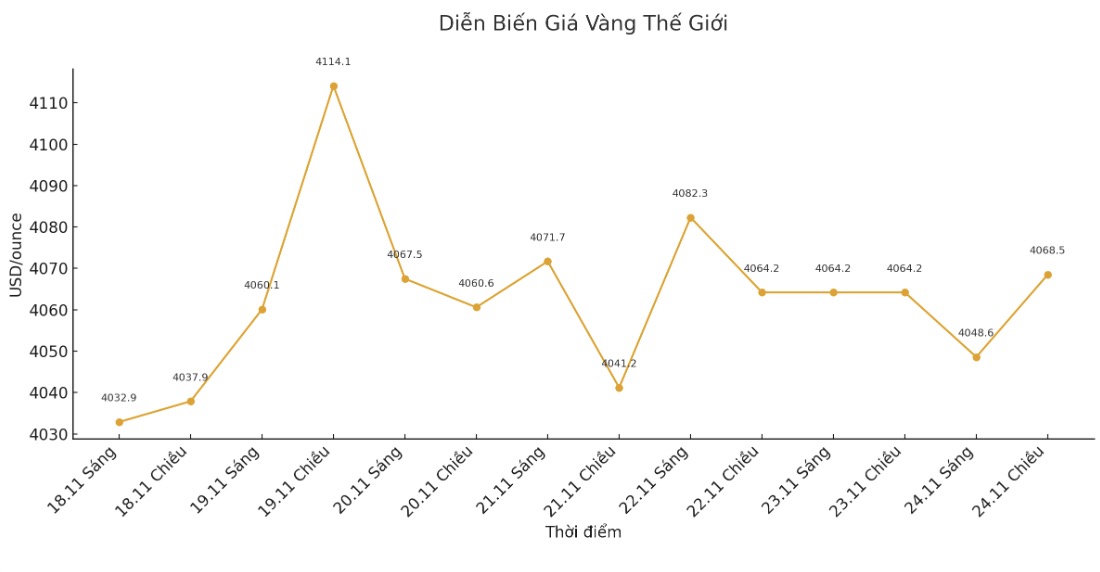

Spot gold prices increased by 0.1% to 4,070.97 USD/ounce at 10:11 GMT (equivalent to 5:11 p.m. Vietnam time). The December US gold futures fell 0.3% to $4,067.8 an ounce.

The $5.25).DXY index remained near a six-month high set on Friday, making gold - priced in greenback - more expensive for holders of other currencies.

Gold is moving sideways as investors assess the prospect of another interest rate cut by the US Federal Reserve (FED), after New York Fed Chairman John Williams hinted that there could be room to lower borrowing costs in the context of a weakening labor market, although some other officials are still cautious, said Ole Hansen, head of commodity strategy at Saxo Bank.

On Friday, Williams said that the US interest rate could fall without affecting the Fed's inflation target, while helping to prevent the risk of weakening the job market.

According to CME's FedWatch tool, betting on a Fed rate cut next month has skyrocketed to 76% from 40% on Friday, following Williams' somewhat dovish comments.

Gold - a non-yielding asset often moves positively in a low interest rate environment.

Meanwhile, investors are awaiting a series of important economic data to be released this week, including retail sales, unemployment claims and the US producer price index.

On the geopolitical front, the US and Ukraine are expected to continue working on Monday on a plan to end the war with Russia, after agreeing to adjust a previous proposal.

Gold is having difficulty creating momentum as the possibility of the Fed cutting interest rates may be delayed, demand in China causes concern, and trade risks reduce. In the supportive direction, central banks remain net buyers and concerns remain around the Supreme Court's ruling (on Donald Trump's tariffs)," Standard Chartered wrote in a note.

For other metals, spot silver rose 0.4% to 50.2 USD/ounce; platinum rose 0.4% to 1,516.2 USD; while palladium fell 0.4% to 1,369 USD.

See more news related to gold prices HERE...