Bart Melek - CEO, Head of Global Commodity Strategy at TD Securities predicted that gold prices could reach $4,000/ounce in the short term as central banks, especially China and many emerging markets, will buy millions ofounces to increase their reserve ratio.

This is a great time for the precious metals industry. I have repeatedly asserted that the possibility of gold reaching $4,000/ounce is completely real.

The main reason is that the FED continues to loosen monetary policy as it enters 2026. There is a possibility of another rate cut this year, even two, even if the Fed Chairman did not confirm it clearly in his speech on Tuesday, Melek said in an interview on Tuesday.

He said gold ETFs are attracting investors again as holdings have increased compared to February's low.

Self-employed traders, who missed out on this rally, are also likely to join. The lower yield curve is reducing holding costs, inflation is expected to increase, and investors who have not yet allocated enough gold are looking to restructure their portfolios, he added.

According to Melek, the Fed's interest rate cut helps borrowing costs become cheaper to open up a new gold position. Some short-term yields have fallen, making gold cheaper to hold, he explained.

Referring to central bank buying power - the main factor supporting gold price increase - Melek said that the gold reserve ratio in many countries is still low.

Gold accounts for only about 6.7% of Chinas reserves, while their foreign exchange reserves are about $3,700 billion. Even if China doubles to 15%, it is still far from the 72% of the US or 70% of Germany. Russia also has a lot, and countries like Poland are still buying more.

This means millions of more ounces of gold need to be bought in. Melek stressed that these programs last for decades, not just 1-2 years. If China speeds up the pace, prices could reach $6,000-7,000 an ounce. But this will be a gradual process.

Regarding the information that China may provide gold deposition services to other countries, he said that this possibility is real. Currently, central banks of many countries mainly deposit gold at the Bank of England. But in the context of a volatile world, some countries may want to diversify and transfer part of their gold to China.

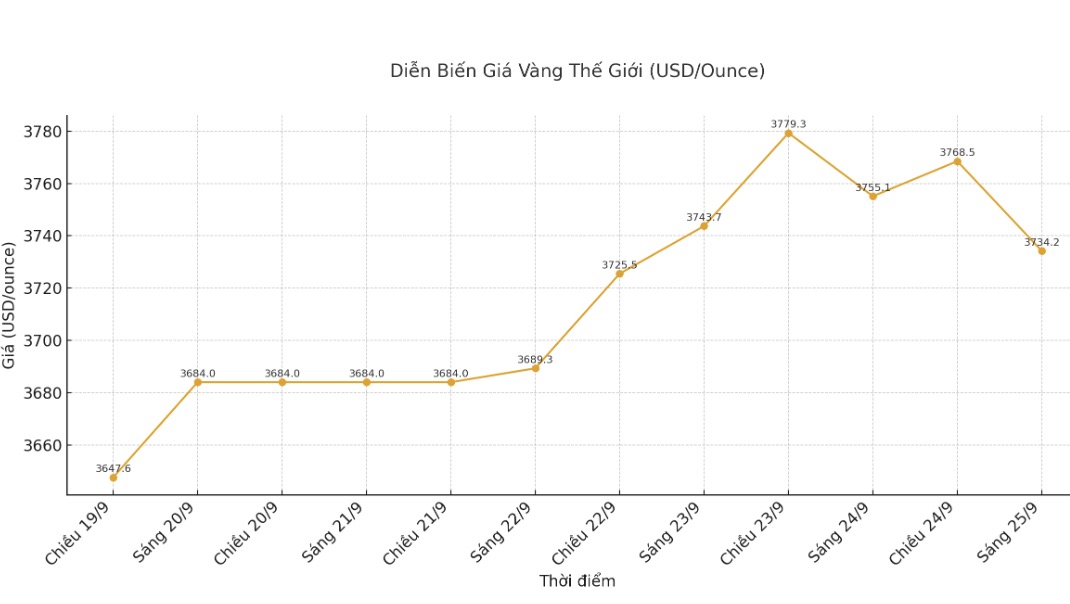

In the market, gold prices once touched 3,779.34 USD/ounce in the night trading session, before falling to 3,734.2 USD/ounce.

See more news related to gold prices HERE...