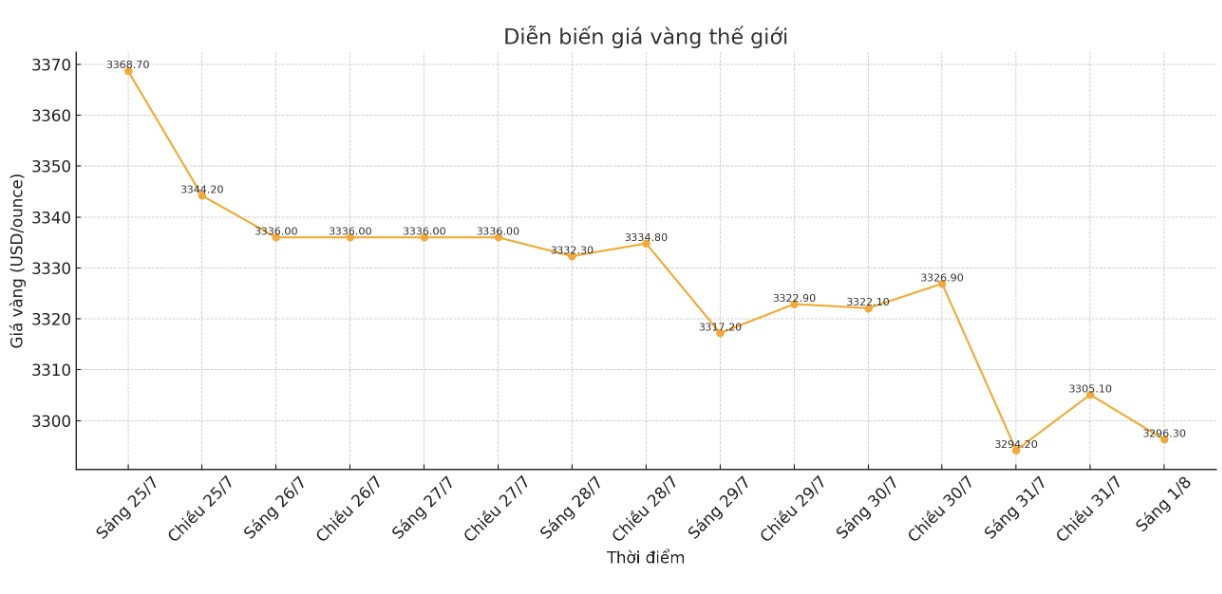

After plunging to a one-month low, world gold prices have rebounded, struggling around $3,300/ounce.

This situation occurred despite the latest data showing US inflation increased slightly and the labor market remained stable. These are factors that may delay expectations of the US Federal Reserve (FED) cutting interest rates in the coming time.

According to the US Commerce Department, the core personal consumption expenditure (core PCE) - the Fed's preferred inflation measure, excluding food and energy prices, increased by 0.3% in June, after an increase of 0.2% in May.

Compared to the same period last year, this index increased by 2.8%, higher than the analysts' expectation of 2.7%. bullish inflation also rose 0.3% in June, bringing the whole year's increase to 2.6%.

This data shows that inflationary pressures remain, although not exceeding the forecast. However, the gold market hardly reacted strongly to this report.

Spot gold prices were recorded at 0:15 on August 1 (Vietnam time) at 3,296.3 USD/ounce - somewhat recovering after a strong sell-off on Wednesday, when FED Chairman Jerome Powell made the market doubt the possibility of interest rate cuts in September.

Some economic experts believe that the inflation figures are quite in line with expectations, so they do not create pressure for the FED to change its policy immediately. Although still exceeding the FED's 2% target, this increase is not considered large enough to cause concern.

In addition, the report also recorded a slowing consumer spending trend. Personal income rose 0.3% in June, better than May's 0.4% decline and above expectations for a 0.2%. However, personal spending increased by only 0.3%, down from the forecast of 0.4%.

Meanwhile, the US labor market continues to show stability - a key factor in the Fed's monetary policy decision. The number of first-time unemployment claims in the week ended July 26 reached 218,000, lower than the forecast of 222,000. Last week's figure was unchanged at 217,000.

On a four-week average, the index is considered more reliable due to the removal of short-term fluctuations reaching 221,000 applications, down slightly from the previous week's 224,500. The number of people continuing to receive unemployment benefits is 1.946 million people, unchanged from last week.

The continued stability of the labor market, along with the lack of significant inflation, has led Chairman Jerome Powell to stress that the Fed has no urgent reason to cut interest rates soon. This view further reduces the likelihood of loose policy action at the September meeting.

However, gold as a safe haven asset still maintains good demand. Analysts say that if the FED delays interest rate cuts for too long, while global growth slows down or there are geopolitical fluctuations, gold could continue to be an attractive choice for investors.

See more news related to gold prices HERE...