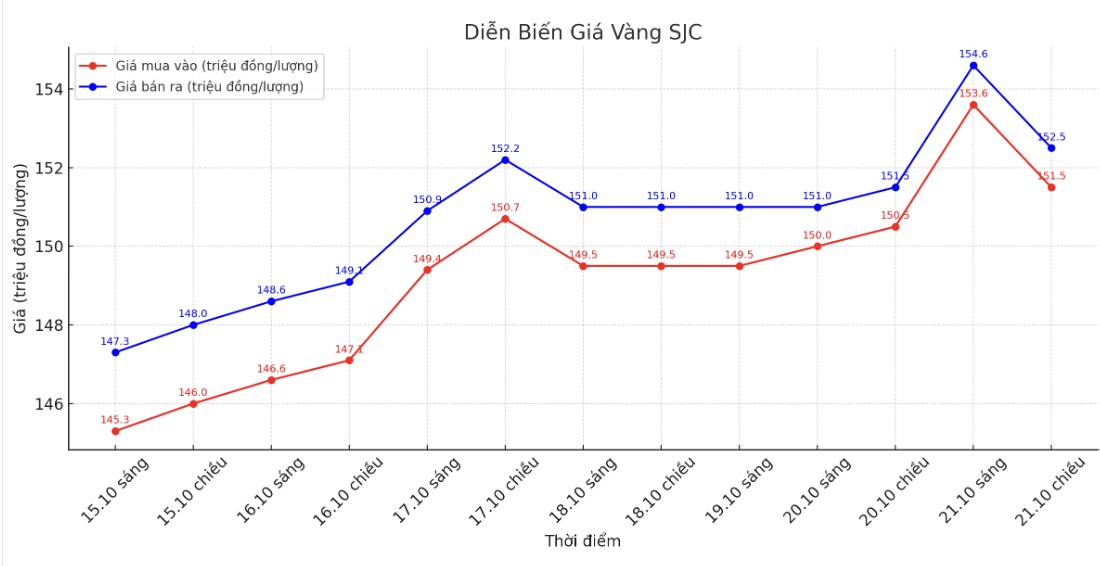

SJC gold bar price

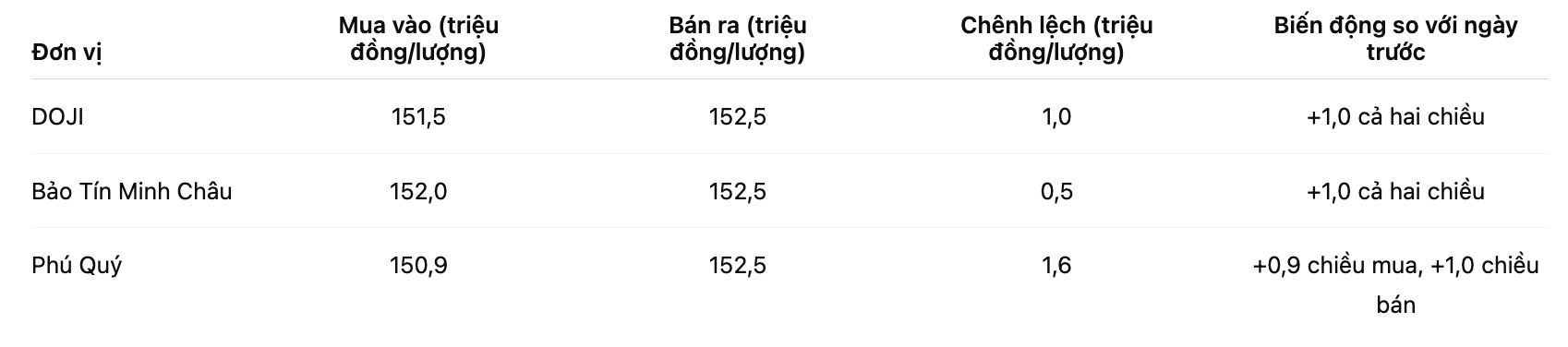

As of 6:37 p.m., DOJI Group listed the price of SJC gold bars at 151.5-152.5 million VND/tael (buy - sell), an increase of 1 million VND/tael in both directions. The difference between buying and selling prices is at 1 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 152-152.5 million VND/tael (buy - sell), an increase of 1 million VND/tael in both directions. The difference between buying and selling prices is at 500,000 VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 150.9-152.5 million VND/tael (buy - sell), an increase of 900,000 VND/tael for buying and an increase of 1 million VND/tael for selling. The difference between buying and selling prices is at 1.6 million VND/tael.

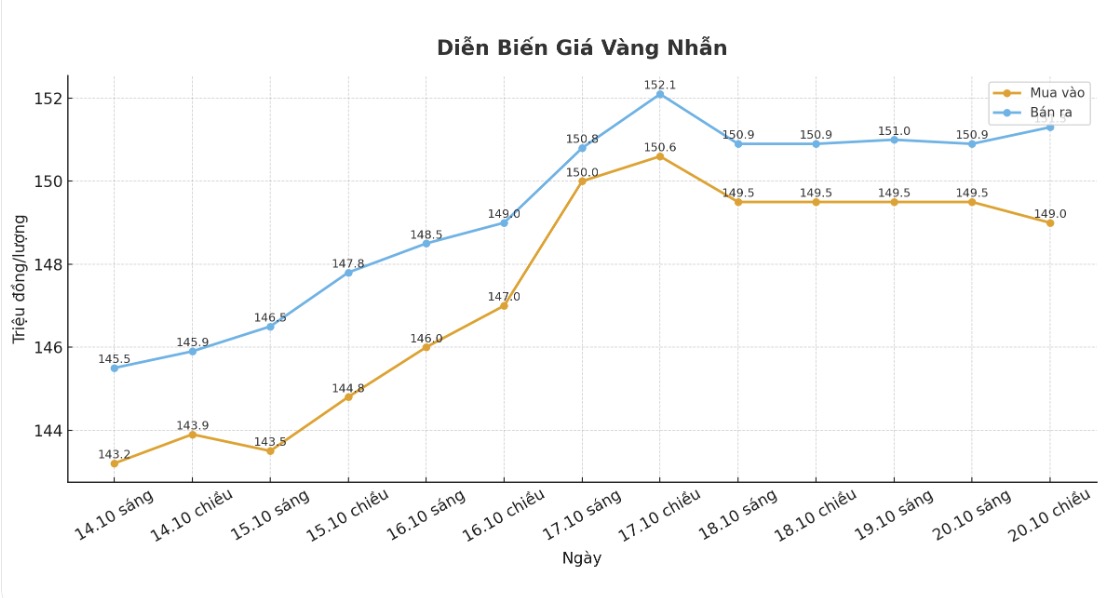

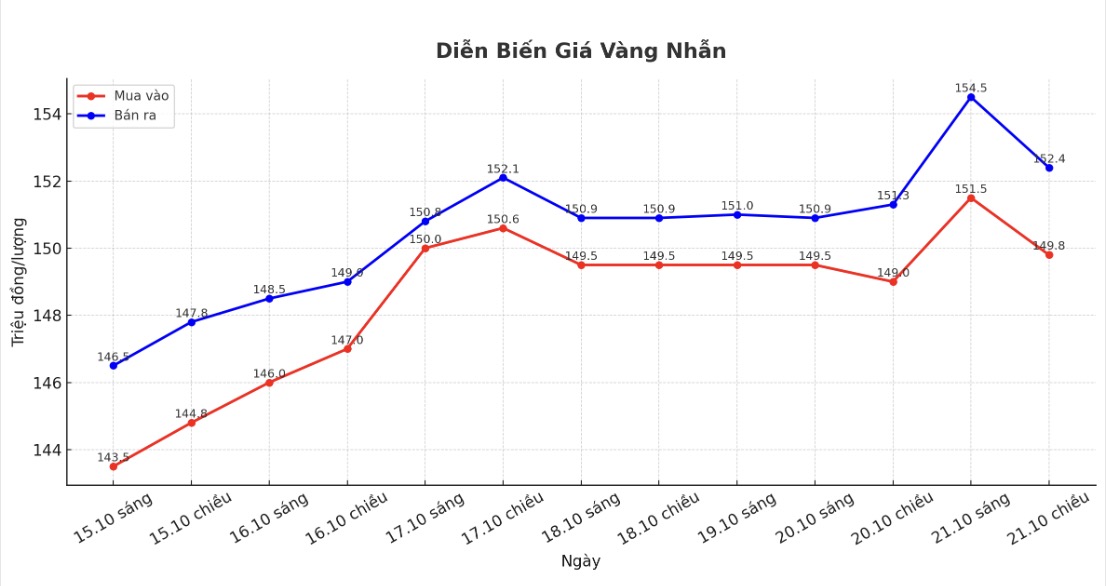

9999 gold ring price

As of 6:37 p.m., DOJI Group listed the price of gold rings at 149.8-152.4 million VND/tael (buy - sell), an increase of 800,000 VND/tael for buying and an increase of 1.1 million VND/tael for selling. The difference between buying and selling is 2.6 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 156.5-159.5 million VND/tael (buy - sell), an increase of 1 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 149.5-152.5 million VND/tael (buy - sell), an increase of 500,000 VND/tael for both buying and selling. The difference between buying and selling is 3 million VND/tael.

The buying-selling gap is pushed up too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

World gold price

The world gold price was listed at 6:42 p.m. at 4,262.1 USD/ounce, up 4.7 USD compared to a day ago.

Gold price forecast

Gold prices opened the first trading sessions of the new week quite positively. Gold's rally is being driven by a series of political and trade uncertainties. According to Mr. Sagar Khandelwal - strategist of UBS Global Wealth Management, real interest rates falling, the weaker US dollar, increased public debt and escalating geopolitical tensions could push gold prices to $4,700/ounce in the first quarter of 2026, while stocks of gold mining enterprises could increase faster.

However, after soaring last night, world gold prices almost completely lost their increase in this afternoon's trading session.

Gold prices fell sharply in the session of October 21 as investors took profits after the precious metal hit a new peak in the previous session, driven by expectations of the US to soon cut interest rates and increased safe-haven demand.

Gold prices are still likely to increase further, but the current growth rate is quite strong, so every time a new peak is set, there will be a technical correction, said Nitesh Shah - commodity strategist at WisdomTree.

The combination of factors such as geopolitical and economic instability, strong investment demand, net buying by central banks and expectations of the US Federal Reserve (FED) cutting interest rates has helped gold prices increase by 63% since the beginning of the year.

Investors are now paying attention to the US consumer price index (CPI) report due out on Friday. The data is forecast to show September inflation rose 3.1% year-on-year, reinforcing expectations that the Fed will cut interest rates by 25 basis points at next week's meeting.

Gold - a non-profit asset - often benefits in a low interest rate environment.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...