Gold price developments last week

World gold prices have just experienced one of the worst sessions in many years. Gold's rally was held back right before a 10-week mark. Traders, experts and retail investors are asking: What will happen next to precious metals?

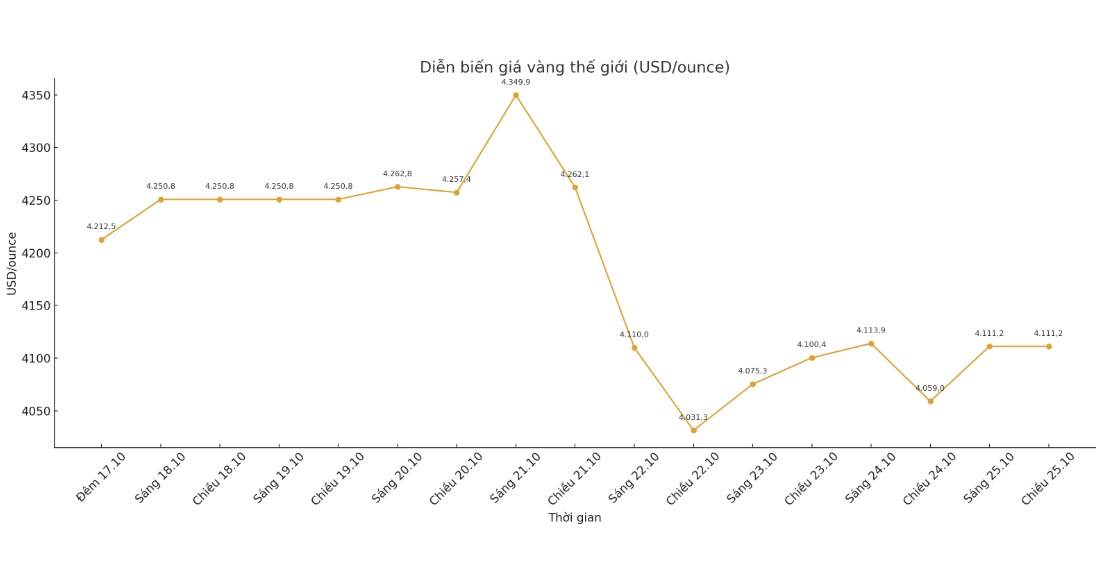

Spot gold prices opened the week at $4,259.43/ounce, which was quite positive in the early stages. After a short correction to check the support zone around 4,220 USD/ounce, gold prices increased to 4,320 USD/ounce at 8:30 am (EDT, 7:30 pm Vietnam time) and reached 4,350 USD/ounce at 11:30. About 15 minutes before North American stocks closed, spot gold prices rose to $4,380 an ounce.

However, this is the highest price of the week and also a reversal point of the trend. Three consecutive failed fixtures above $4,370/ounce caused gold prices to gradually weaken, falling to $4,340/ounce before 11:00 p.m. and falling below $4,325/ounce near 2:00 a.m.

The opening of European stocks has triggered a strong sell-off, pulling gold prices from $4,343/ounce at 2:45 a.m. down to $4,245/ounce at 4:00 a.m. When this mark was broken just before 8:00 a.m. (EDT), gold prices fell to $4,100/ounce after just 1 hour of trading in North America.

A slight recovery in this price range helped the market expect stability, but as Asia entered the session, selling pressure continued to increase strongly, pushing gold prices down to 4,036 USD/ounce. Efforts to return to the 4,160 USD/ounce zone were unsuccessful, gold prices fell to 4,020 USD/ounce at 7:15 and hit a weekly low right above the 4,000 USD/ounce mark at 10:45 am on Wednesday (EDT).

Up to this point, most speculators and fake sellers have left the market, while buyers have also been cautious after two days of shock reduction. Gold prices did not fall further but also lacked strong recovery momentum. The remaining sessions of the week saw gold prices fluctuate within a narrow range of about 100 USD, around 4,050 - 4,150 USD/ounce.

Gold price forecast for next week

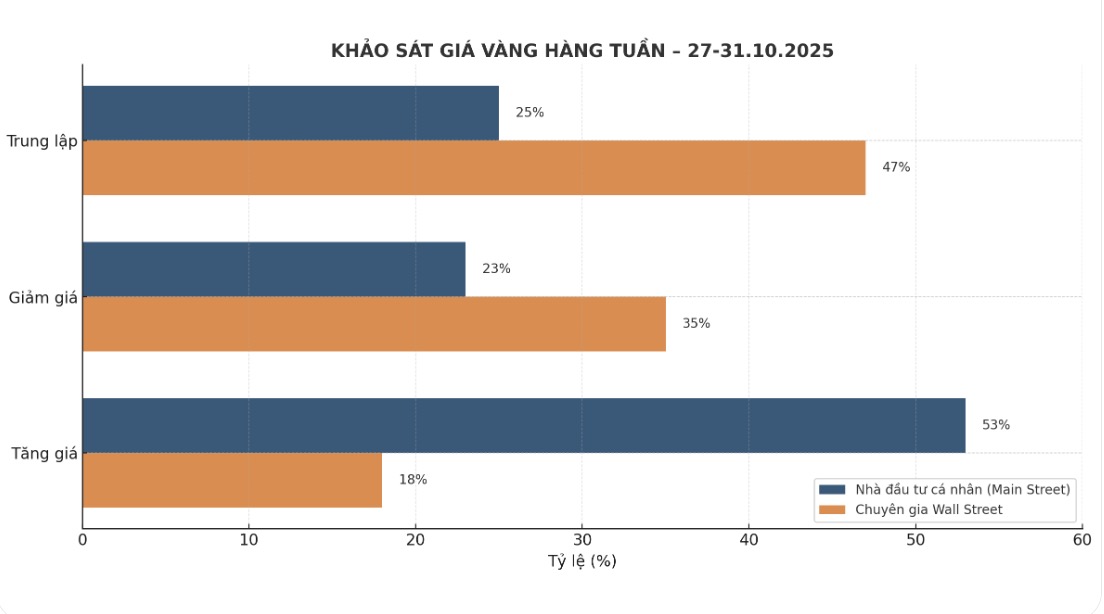

The latest weekly gold survey by an international financial information platform shows that the majority of Wall Street analysts are shifting to a pessimistic or neutral view, while retail investors are still slightly optimistic about gold.

This week, there are 17 experts participating in the survey. Less than a fifth of experts see gold prices rising. Only 3 people (18%) see gold prices rising next week, while 6 (35%) see prices falling. The remaining eight experts, or 47%, predict gold prices will move sideways.

Meanwhile, 274 participants participated in the online survey for small investors. The group's optimistic sentiment has weakened after last week's sell-off, but it still dominates. Accordingly, 144 people (53%) expect gold prices to increase next week, 62 people (23%) predict prices to decrease, and 68 people (25%) believe that prices will continue to accumulate in narrow areas.

Economic data to watch next week

With the US government still closed, there will be very little economic data released next week. Instead, central banks continue to be the focus, with the Fed's interest rate decision being the most popular event in the market.

On Tuesday, the market will welcome the US Consumer Confidence Index for October.

Notable developments focused on Wednesday with the monetary policy decision of the Bank of Canada (BoC) and the US Pending Home Sales data, before the FED made an interest rate decision at 2:00 p.m. EDT (EDT, 1:00 a.m. the next morning Vietnam time). Later in the evening, the Bank of Japan (BoJ) will also update monetary policy.

The final event of the week is the monetary policy decision of the European Central Bank (ECB) on Thursday morning.

See more news related to gold prices HERE...