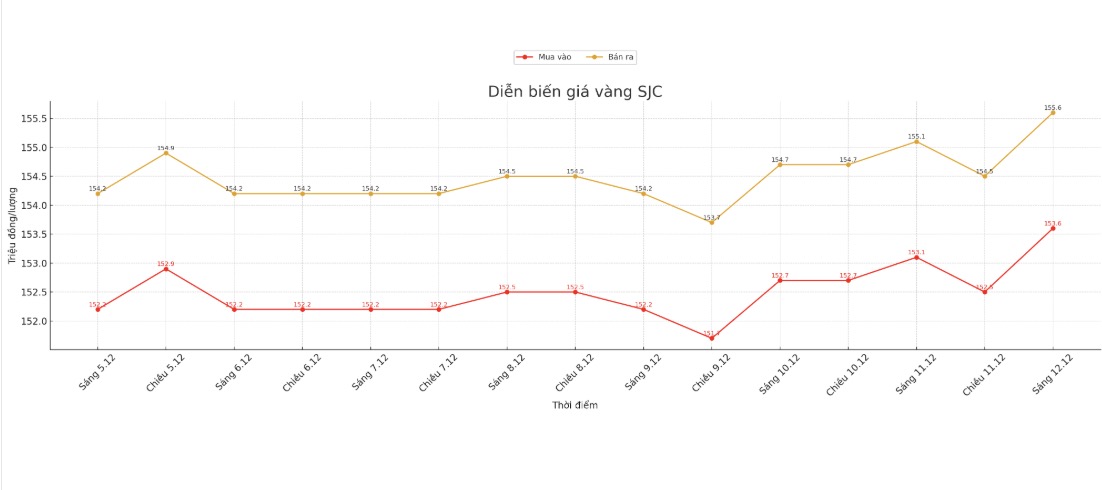

Updated SJC gold price

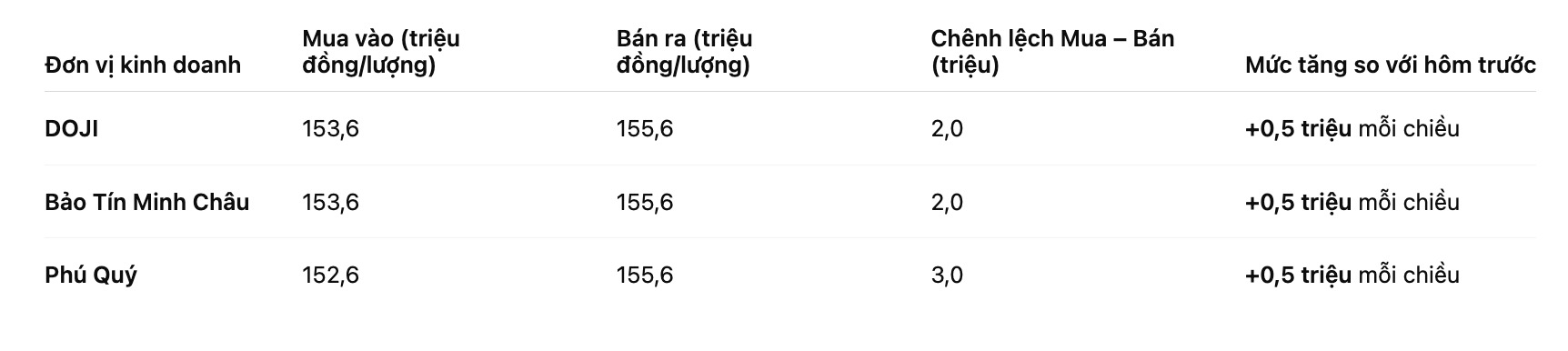

As of 10:00, the price of SJC gold bars was listed by DOJI Group at 153.6-155.6 million VND/tael (buy - sell), an increase of 500,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 153.6-155.6 million VND/tael (buy - sell), an increase of 500,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 152.6-155.6 million VND/tael (buy - sell), an increase of 500,000 VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

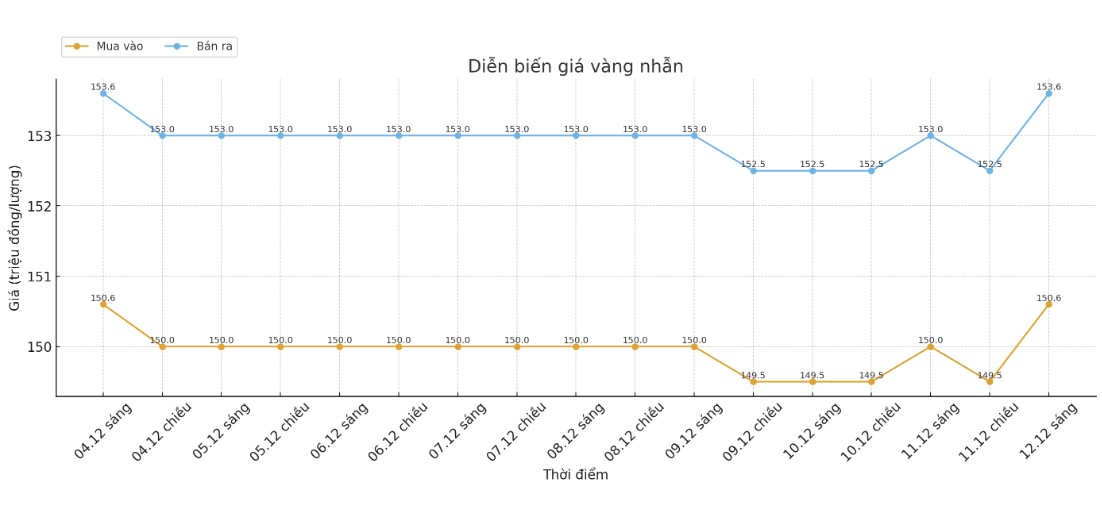

9999 round gold ring price

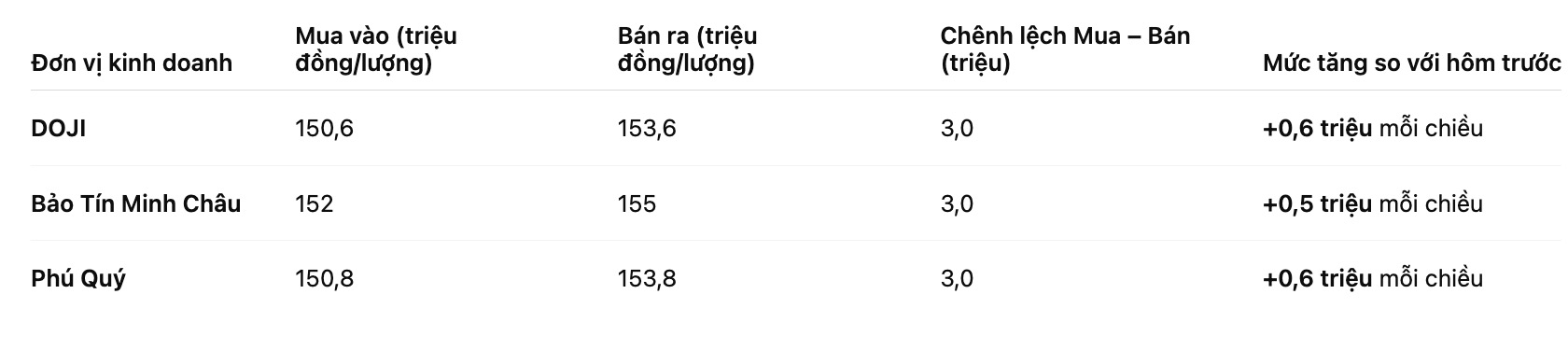

As of 10:00, DOJI Group listed the price of gold rings at 150.6-153.6 million VND/tael (buy - sell), an increase of 600,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 152-155 million VND/tael (buy - sell), an increase of 500,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 150.8-153.8 million VND/tael (buy - sell), an increase of 600,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

The buying-selling gap is at a high level, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

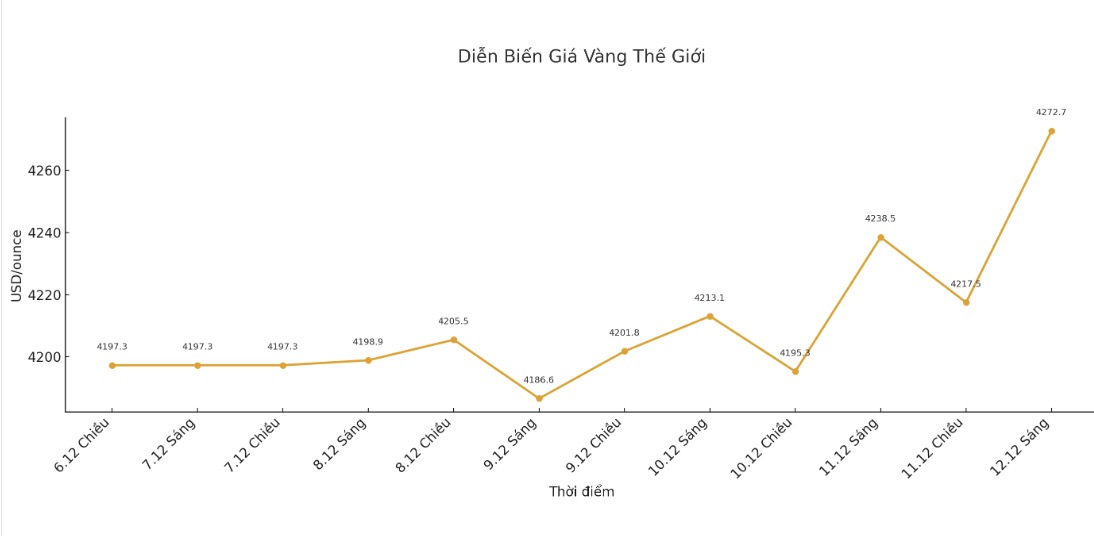

World gold price

At 10:10, the world gold price was listed around 4,272.7 USD/ounce, up 34.2 USD compared to a day ago.

Gold price forecast

Gold prices are rising, supported by a large daily increase in silver prices, bringing silver to a new record high. Both precious metals have seen solid technical purchasing power and benefited from the US Federal Reserve's dovish, dovish, and dovish stance.

The sharp decline of the USD index to a six-week low also contributed to boosting demand for precious metals.

The Federal Open Market Committee (FOMC) decided to cut interest rates by 0.25 percentage points on Wednesday afternoon, a move that was already predicted by the market and also the third consecutive decline in three recent FOMC meetings. FOMC voted 9-3 to lower the operating interest rate to 3.5% - 3.75%.

The FOMC statement shows more uncertainty about when the Fed could continue to cut interest rates. The Fed surprised by announcing that it will start buying $40 billion in Treasury bills per month from Friday, in order to reduce short-term capital costs by adding reserves to the financial system. The currency market has recently sent out an alert about increased pressure in a market worth 12.6 trillion USD in the context of the Fed narrowing the accounting balance sheet.

Investors are now waiting for the US non-farm payrolls report due on December 16 for further signs on the Fed's policy path. In addition, the market is also monitoring the information that the new candidate is nominated for the next Fed Chairman position.

White House economic adviser Kevin Hassett is now considered a leading candidate for the position. He is a supporter of US President Donald Trump's view of cutting interest rates. If interest rates fall, it will often benefit gold.

Technically, the next bullish price increase for the February gold contract is to create a closing session that surpasses the strong resistance level at the contract's record high of $4,433/ounce.

In contrast, the near-term downside target for bears is to push futures below the solid technical support level of $4,100/ounce.

The first resistance was seen at $4,300/ounce, then $4,350/ounce. The first support was at the lowest level of this week at 4,197.8 USD/ounce, followed by 4,150 USD/ounce.

Note: Gold price data is compared to a day earlier.

The world gold market operates through two main valuation mechanisms. The first is the spot delivery market, where prices are quoted for transactions and spot deliveries.

Second is the futures contract market, which sets prices for future deliveries. Due to year-end book-taking activities, December gold contracts are currently the most actively traded on CME.

See more news related to gold prices HERE...