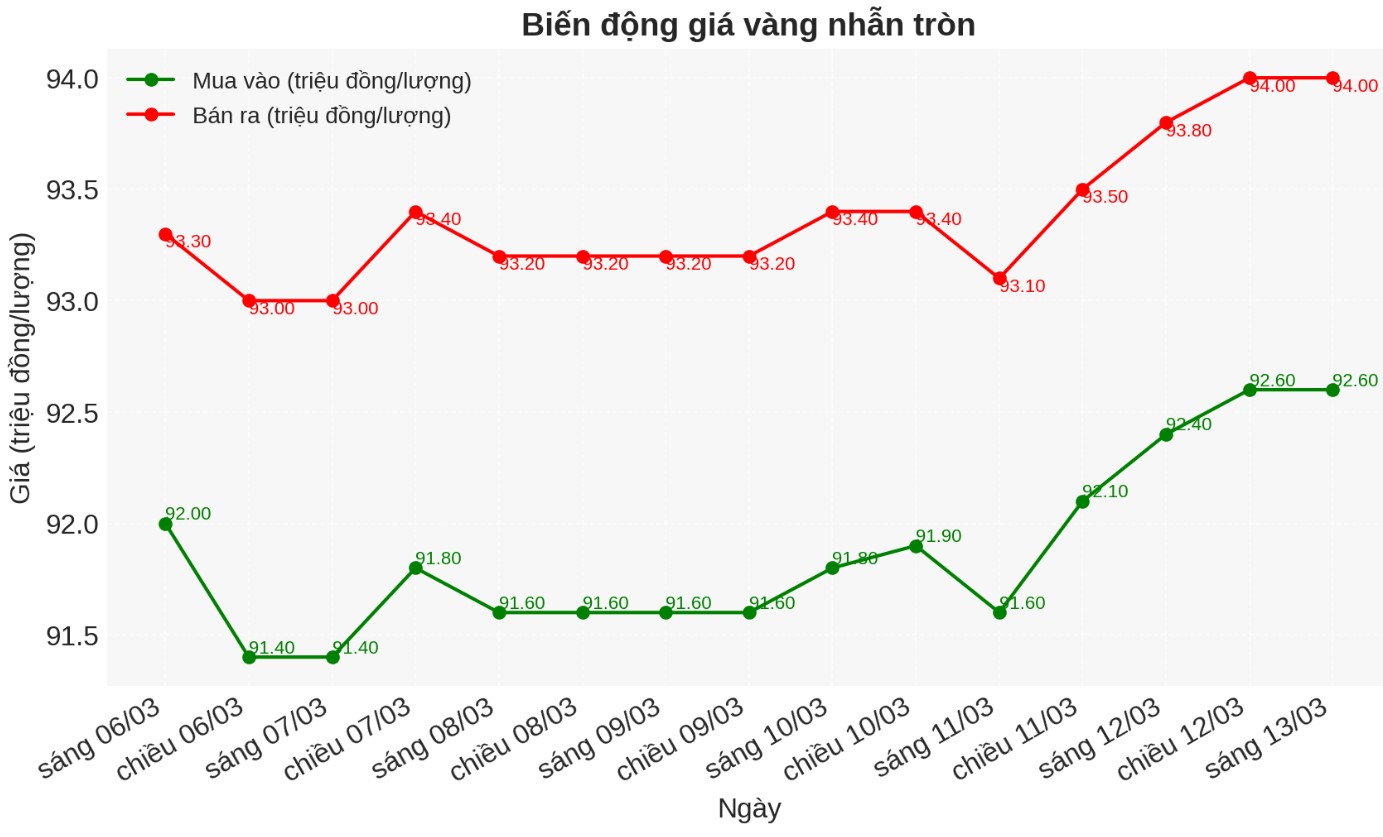

9999 round gold ring price

As of 6:30 a.m. today, the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at VND92.6-94 million/tael (buy in - sell out); increased by VND500,000/tael for both buying and selling. The difference between buying and selling is listed at 1.4 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 92.55-94.1 million VND/tael (buy - sell); increased by 650,000 VND/tael for buying and increased by 700,000 VND/tael for selling. The difference between buying and selling is 1.55 million VND/tael.

In the context of high world gold prices, domestic gold rings may increase when the market opens a new trading session.

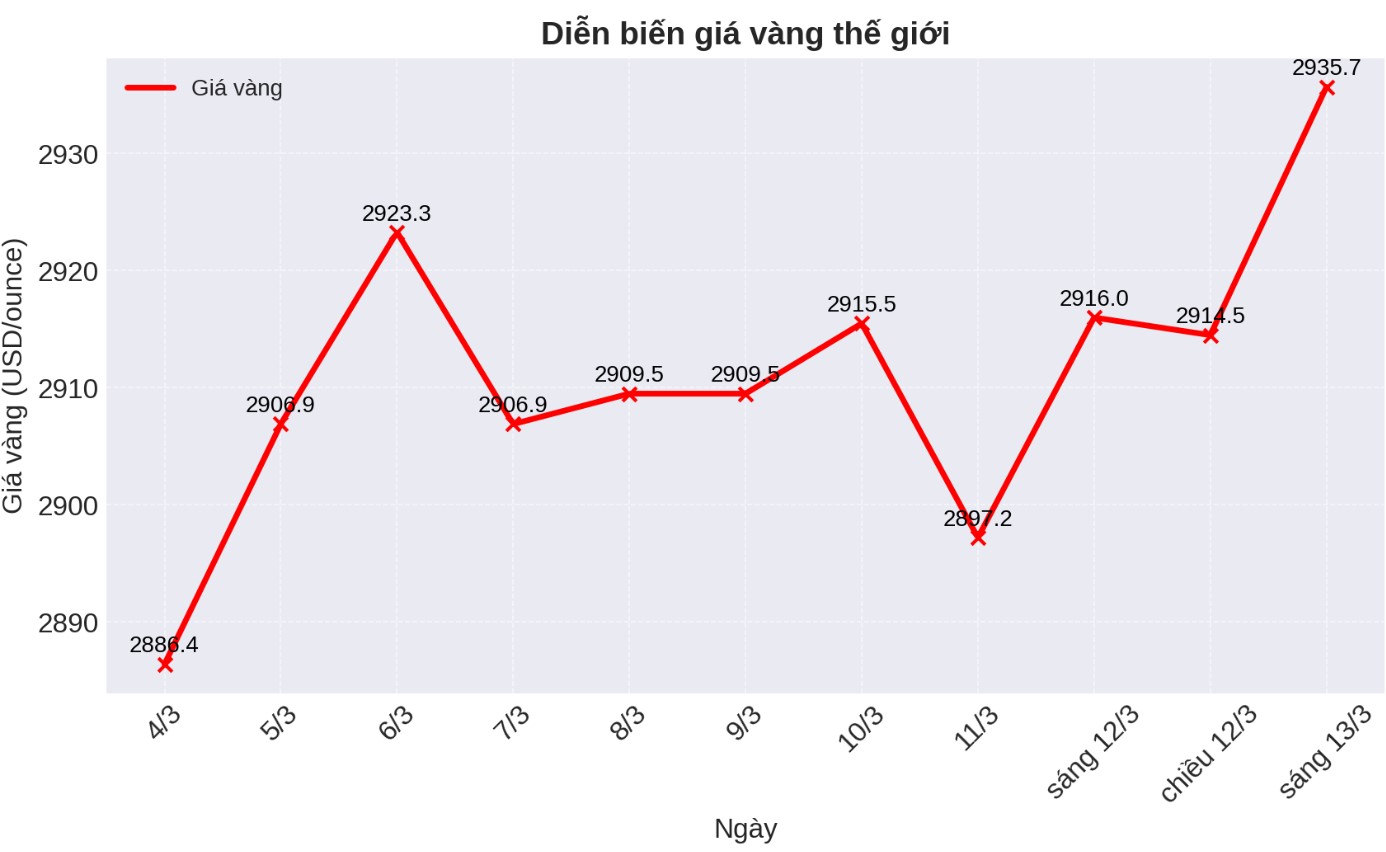

World gold price

As of 6:30 a.m., the world gold price listed on Kitco was at 2,935.7 USD/ounce, up 18 USD/ounce compared to the same time of the previous session.

Gold price forecast

World gold prices increased despite a sharp decrease in the USD. Recorded at 6:30 a.m. on March 13, the US Dollar Index measuring the fluctuations of the greenback against 6 major currencies was at 103.550 points (up 0.27%).

Gold prices hit a two-week high, the reason being that the US inflation report showed the consumer price index (CPI) was lower than expected. The need for safe havens for these two precious metals remains strong as global trade tensions could slow the world's economic growth rate.

Gold contracts for delivery in April increased by 20.4 USD to 2,941.3 USD/ounce. The May silver contract increased by 0.538 USD to 33.68 USD/ounce.

The US February CPI report - one of the important economic data this week - showed the consumer price index increased by 2.8% over the same period last year. Previously, the market predicted a 2.9% increase in CPI over the same period, lower than the 3.0% in the January report.

The Producer Price Index (PPI) report will be released on Thursday, expected to increase by 0.3% monthly, down from January's 0.4% increase. After the CPI data was released, the USD index decreased largely the increase achieved in the previous session.

US stock indexes are rising in the middle of the session but are still below their daily highs, due to a recent recovery after selling pressure that has caused key indexes to fall to their lowest level in many months.

Investors are still concerned about continued changes in US tariff policies and retaliatory measures from trading partners. The Wall Street Journal wrote: "The expired tariff scenario, the stock market needs the return of Mr. Donald Trump as a deal maker".

Technically, the price of gold for delivery in April shows that bulls are still in the short term with the next goal of pushing closing prices above the solid resistance level at the contract peak of 2,974 USD/ounce.

In contrast, the target for sellers is to pull prices below the important support level at the bottom of last week at 2,844.1 USD/ounce. The first resistance was at $2,950/ounce, followed by $2,974/ounce.

The first support was at the lowest level of the day at 2,911 USD/ounce, followed by 2,900 USD/ounce.

Major outside markets saw WTI crude oil prices on Nymex increase, trading around 67.75 USD/barrel. The yield on the 10-year US Treasury note is currently around 4.3%.

Important economic data for the week

Thursday: US Producer Price Index (PPI), weekly jobless claims.

Friday: University of Michigan Preliminary Consumer Confidence Index.

Note: The article data compares with the same time of the previous trading session.

See more news related to gold prices HERE...