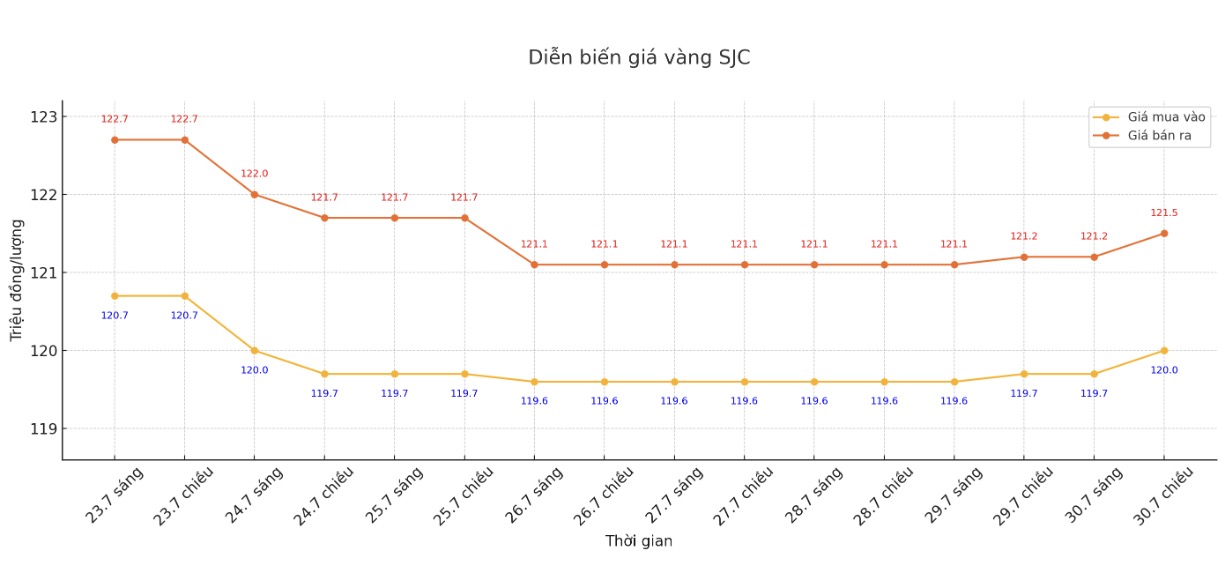

SJC gold bar price

As of 6:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND 120-121.5 million/tael (buy in - sell out); increased by VND 300,000/tael in both directions. The difference between buying and selling prices is at 1.5 million VND/tael.

DOJI Group listed at 120-121.5 million VND/tael (buy - sell); increased by 300,000 VND/tael in both directions. The difference between buying and selling prices is at 1.5 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 120-121.5 million VND/tael (buy - sell); increased by 300,000 VND/tael in both directions. The difference between buying and selling prices is at 1.5 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at VND 119.5-121.5 million/tael (buy in - sell out); increased by VND 300,000/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

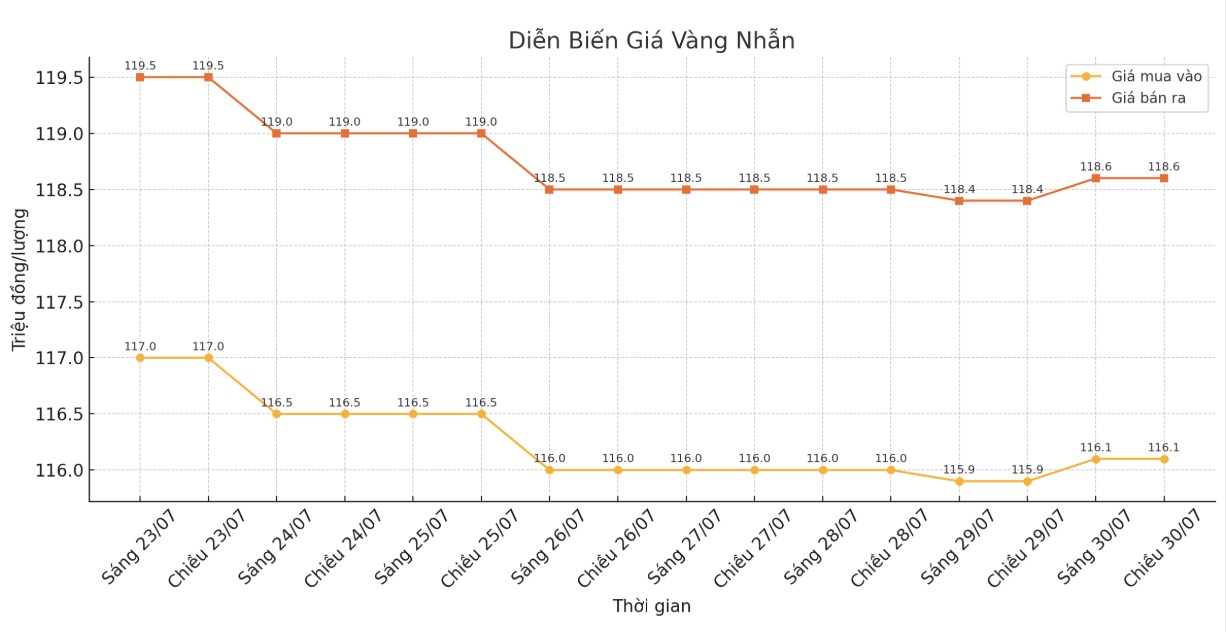

9999 gold ring price

As of 6:00 a.m., DOJI Group listed the price of gold rings at 116.1-118.6 million VND/tael (buy in - sell out), an increase of 200,000 VND/tael in both directions. The difference between buying and selling is 2.5 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 116.3-119.19.3 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 115.2-118.2 million VND/tael (buy in - sell out), an increase of 200,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

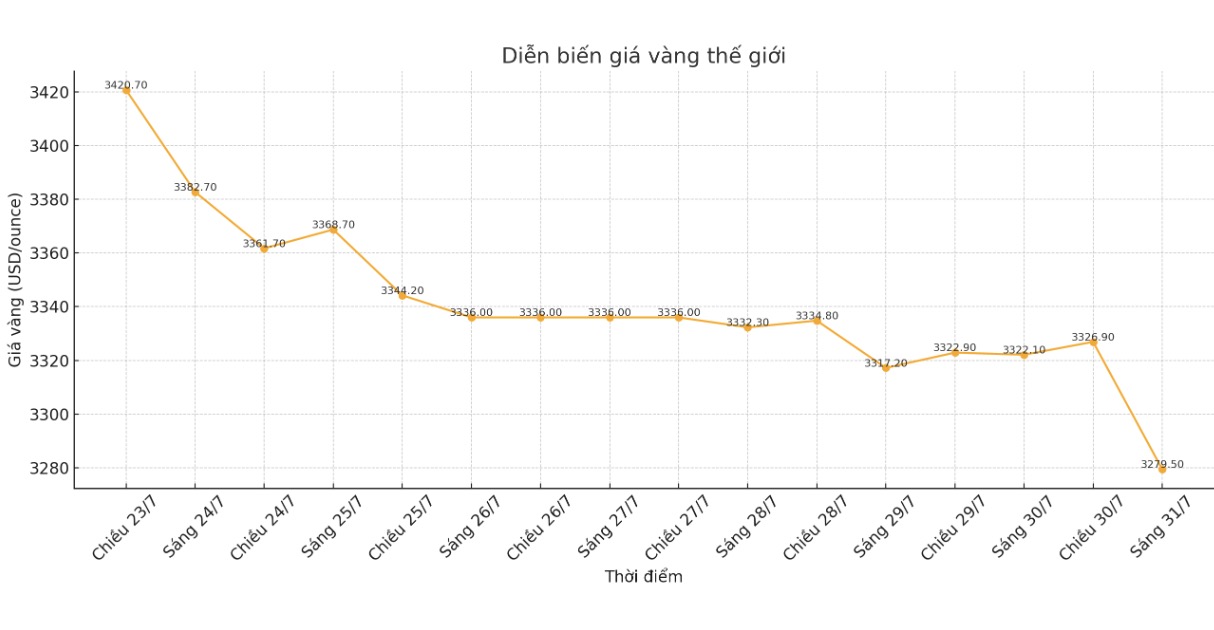

World gold price

The world gold price was listed at 6:35 at 3,279.5 USD/ounce, down 43.5 USD compared to 1 day ago.

Gold price forecast

Gold prices fell sharply after the US economic report positively reinforced the US monetary policy stance. December gold contract decreased by 26.2 USD to 3,354.7 USD/ounce.

The US economy grew 3% year-on-year in the second quarter, recovering strongly from a 0.5% decline in the first quarter and far exceeding the forecast of 2.4%. The main driver comes from reduced imports due to prolonged trade tensions.

Personal consumption - measured as the Personal Consumption Expenditures (PCE) - increased by 1.4%, in line with expectations and much higher than the 0.5% in the previous quarter. However, decreased corporate investment and exports have somewhat hindered growth. This report will make it more difficult for the US Federal Reserve (FED) to lower interest rates in the near future.

The market is waiting for the results of the Federal Open Market Committee (FOMC) meeting that started from Tuesday morning and ended this afternoon with a policy announcement and press conference from FED Chairman Jerome Powell.

The Fed is expected to keep interest rates unchanged this week, but many market watchers believe that Powell could suggest a potential easing of monetary policy in the fall.

Technically, December gold buyers still have a short-term advantage but are weakening. The next target for buyers is to close above the strong resistance level at the July peak of 3,509 USD/ounce.

On the contrary, the sellers are aiming to pull prices below the solid technical support zone at 3,300 USD/ounce. The immediate resistance is at today's high of $3,389.30 an ounce, then this week's high at $3,402.24 an ounce. The first support is $3,350/ounce, followed by $3,325/ounce.

Overseas markets saw the USD index rise sharply, reaching a two-month high. Nymex crude oil prices rose, trading around 69.75 USD/barrel. The yield on the 10-year US Treasury note is currently around 4.4%.

Economic data to watch this week

Thursday: US PCE, weekly jobless claims.

Friday: US non-farm payrolls, ISM manufacturing PMI.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...