Gold prices plummet, investors line up to buy

According to Business-Standard.com - a prestigious economic newspaper in India, while the image of people lining up in front of gold shops has been flooding social networks over the past month, professional precious metals traders have gradually become concerned.

Gold is becoming an overwhelming investment channel, pushed too high by all technical indicators, said Nicky Shiels, head of research at MKS Pamp SA precious metals refining company.

Last Monday, when gold prices climbed to a new record of nearly $4,400/ounce, Mr. Marc Loeffert - a trading expert at Heraeus Precious Metals - warned that this precious metal is "increasingly falling into the overbought zone".

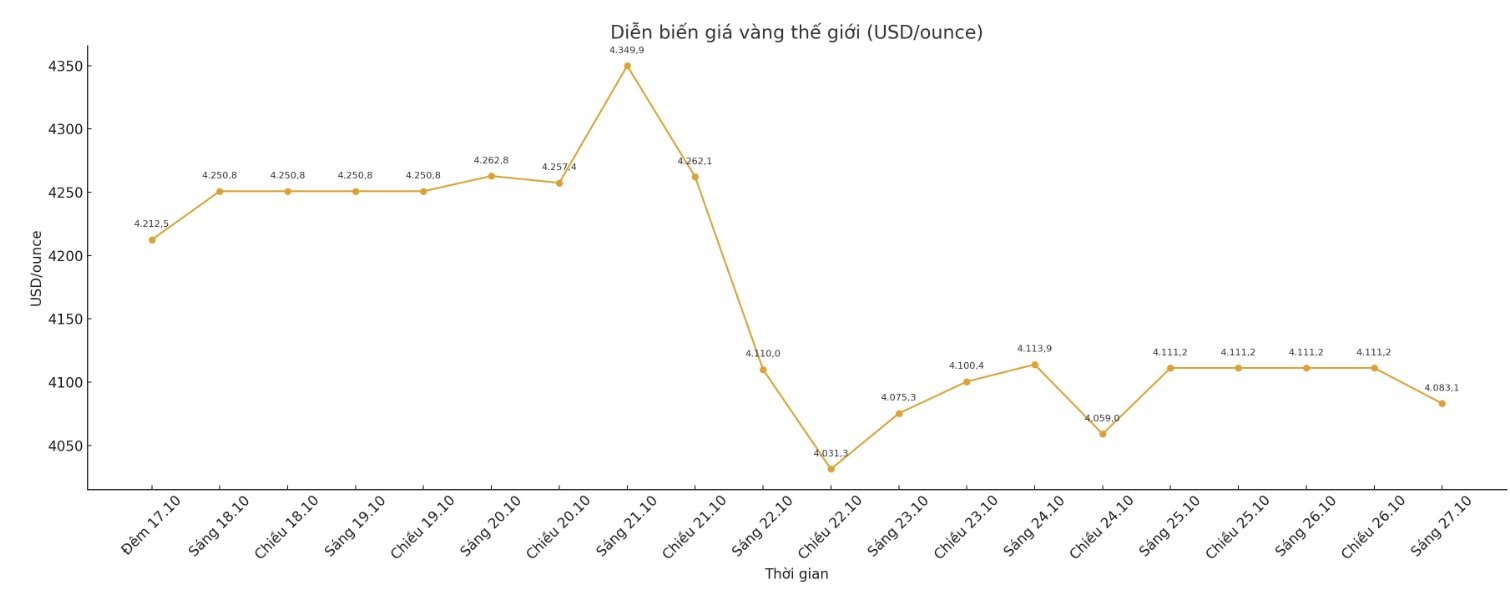

Adjustments have occurred. Last week, gold prices had a time to plummet to 6.3% on Tuesday - the strongest day's decline since 2013 - and maintained their decline until the end of the week, closing Friday's session at 4,111.2 USD/ounce. In absolute terms, the decline of 139.6 USD/ounce for the week was also among the strongest groups ever.

Is this a turning point in gold's multi-year price increase cycle, or just a correction? At Chinatown in Bangkok - Thailand's largest gold exchange, Sunisa Kodkasorn, 57, a worker at a textile factory, said she had no worries: "Gold is the best investment. We collected all the money and came here today because we knew the price had dropped".

She's not the only. From Singapore to the US, gold dealers said a large number of retail investors are taking advantage of buying gold when prices adjust.

However, Kodkasorn's efforts to "catch the bottom" were hampered when it removed gold bars suitable for its financial capacity and sold them. Meanwhile, in Kyoto, nearly 1,000 traders, brokers and refiners flocked to the city to attend Japan's largest precious metals conference, which opened on Sunday - a signal of strong excitement from within the market.

Priced markets always need healthy corrections to eliminate excess excitement and help the growth cycle become more sustainable, Shiels said last week.

Wall Street experts reduce expectations

Commenting on gold prices in the short term, many Wall Street experts are leaning towards the possibility of going sideways or down.

Kitco veteran expert Jim Wyckoff predicted that gold will continue to fluctuate strongly with a downward trend next week: "Large fluctuations have caused both buyers and sellers to be swept out of the market in the same session. When speculators withdraw out of fear of risks, the trend tends to decrease.

However, he emphasized that factors supporting gold still exist: The US government is closed for the fourth week, lacking important economic data, increasing instability. In that context, gold still plays a safe-haven asset role.

Sharing the same view, Ryan McIntyre - Management partner at Sprott Inc - assessed that it is unlikely that gold prices will fall further as economic and geopolitical instability remains high, in the context of the US continuing to negotiate with China on trade and US President Donald Trump announcing the end of all trade negotiations with Canada.

The trend of safe havens remains the same, he added.

Ole Hansen - Head of Commodity Strategy at Saxo Bank - said that although gold is still stuck in the support zone, he does not think that selling pressure has ended.

I am not in a hurry to return to the market, because the current correction comes from profit-taking cash flow rather than economic data. The lower CPI than expected helps maintain expectations of interest rate cuts, creating a basic support for gold, but whether $4,000/ounce is at the bottom or not is too early to confirm. The strong fall of $4,000/ounce at the beginning of the week shows that the accumulation phase has begun and that is necessary after a series of hot increases, he said.

Although gold is entering a new accumulation cycle - similar to the May-August period after surpassing $3,000/ounce - analysts emphasized that the fundamental drivers that helped gold prices increase by more than 60% since the beginning of the year are still intact.

Meanwhile, Mr. Michael Moor Moor - founder of Moor Analytics - is leaning towards the scenario of a rebound if gold maintains important technical levels.

Notable economic data next week

Tuesday: US consumer confidence.

Wednesday: Bank of Canada policy decision, US waitress data, FED policy decision, Bank of Japan policy decision.

Thursday: ECB policy decision.