According to Mr. Chris Mancini - co-manager of the Gabelli Gold Fund (GOLDX) portfolio, the balance may be leaning completely towards mining businesses - provided they use the huge free cash flow accumulating on the balance sheet correctly.

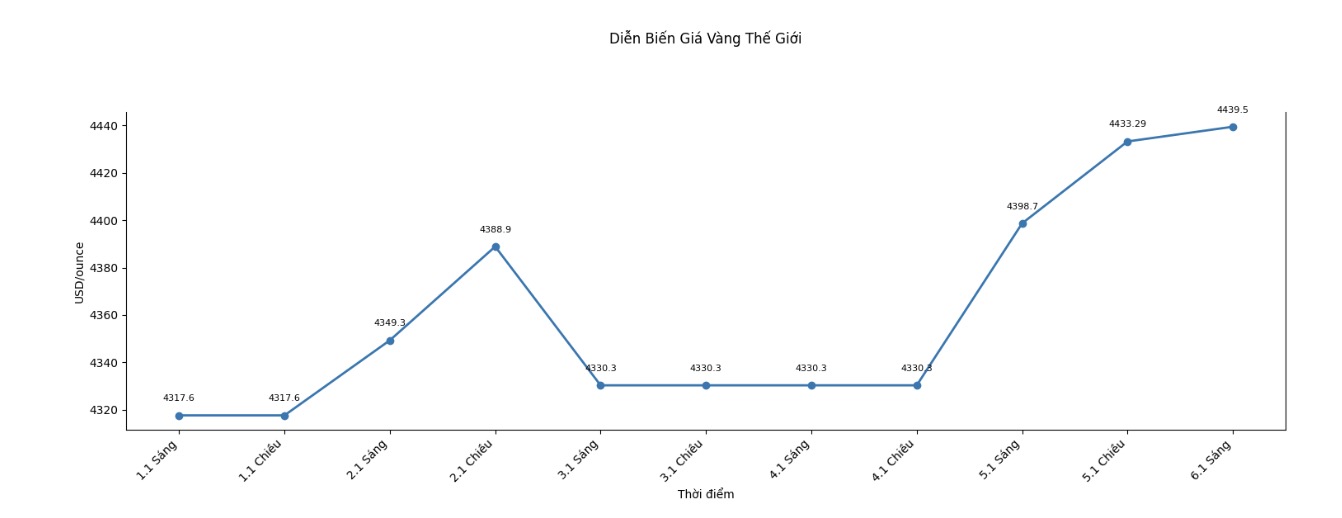

While some opinions are starting to warn about signs of excessive speculation, Mr. Mancini believes that the factors that pushed gold prices to a record high of over 4,400 USD/ounce remain, thereby continuing to support high gold prices and strong corporate profits.

He predicts that interest rates in the US will tend to decrease this year, regardless of who leads the Federal Reserve (Fed), amid slowing economic growth. At the same time, the demand for gold from central banks - especially from China - is still a long-term structural factor of the market.

According to him, this context is directly helping to expand the profit margin of mining companies.

Free cash flow surges - and the market is just beginning to realize

At the current price level, Mr. Mancini said that the gold mining industry is creating "extraordinary" free cash flow, but market valuations still reflect skepticism formed after years of ineffective operation and capital destruction.

He gave an example of the world's largest gold producer. According to Mancini's estimates, with the current gold price, Newmont could generate nearly $10 in profit per share next year - a figure almost equivalent to free cash flow. He added that the balance sheet of the entire industry has improved significantly, and many businesses are almost out of net debt.

However, stock valuation is still implicitly assuming a gold price environment much lower than the current reality.

That mismatch is where the opportunity still exists" - Mancini emphasized.

2026 Prospects

Dividends, not buying back shares, are the missing catalyst.

Mancini admitted that buying back shares was reasonable during the period when gold industry shares were overvalued. However, he believes that the industry is approaching an important turning point.

As the valuation gradually returns to normal levels and free cash flow continues to increase in 2026, Mancini believes that mining companies should strongly shift to paying larger and clearer dividends.

According to him, buying back shares does not attract new investors because the market does not see a specific yield level. Conversely, dividends force investors to pay attention.

A gold stock that has both dividends and growth is a completely different story from a gold bar in the safe" - Mancini said.

In the context of reduced cash yields and persistent inflation, he believes that investors will increasingly look for income-generating assets.

If large mining enterprises start paying dividends at 3%, 4% or higher - based on rising profits, the industry may become competitive with traditional income assets.

Mancini believes that instead of spending billions of USD to buy back shares, large manufacturers can completely maintain a dividend rate of 4-5 USD/share at the current gold price level - a move that could significantly change the market's valuation of gold shares.

For gold investors, the next stage of the market price increase may not only be higher prices - but also income.

An industry still being discounted by skepticism

Despite the fundamental factors improving, Mancini believes that investors are still very cautious about gold mining stocks, due to being haunted by many years of poor operational errors and discipline in the past. In 2025, the NYSE Arca Gold BUGS Index (HUI) increased by 154% in the year, for the first time surpassing gold. However, if viewed in the long term, the gold mining industry is still far behind the S&P 500 index in the past decade.

According to Mancini, this skepticism makes dividends particularly important.

The market wants to see real money - cash in hand. Not just promises of capital recovery," he said.

He compared it to other cyclical sectors, such as energy, where stable dividend policies ultimately helped the valuation recover after a long period of investors losing confidence.