Update SJC gold price

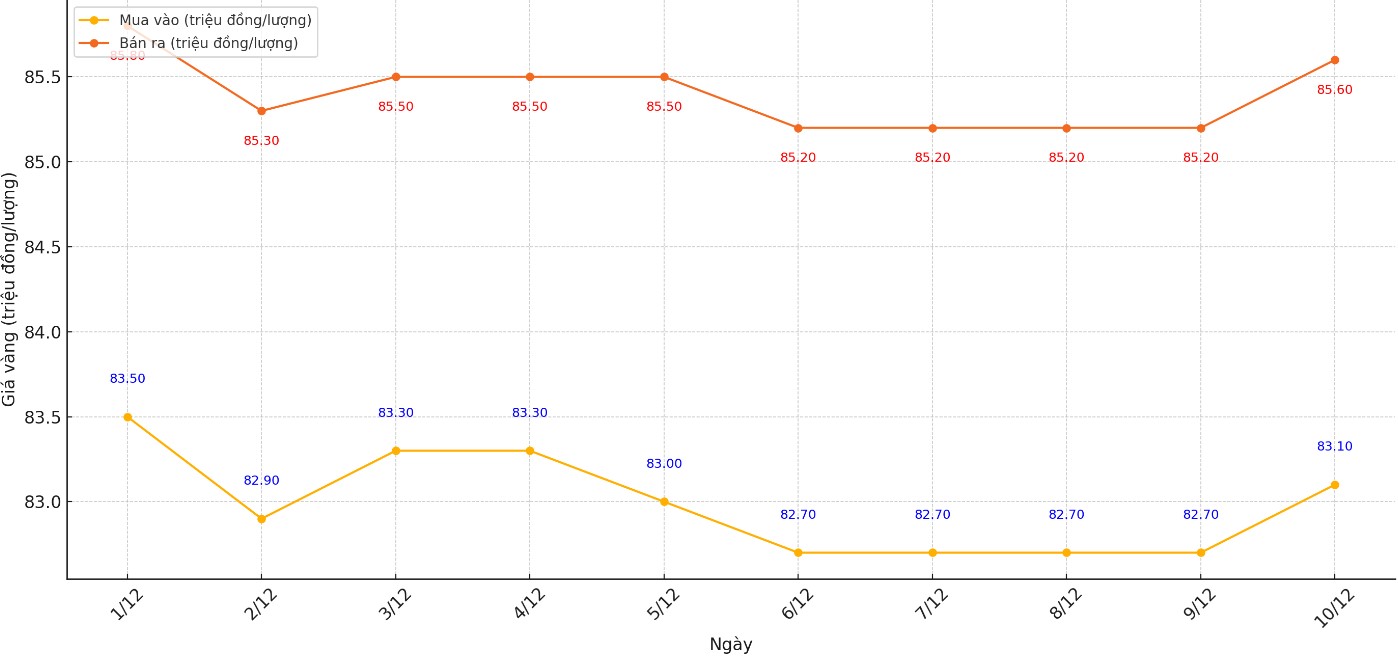

As of 10:30 a.m., DOJI Group listed the price of SJC gold bars at VND83.1-85.6 million/tael (buy - sell); an increase of VND400,000/tael in both directions compared to the opening price of the trading session yesterday morning.

The difference between buying and selling price of SJC gold at DOJI Group is at 2.5 million VND/tael.

Meanwhile, Saigon Jewelry Company listed the price of SJC gold at 83.6-85.6 million VND/tael (buy - sell), an increase of 900,000 VND/tael for buying and 400,000 VND/tael for selling compared to the opening of the trading session yesterday morning.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 2 million VND/tael.

Bao Tin Minh Chau listed SJC gold price at 83.6-85.6 million VND/tael (buy - sell), an increase of 900,000 VND/tael for buying and 400,000 VND/tael for selling compared to the opening of the trading session yesterday morning.

The difference between buying and selling price of SJC gold at Bao Tin Minh Chau is at 2 million VND/tael.

Currently, the difference between buying and selling gold prices is listed at around 2-2.5 million VND/tael. Experts say this difference is still very high. The difference between buying and selling prices is a factor that investors need to consider when participating in the gold market. It directly affects the ability to make a profit, especially in the short term.

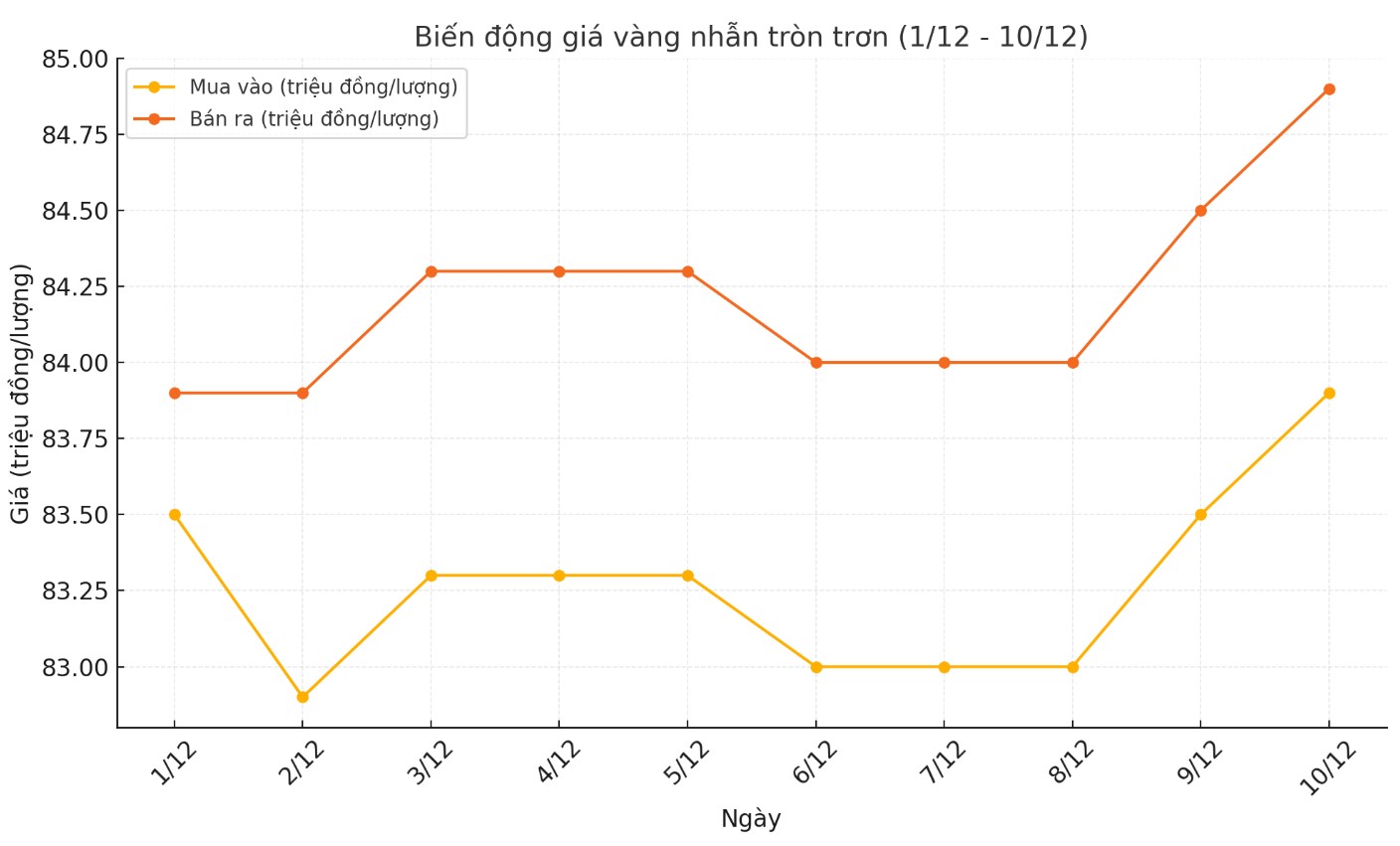

Price of round gold ring 9999

As of 10:30 a.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 83.9-84.9 million VND/tael (buy - sell); an increase of 600,000 VND/tael for both buying and selling compared to early this morning.

Bao Tin Minh Chau listed the price of gold rings at 83.83-84.93 million VND/tael (buy - sell), an increase of 650,000 VND/tael for both buying and selling compared to early this morning.

World gold price

As of 10:30 a.m., the world gold price listed on Kitco was at 2,667.5 USD/ounce, up 25.3 USD/ounce compared to the beginning of the previous trading session.

Gold Price Forecast

World gold prices increased despite the USD remaining very strong. Recorded at 10:35 on December 10, the US Dollar Index measuring the greenback's fluctuations against 6 major currencies was at 105.860 points (up 0.06%).

TD Securities commodity strategist Bart Melek said the most important factor driving demand for gold in the first trading session of the week was news that the People's Bank of China (PBoC) announced it had continued to buy gold.

According to data from the People's Bank of China, the agency bought an additional 5 tons of gold in November, bringing its total official gold reserves to 2,269 tons, according to Krishan Gopaul, senior analyst for EMEA at the World Gold Council.

China's comeback comes amid sharp corrections and major fluctuations in gold prices following Donald Trump's victory in the US presidential election.

Despite the six-month pause, the PBoC has purchased a total of 34 tonnes of gold this year, maintaining its position as one of the largest gold buyers in 2024. However, gold still accounts for less than 6% of China's total foreign exchange reserves.

Many experts believe that China’s return is just a matter of time. In a recent interview with Kitco News, Nitesh Shah, head of commodity and macroeconomic research at WisdomTree, said that China needs to increase its gold holdings to at least 10%, if not 20%, of its total foreign exchange reserves.

In addition, expectations of monetary easing are also supporting gold. The US Federal Reserve (FED) started its interest rate easing cycle with an unusual 50 basis point cut in September, followed by a 25 basis point cut in November.

Traders are pricing in an 87% chance the central bank will cut interest rates by another 25 basis points at its meeting on December 17-18.

See more news related to gold prices HERE...