According to the commodity outlook report for 2026 by TD Securities (a securities company and investment bank under Toronto-Dominion Bank of Canada), gold prices are unlikely to fall sharply in 2026. Conversely, this organization expects this precious metal to continue to set new historical peaks, thanks to persistent demand from many investor groups.

TD Securities believes that the new long-term price range of gold will be in the range of 3,500 - 4,400 USD/ounce. To maintain prices below the bottom of this region, there needs to be a significant change in market sentiment, specifically the return of investors to risky assets in the US or the appearance of views that the US labor market is not weakening and the US Federal Reserve (Fed) will not continue to cut interest rates.

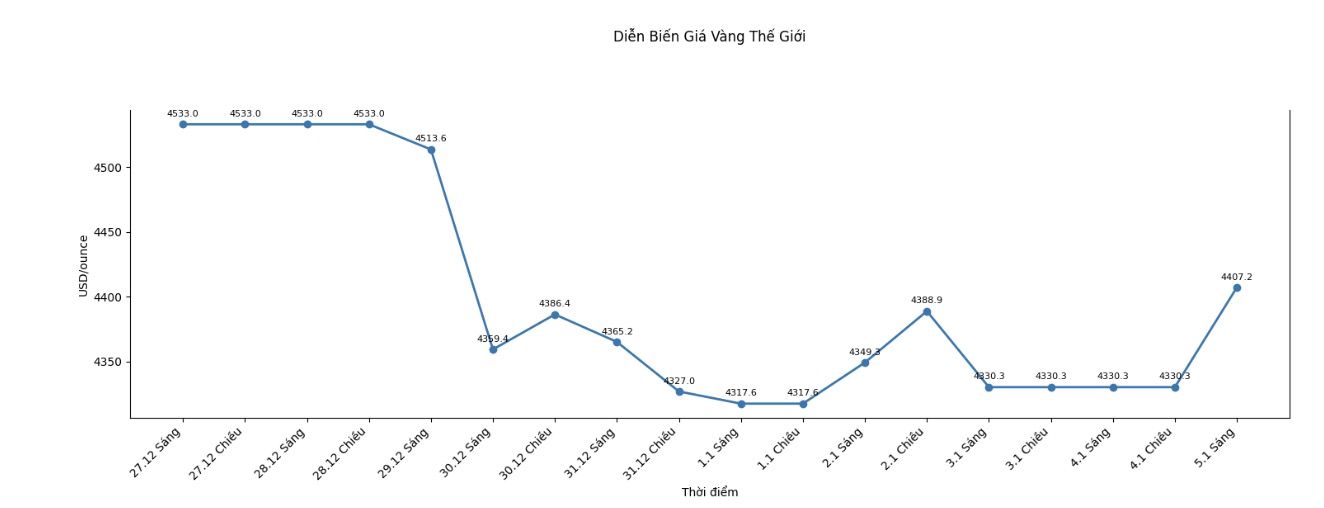

TD analysts believe that gold buying power will come simultaneously from central banks, ETF investors and traders. Therefore, TD forecasts that the average quarterly gold price may reach a record level of 4,400 USD/ounce in the first half of 2026, with even higher trading peaks.

Sharing the same positive view, analysts at Wells Fargo (one of the largest commercial and financial services banks in the US) believe that gold will be one of the few prominent commodities in the commodity group in 2026. In the 2026 Outlook report, Wells Fargo emphasized that they continue to maintain an optimistic view of the upward trend of gold and precious metals in general.

According to Wells Fargo, recent conditions are very favorable for gold, as global demand is driven by strong buying activity by central banks, the weakening of the USD, Fed interest rate cuts and geopolitical instability. The organization expects these supporting factors to continue in 2026, helping gold prices continue to prevail, although the growth rate may be slower than in 2025.

Among the key investment ideas for 2026, Wells Fargo recommends that investors adjust their portfolios to take advantage of the short-term low-interest environment, prioritizing quality assets to preserve capital.

According to their assessment, goods, especially gold and precious metals, could play an important role in preventing persistent geopolitical risks and inflation, in the context of the USD being forecast to stabilize and demand from central banks remaining.

Meanwhile, strategists at RBC Capital Markets forecast that gold prices in 2026 will mainly trade in the 4,500 - 5,000 USD/ounce range, with a tendency to lean towards the upper edge of this range in the second half of the year.

Although it is difficult to repeat the explosive increase of 2025, RBC believes that the risk of gold price depreciation is quite limited, as strong support zones have been set significantly higher than the period before 2024.

Mr. Christopher Louney - gold strategist at RBC Capital Markets (the global investment banking and capital market segment of Royal Bank of Canada - one of the largest banks in Canada), said that the big lesson from 2025 is the prolonged uncertainty related to tariffs, geopolitics, conflicts, politics and government shutdown risks that have made many investors realize they are holding too little gold.

When combined with strong price movements and low correlation with other assets, gold is increasingly accepted as a strategic part of the investment portfolio.

See more news related to gold prices HERE...