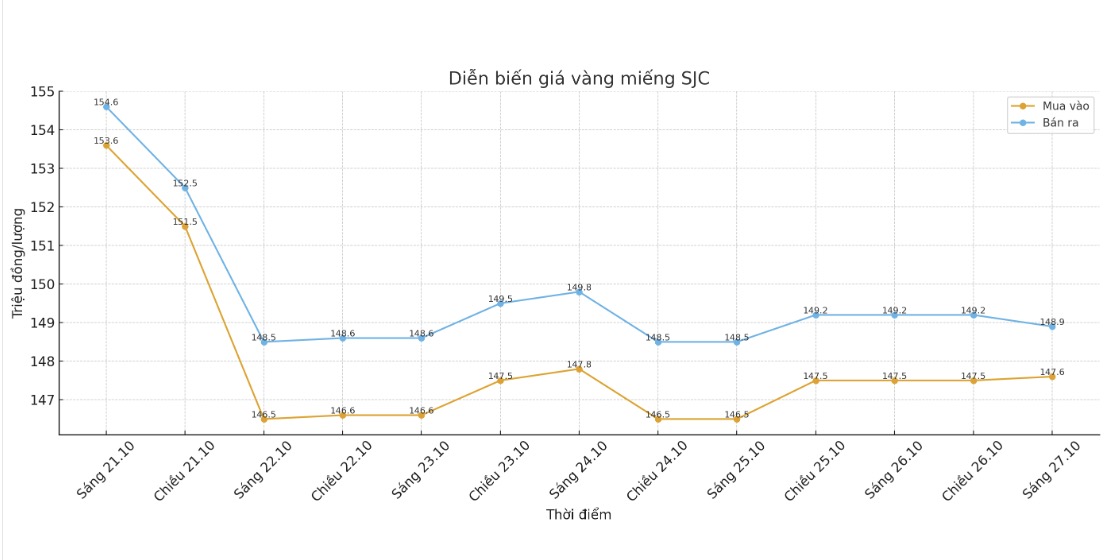

Updated SJC gold price

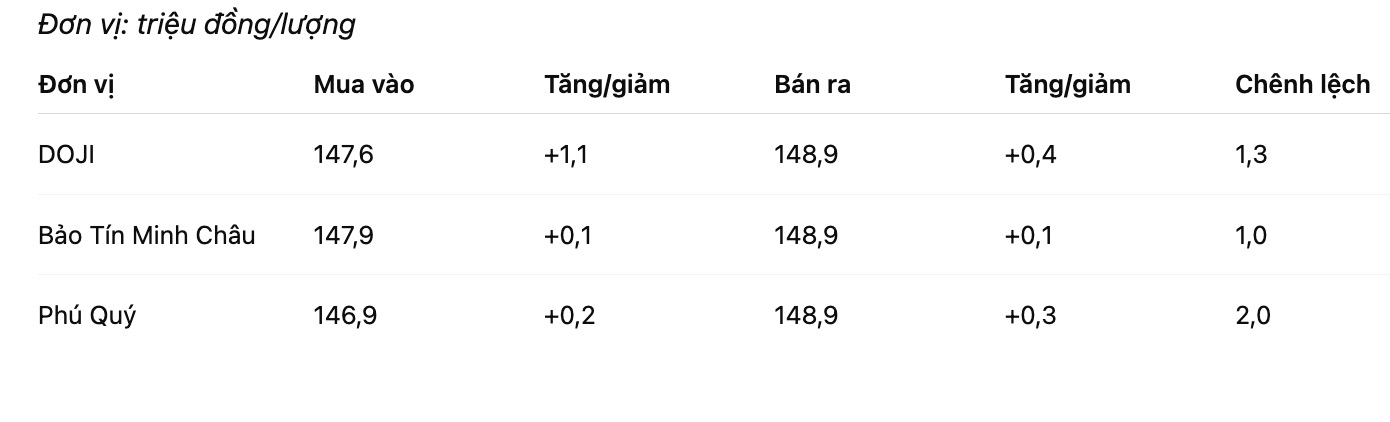

As of 9:30 a.m., DOJI Group listed the price of SJC gold bars at 147.6-148.9 million VND/tael (buy - sell), an increase of 1.1 million VND/tael for buying and an increase of 400,000 VND/tael for selling. The difference between buying and selling prices is at 1.3 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 147.9-148.9 million VND/tael (buy - sell), an increase of 100,000 VND/tael in both directions. The difference between buying and selling prices is at 1 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at 146.9-148.9 million VND/tael (buy - sell), an increase of 200,000 VND/tael for buying and an increase of 300,000 VND/tael for selling. The difference between buying and selling prices is at 2 million VND/tael.

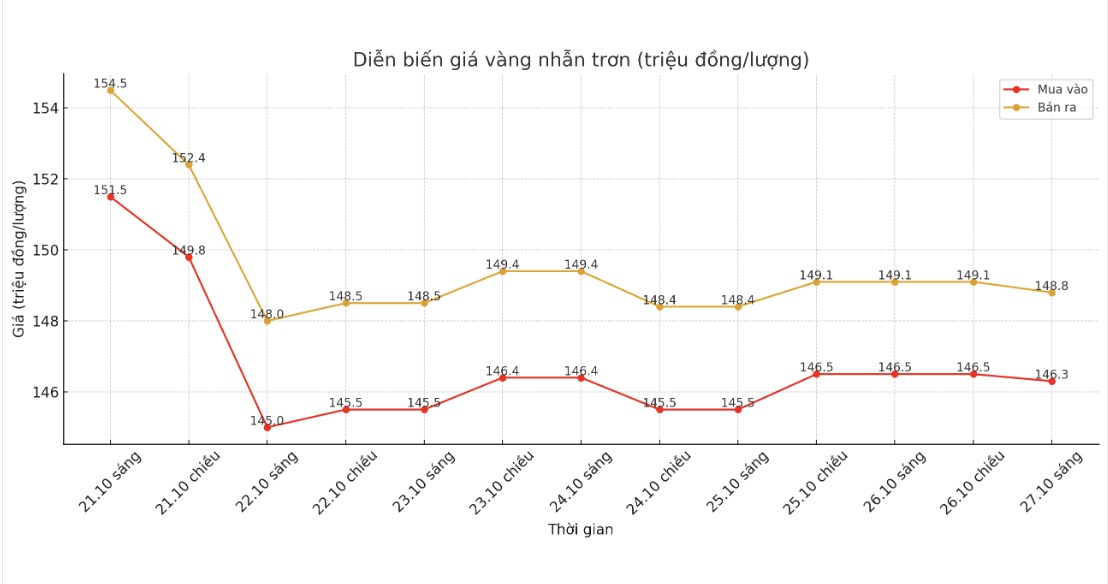

9999 round gold ring price

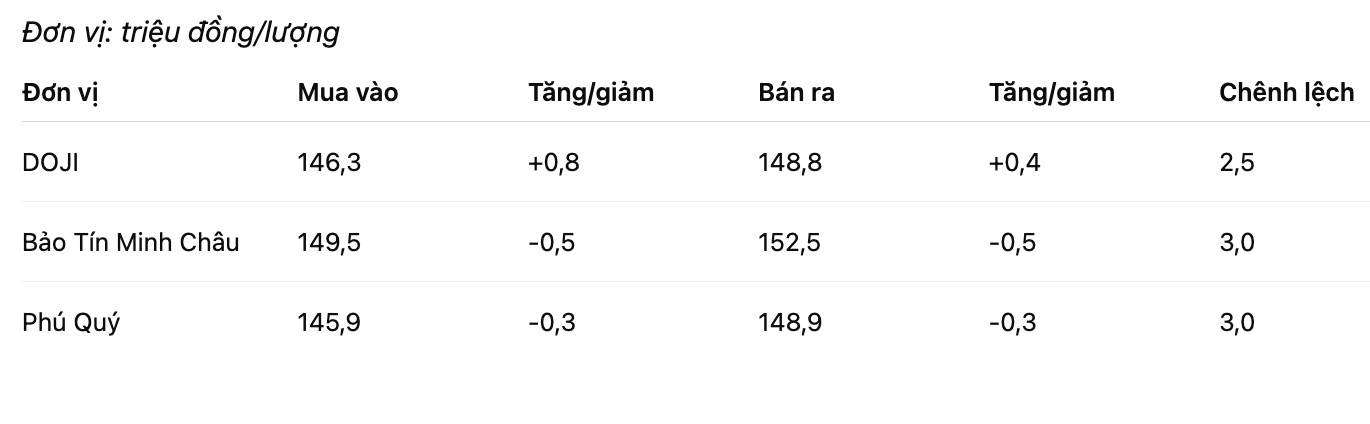

As of 9:40 a.m., DOJI Group listed the price of gold rings at 146.3-148.8 million VND/tael (buy - sell), an increase of 800,000 VND/tael for buying and an increase of 400,000 VND/tael for selling. The difference between buying and selling is 2.5 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 149.5-152.5 million VND/tael (buy - sell), down 500,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 145.9-148.9 million VND/tael (buy - sell), down 300,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

The buying-selling gap is at a high level, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

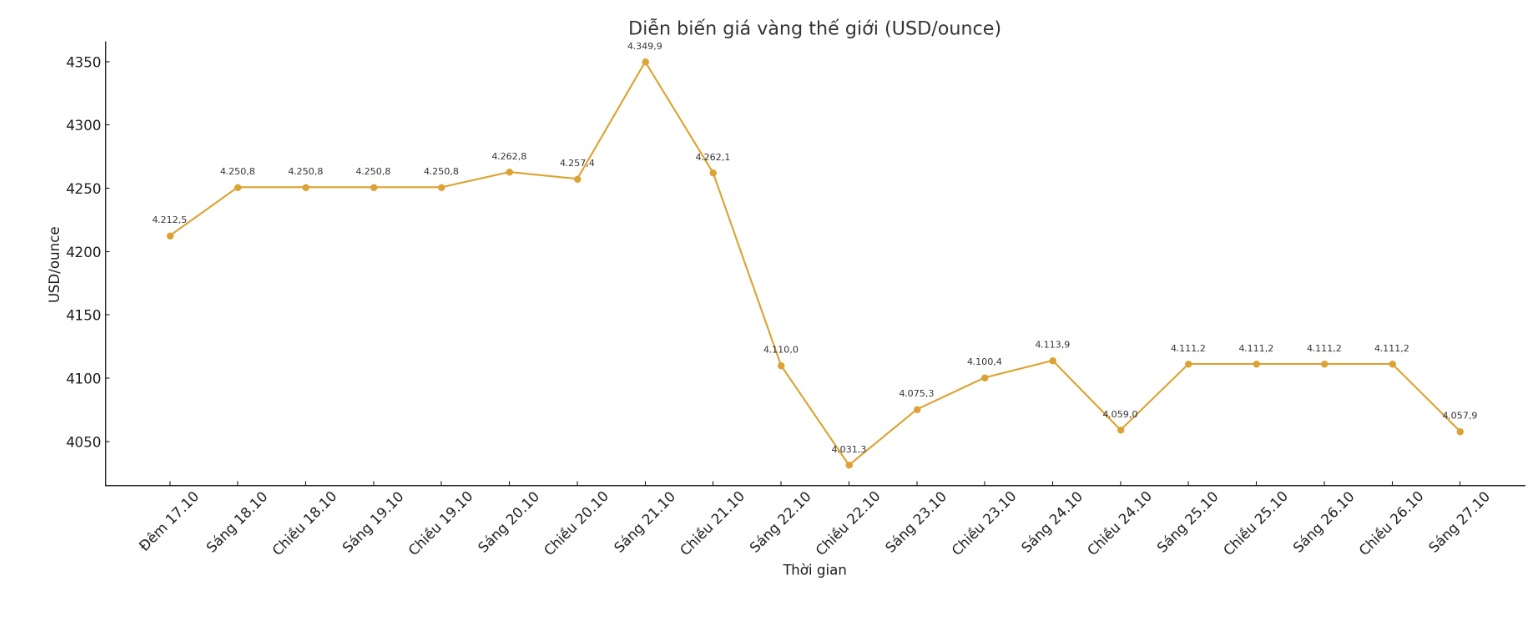

World gold price

At 9:45 a.m., the world gold price was listed around 4,057.9 USD/ounce, down 53.3 USD.

Gold price forecast

Mr. Adrian Day - Chairman of Adrian Day Asset Management - predicted that gold could fall further before creating a new bottom: "I don't think this correction will be prolonged or too deep and the low could appear this week."

He stressed that there were no concerns about the long-term outlook for gold: All factors that have driven gold prices over the past three years remain unchanged.

Mr. Sean Lusk - Co-Director of Trade Defense Strategy at Walsh Trading - commented: "The adjustment process is necessary. But it is difficult to predict a clear direction now.

He said that US stocks are performing very well, the USD is not weakening, causing gold to face a challenge: " Prices have decreased from the overbought zone but still remained high. Investors are taking profits over the weekend, especially as geopolitical risks return from energy tensions and sanctions on Russia.

According to Mr. Lusk, the metal market shows signs of fatigue after a series of consecutive threshold breaks: "Everyone is waiting for gold to adjust deeply to buy back".

He warned that gold is entering the most negative crop season of the year - from late October to the end of the first half of December: "Gold is a commodity. Prices may be affected by ETFs, but that does not ensure that futures contracts remain high.

He also did not rule out the bubble factor: Since the bottom of August, prices have increased by nearly 1,100 USD/ounce. Some investors will take profits, withdraw from the market, and wait until 2026 to re-evaluate.

He predicted: " Prices may fall to $3,690/ounce while still in a long-term uptrend. But it could also increase to $4,589 an ounce by the end of the year.

Mr. Marc Chandler - CEO of Bannockburn Global Forex - said that gold has just ended its 9-week increase streak: "The decline was mainly due to trading position, not macro factors. I expect gold to surpass $4,200 and best go up to $4,240/ounce to confirm bottoming.

Meanwhile, Mr. Rich Checkan - Chairman and COO of Asset Strategies International - said that gold prices will increase again: "The correction has been awaited for a long time, but the recent decline was inflated by the fear of weak investors. A lower CPI than expected, combined with expectations of a Fed rate cut next week, will be enough to bring gold prices back to the uptrend.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...