Stepping into 2026, the global gold market continues to heat up after a strong breakthrough in 2025. A noteworthy point is that a series of large financial institutions have simultaneously updated their views, mostly in the direction of increasing forecasts, in the context of geopolitical - policy risks that are still dense and the central bank's gold buying demand is still persistent.

However, the gap between forecast scenarios is also very wide, suggesting that 2026 may be a year of "large profits accompanied by large fluctuations".

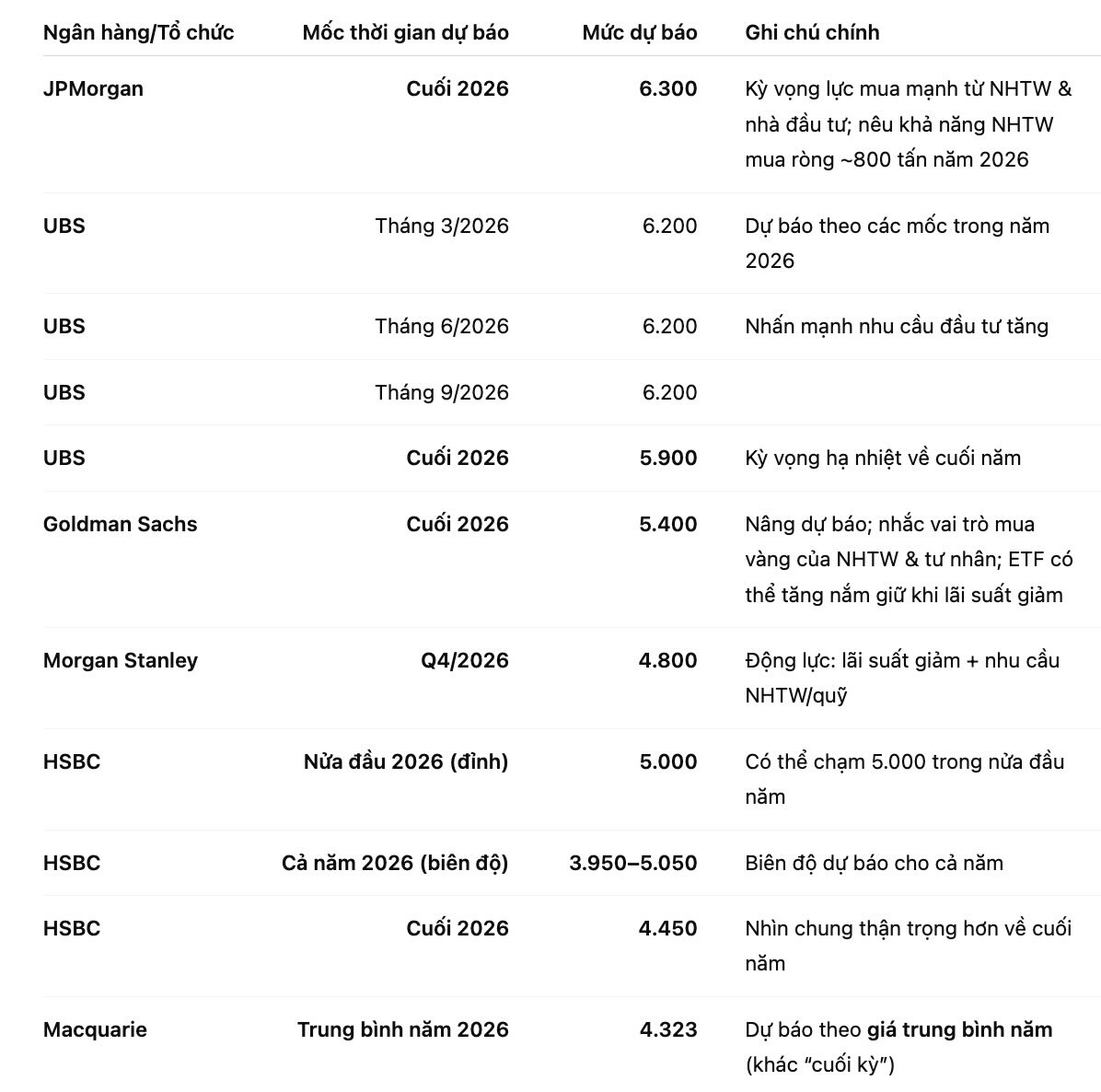

Horizon" forecast: JPMorgan and UBS pull the mark up to 6,200 - 6,300 USD/ounce

In the group of most optimistic forecasts, JPMorgan attracted attention when it said that gold prices could rise to $6,300/ounce by the end of 2026, with the focus being on the buying power of central banks and investors still maintained, reflecting the trend of diversifying reserves away from "paper" assets.

Notably, JPMorgan also stated that the central bank's net buying expectation could reach 800 tons in 2026.

Sharing the same optimistic "tone", UBS raised the gold price target to 6,200 USD/ounce for the March, June and September 2026 milestones, emphasizing strong investment demand. However, UBS also forecasts that prices may cool down to 5,900 USD/ounce by the end of 2026.

A little lower, some other organizations such as Deutsche Bank and Société Générale once offered a scenario of 6,000 USD/ounce by the end of 2026.

Destination group 5,400 USD/ounce: Goldman Sachs bets on buying gold from the private sector and emerging central banks

Goldman Sachs raised its gold price forecast for the end of 2026 to $5,400/ounce (up $500 compared to before), saying that the "diversification to gold" activity comes not only from central banks, but also from the private sector considering gold as a tool to hedge global policy risks.

Goldman also expects Western gold ETFs to increase holdings as interest rates tend to fall, while assuming the Fed may cut 50 basis points in 2026.

A noteworthy point in Goldman's argument is: they "bet" that defensive buying power will not rush to take profits/divest in 2026, thereby raising the forecast level.

More cautious group: Morgan Stanley, HSBC and "adjustment warning

In a cautious direction, Morgan Stanley forecasts gold to rise to 4,800 USD/ounce in Q4/2026, with drivers including falling interest rates, changing expectations about Fed leadership and central bank/fund buying demand.

HSBC offers a "year-on-year high – year-on-year fluctuation" picture: gold could reach 5,000 USD/ounce in the first half of 2026, but the bank warns of adjustment risks if geopolitical tensions cool down or the Fed stops its interest rate cut cycle. HSBC announced a very broad forecast range of 3,950–5,050 USD/ounce for the whole year 2026, and a year-end level of about 4,450 USD/ounce.

Not only "target prices", banks also emphasize volatile risks

A consistent message throughout the early 2026 reports is: volatility may be a new normal state. Citi sees gold still being "supported" by many overlapping risks (geopolitical tensions, US public debt, uncertainty about AI...), but about half of the risks being valued by the market may decrease in the second half of 2026 if some hot spots cool down.

From an average price forecast perspective, Macquarie raised its 2026 average gold price forecast to 4.323 USD/ounce, while acknowledging they are cautious with long-term forecasts due to the "disparage" between the fundamentals and too strong price volatility.

See more news related to gold prices HERE...