In the context of falling gold prices, this precious metal and many key commodities are forecast to continue to be supported by favorable fundamentals. This is the assessment of Mr. Dominic Schnider - Head of APAC Commodities and Foreign Exchange, UBS Wealth Management.

Prices of precious metals, although volatile, increased in January, as political, geopolitical and economic instability boosted safe-haven demand," Schnider wrote in a commodity market update released on Monday.

He also said that copper prices hit record highs at the end of January before adjusting, while oil prices were supported by short-term supply disruptions in the US and Kazakhstan, along with the weakening of the USD and tensions in the Middle East.

According to UBS, as recent fluctuations continue to cool down, the fundamental factors of gold and many other important commodities remain positive.

We expect gold to continue its upward trend, possibly reaching 6,200 USD/ounce by mid-year, thanks to buying power from central banks and investors, large budget deficits, falling real interest rates in the US and geopolitical risks" - Mr. Schnider said.

For industrial metals, UBS forecasts that the shortage of supply for copper and aluminum will continue to support prices in the medium term, while structural drivers such as the electrification process will strengthen long-term demand.

Mr. Schnider believes that investors who do not yet hold gold should consider adding to their portfolios, while those who already have a large proportion can diversify to other commodities.

For investors who love gold, a moderate allocation ratio can help increase diversification and minimize systemic risks. Meanwhile, investors who are holding large amounts of gold and have not made significant profits should expand to copper, aluminum and agricultural assets to diversify profit sources in the future," he wrote.

UBS believes that commodities will play an increasingly important role in the 2026 investment portfolio, in the context of supply-demand imbalances, geopolitical risks and the global energy transition.

We prefer a large-scale commodity investment strategy and continue to value gold as an effective risk hedging tool," Mr. Schnider emphasized.

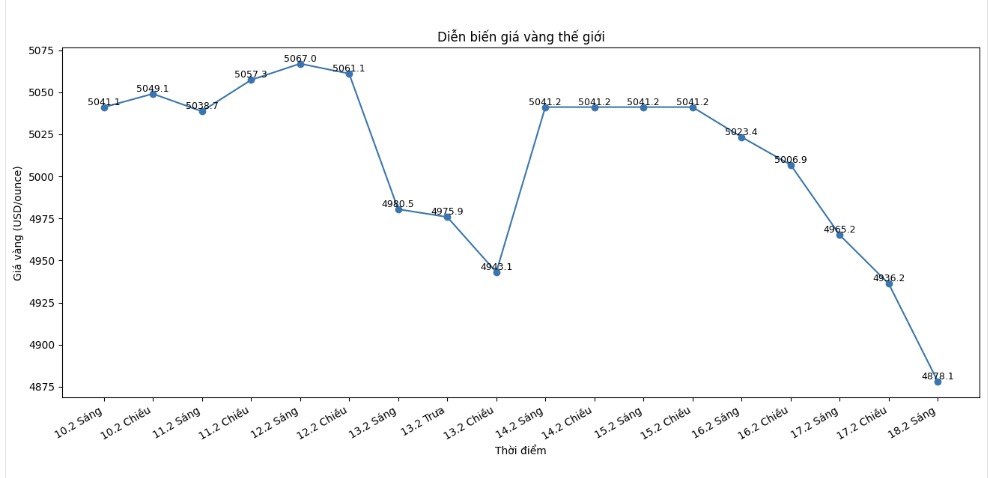

Gold price forecast of 6,200 USD/ounce marks a sharp increase compared to UBS's previous forecast. In early January, Mr. Schnider predicted that gold could reach 5,000 USD/ounce by the end of Q1, thanks to buying power from central banks, increased budget deficits, expectations of interest rate cuts in the US and prolonged geopolitical tensions.

UBS believes that limited supply and increased demand will continue to support prices of many types of goods in 2026.

Gold prices are expected to continue to rise, thanks to buying power from central banks, large fiscal deficits, reduced real interest rates and geopolitical risks" - Mr. Schnider concluded.