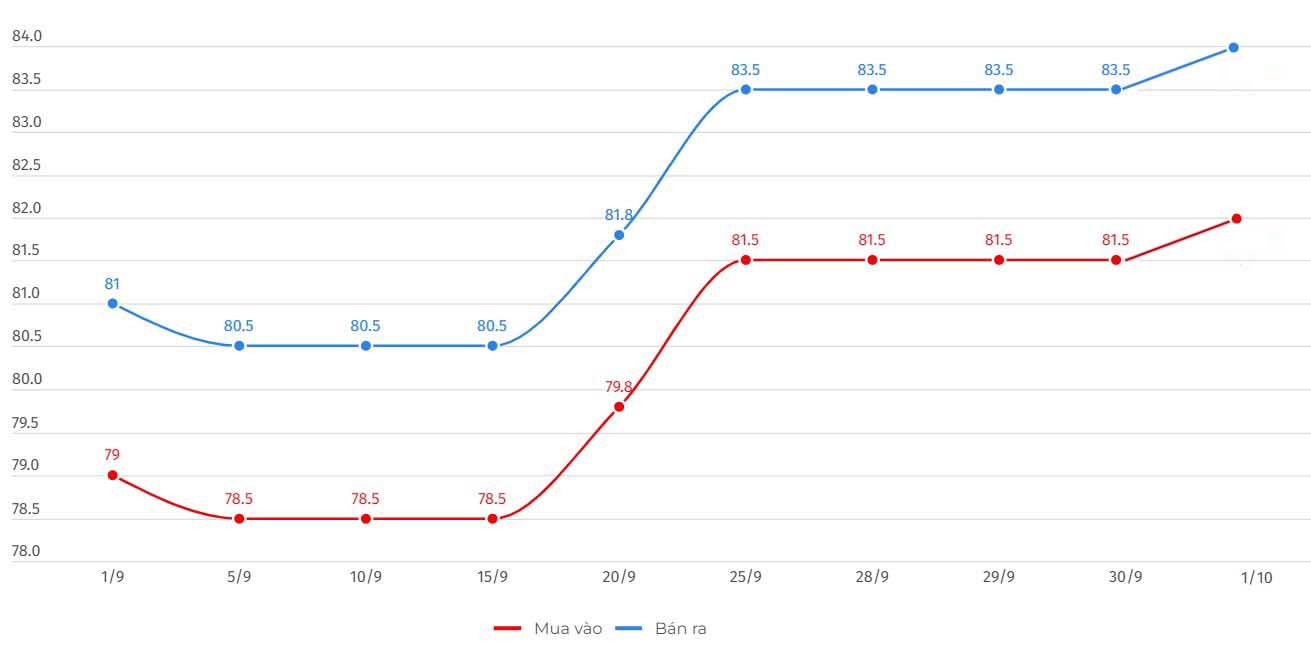

SJC gold bar price

As of 9:00 a.m., the price of SJC gold bars was listed by DOJI Group at 82 - 84 million VND/tael (buy - sell).

Compared to the beginning of the previous trading session, gold price at DOJI increased by 500,000 VND/tael for both buying and selling.

The difference between buying and selling price of SJC gold at DOJI Group is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold at 81.5 - 83.5 million VND/tael (buy - sell).

Compared to the beginning of the previous trading session, gold prices at Bao Tin Minh Chau remained unchanged in both buying and selling directions.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 2 million VND/tael.

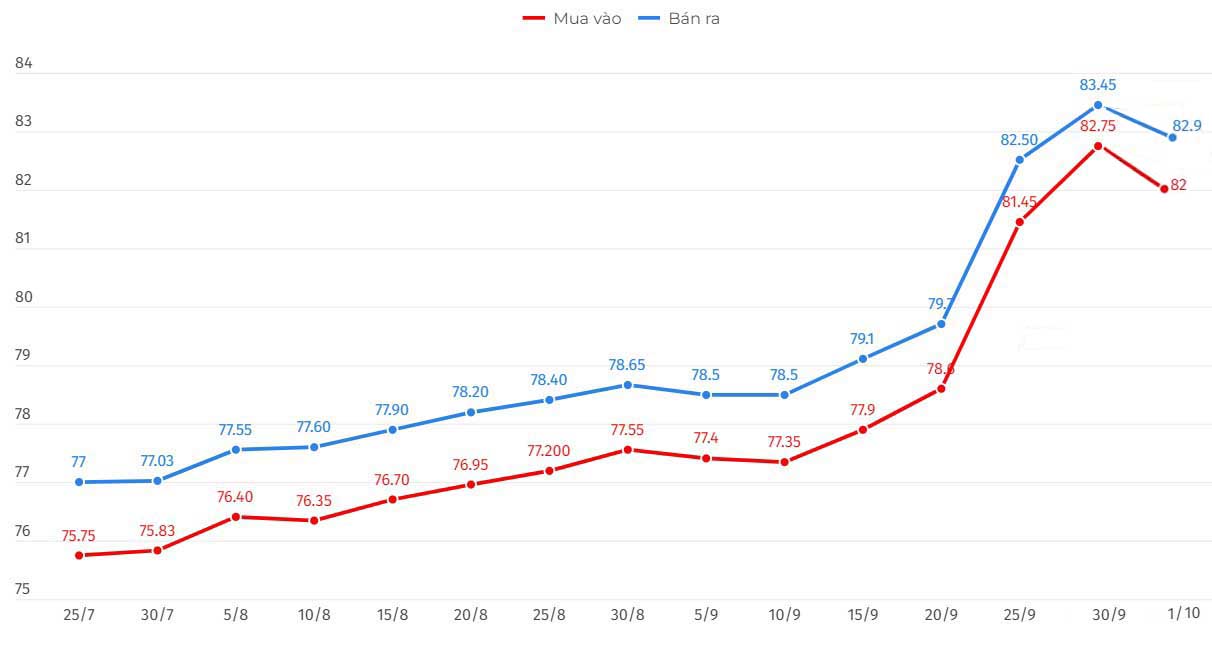

9999 gold ring price

This morning, the price of 9999 Hung Thinh Vuong round gold ring at DOJI was listed at 82-82.9 million VND/tael (buy - sell); down 750,000 VND/tael for buying and down 550,000 VND/tael for selling.

Bao Tin Minh Chau also adjusted the price of plain round gold rings to increase to 82.54 - 83.44 million VND/tael (buy - sell), unchanged.

Despite the drop in world gold prices, the domestic gold market has not shown much reaction. Notably, gold rings - a commodity that usually moves in the same direction as world gold - are anchored at a record high, despite the decline in the world market.

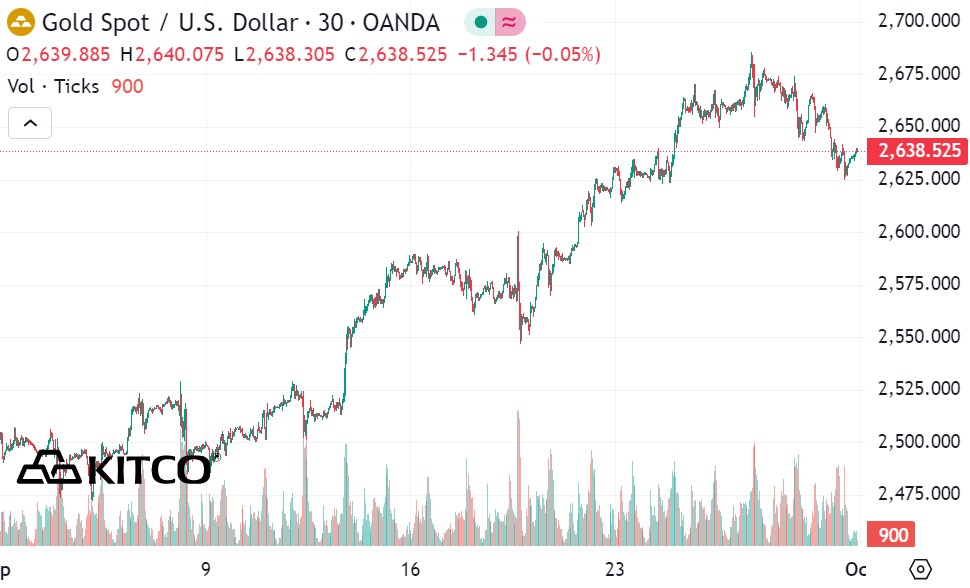

World gold price

As of 9:07 a.m., the world gold price listed on Kitco was at 2,638.5 USD/ounce, down 14.2 USD/ounce compared to the beginning of the previous trading session.

Gold Price Forecast

World gold prices fell amid a recovery in the USD index. Recorded at 9:07 a.m. on October 1, the US Dollar Index, which measures the greenback's fluctuations against six major currencies, was at 100.467 points.

Gold prices were under pressure as the US Federal Reserve (FED) signaled a moderate pace in its next interest rate easing cycle. According to Kitco, FED Chairman Jerome Powell just struck a rather positive tone when noting that “the economy is in a solid state”. He did not provide much guidance on monetary policy.

“Looking ahead, if the economy develops as expected, policy will shift to a more neutral direction. But we are not on any pre-determined path. The risks are two-fold and we will continue to make our decisions meeting by meeting.

When considering additional policy adjustments, we will carefully assess the input data, the evolving outlook, and the balance of risks.

“Our decision to reduce rates by 50 basis points reflects our confidence that, with appropriate adjustments to the stance of policy, labor market strength can be maintained, amid moderate economic growth and inflation falling sustainably to 2 percent,” Mr. Powell said.

According to Jim Wyckoff - senior analyst of Kitco, the world gold price fell sharply due to some profit-taking activities from investors. However, he said that the demand for safe haven amid geopolitical concerns is maintaining the floor of the precious metal.

Jim Wyckoff said the market's focus remains on the escalating military conflict between Israel and Hezbollah.

Going forward, gold prices will continue to be affected by the Fed’s interest rate policy. Currently, according to the CME FedWatch tool, traders predict a 53% chance that the Fed will cut interest rates by another 0.5 percentage points at its next meeting. A lower interest rate will reduce the opportunity cost of holding gold, an asset considered a safe haven during times of economic and political uncertainty.

See more news related to gold prices HERE...