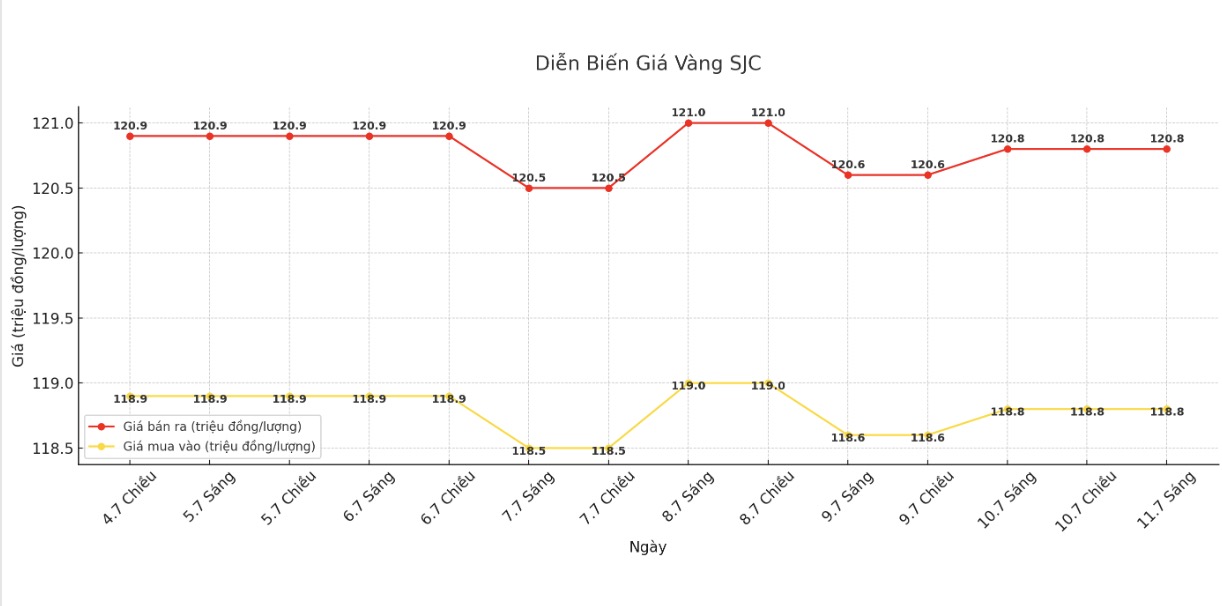

Updated SJC gold price

As of 9:30 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at 118.8-120.8 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling prices is at 2 million VND/tael.

DOJI Group listed SJC gold bar price at 118.8-120.8 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 118.8-120.8 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 118.1-120.8 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling prices is at 2.7 million VND/tael.

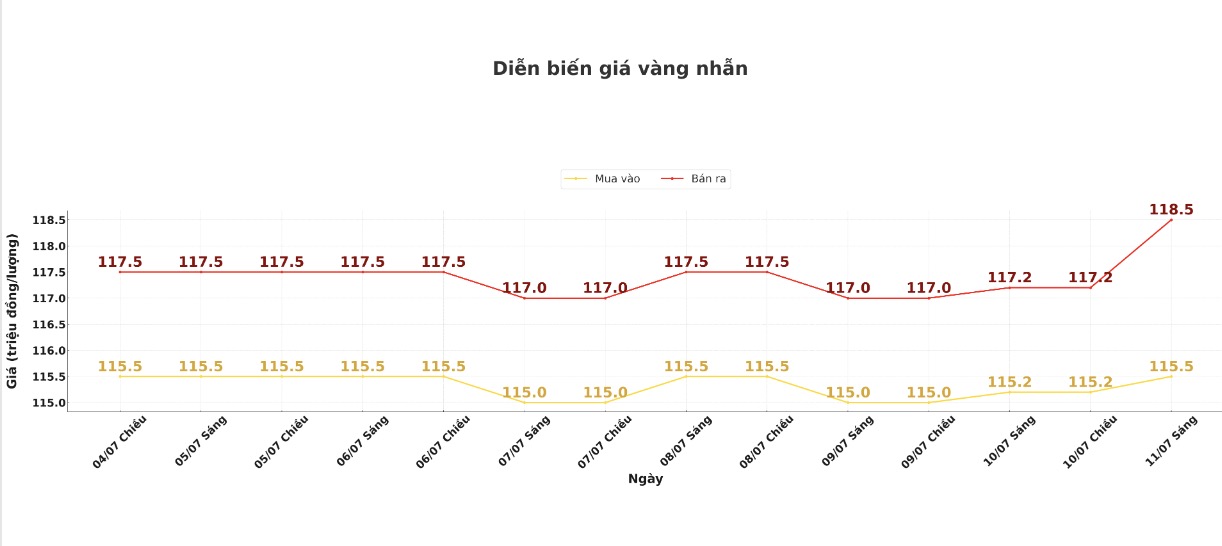

9999 round gold ring price

As of 9:30 a.m., DOJI Group listed the price of gold rings at 115.5-118.5 million VND/tael (buy - sell), an increase of 300,000 VND/tael for buying and an increase of 1.3 million VND/tael for selling. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 115.7-118.7 million VND/tael (buy - sell), an increase of 400,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 114.2-117.2 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling is 3 million VND/tael.

The buying-selling gap is pushed up too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

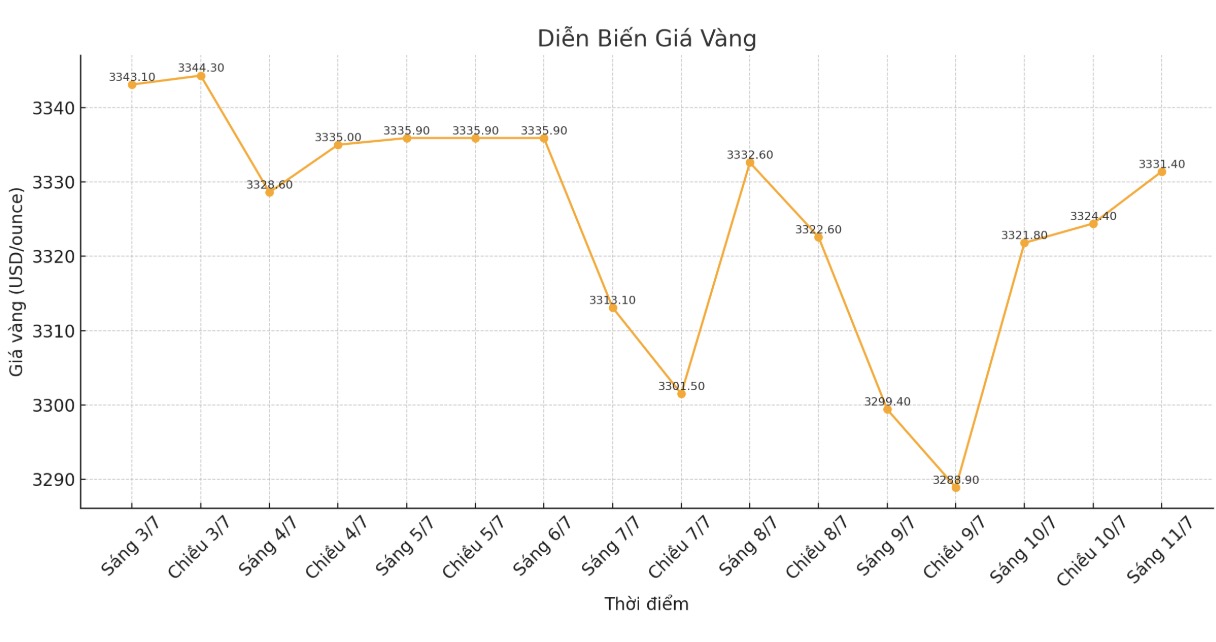

World gold price

At 9:35 a.m., the world gold price was listed around 3,331.4 USD/ounce, up 9.6 USD/ounce compared to 1 day ago.

Gold price forecast

The fear of increasing risks in the market is supporting gold prices. US President Donald Trump on Wednesday heightened trade tensions when he announced a 50% tariff on all copper imports, starting from August 1. He also said the US could impose a 50% tariff on imports from Brazil.

The US Federal Reserve (FED) remains cautious in monetary policy even when opinions appeared in support of the possibility of a rate cut in July.

According to analysts, the minutes of the Fed's June monetary policy meeting did not bring many surprises, as the agency maintained a neutral stance.

In terms of monetary policy outlook, Fed members generally agree that with the economy and labor market remaining strong, along with the current interest rate being at a moderate level, the Fed can continue to wait for clearer data on inflation and growth before adjusting policy according to the meeting minutes.

Mr. Ole Hansen - Head of Commodity Strategy at Saxo Bank, said that factors supporting the precious metal's increase are still intact, and many new drivers may continue to push prices up in the second half of the year.

After a brilliant first half of the year, the investment metals market is entering an accumulation phase. Gold has been flat for the past 12 weeks, creating an opportunity for silver and platinum to catch up. With the increase since the beginning of the year of about 26% for gold and silver, and 54% for platinum, investors are wondering: Is the limit yet? We believe the answer is not yet, Hansen wrote.

According to analysts at the World Gold Council, gold prices will benefit from the soaring budget deficit and the growing financial instability of the US, even if no crisis occurs in the short term.

With the big spending law known as Big Beautiful Bill passed, the US is facing an additional $3,400 billion in debt over the next decade and the debt ceiling could increase by $5,000 billion, if the Trump administration manages to realize ambitious growth forecasts.

In addition, Elon Musk's launch of the "American Party" and the tense political landscape, financial and political risks are piling up."

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...