Most recently, the European Central Bank (ECB) decided not to adjust interest rates, as expected by the market.

According to the official announcement, the ECB kept deposit interest rates unchanged at 2.00%, the main refinancing rate at 2.15% and the marginal lending rate at 2.40%. The Eurozone Central Bank also did not give clear signals on policy orientations in the coming time, in addition to continuing to expect inflation to gradually return to the 2% target.

In a statement after the meeting, the ECB assessed that the euro zone economy still maintains its resilience in the context of a challenging global environment. A stable labor market, a healthy balance sheet of the private sector, along with public spending on defense and infrastructure being gradually implemented, continue to support growth. However, the ECB also emphasized that the outlook still contains many uncertainties, especially related to global trade policy and geopolitical tensions.

The ECB's decision to keep interest rates unchanged combined with economic and geopolitical information is putting pressure on gold prices, currently selling pressure is still dominant. Spot gold price in euros at one point fell more than 2%, to around 4,115 euros/ounce.

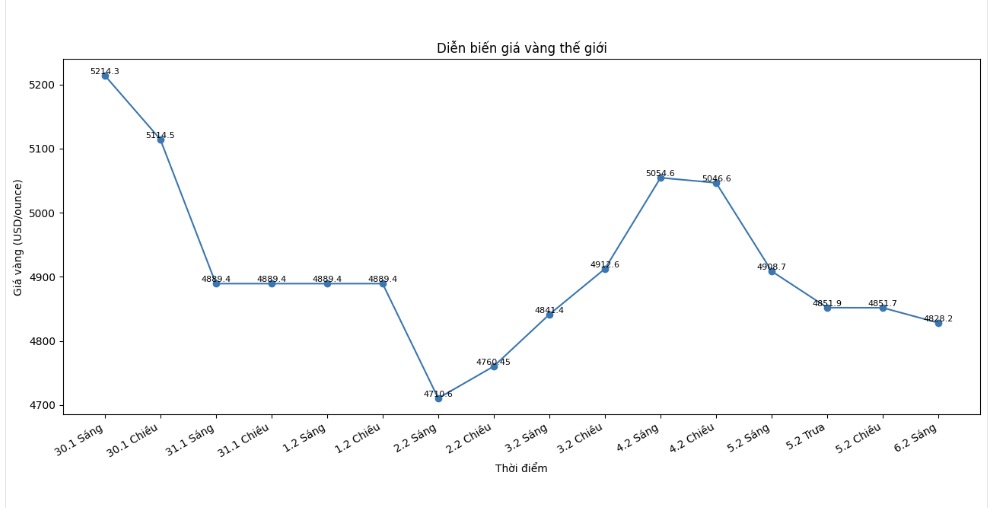

The weakening trend of gold is also similar when converted to USD. On the international market, spot gold prices retreated to around 4,854 USD/ounce, down over 2% compared to the previous session. This development reflects the cautious sentiment of investors in the context that global monetary policy has not changed clearly, while traditional supporting factors of gold are temporarily weakening.

See more news related to gold prices HERE...