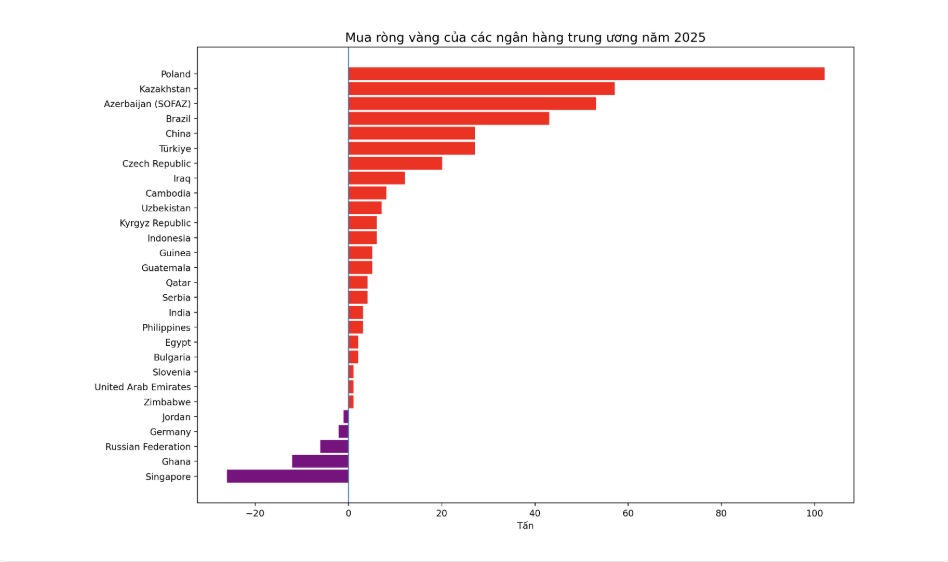

Although high gold prices caused government purchases to slow down somewhat at the end of the year, the total amount of gold purchased by central banks in 2025 still did not decrease much compared to the previous year, according to Ms. Marissa Salim - Head of Senior Research Group for Asia-Pacific of WGC.

“Central banks bought 19 tons of gold in December 2025 based on IMF data and other public sources, thereby raising the total reported net buying volume for the whole year 2025 to 328 tons. This figure is lower than the net buying of 345 tons recorded in 2024,” Ms. Salim said on Tuesday.

In December, central banks bought a total of 30 tons of gold bars, while selling 11 tons, according to Ms. Salim. For the whole year, the average net buying volume reached about 27 tons per month.

The countries that bought the most gold in December were Uzbekistan with 10 tons, followed by Kazakhstan buying 8 tons and Poland buying 7 tons, according to WGC. Other significant buyers include Kyrgyzstan with 2 tons; China, Czech Republic, Indonesia and Mongolia each bought 1 ton in the last month of 2025. In the opposite direction, Singapore was the country that sold the most in December, with 11 tons of gold.

The Central Bank of Poland is the largest net buyer in 2025, adding 102 tons of gold to the national reserves" - Ms. Salim said - "The other significant buyers in the year include Kazakhstan (57 tons), SOFAZ - Azerbaijani National Oil Fund (53 tons), Brazil (43 tons), China (27 tons) and Turkey (27 tons)".

On the selling side, Singapore was the largest net seller in 2025 with 26 tons of gold, followed by Ghana selling 12 tons and Russia selling 6 tons.

See more news related to gold prices HERE...