Updated SJC gold price

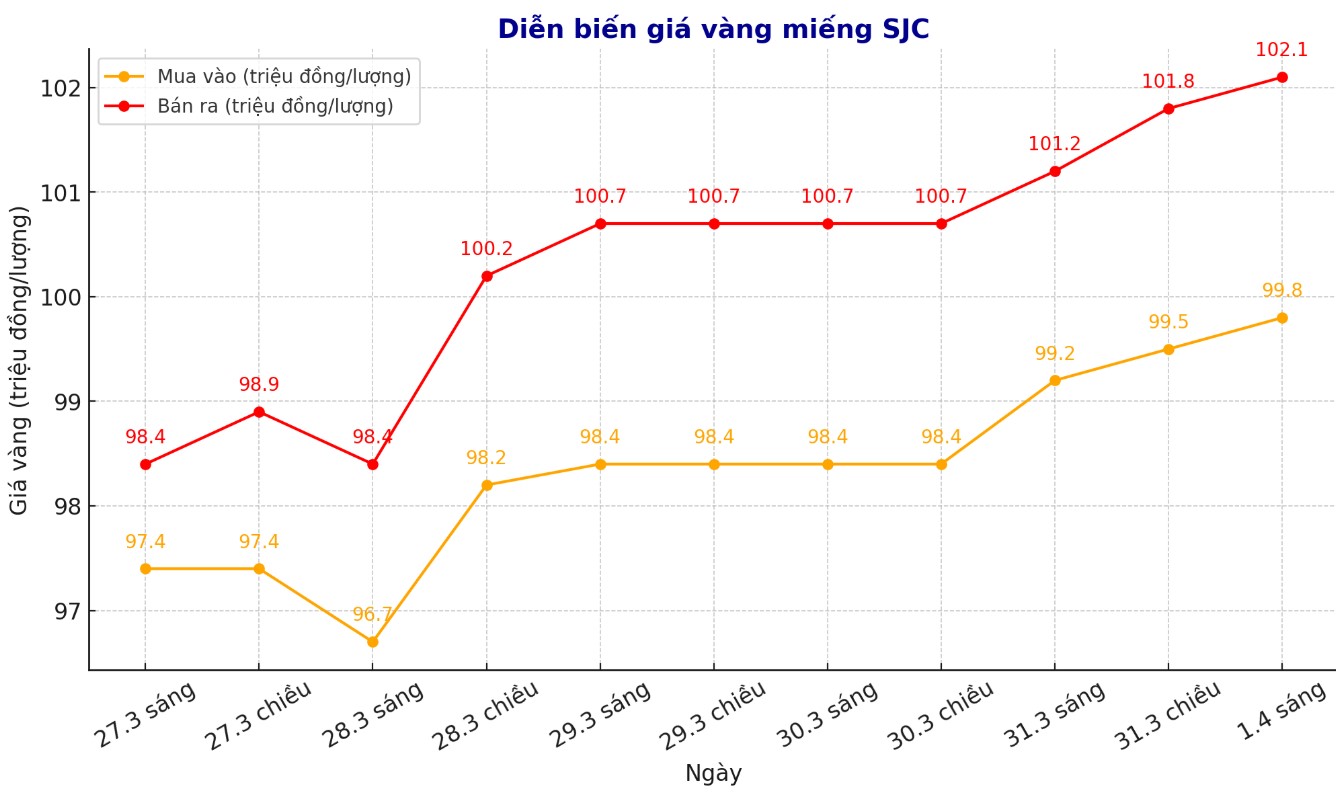

As of 9:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company Limited - SJC at 99.8-102.1 million VND/tael (buy - sell), an increase of 600,000 for buying and an increase of 900,000 VND/tael for selling. The difference between buying and selling prices is at 2.3 million VND/tael.

At the same time, the price of SJC gold bars was listed by DOJI Group at 99.8-102.1 million VND/tael (buy - sell), an increase of 600,000 for buying and an increase of 900,000 VND/tael for selling. The difference between buying and selling prices is at 2.3 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 99.9-102.2 million VND/tael (buy - sell), an increase of 700,000 VND/tael for buying and an increase of 1 million VND/tael for selling. The difference between buying and selling prices is at 2.3 million VND/tael.

9999 round gold ring price

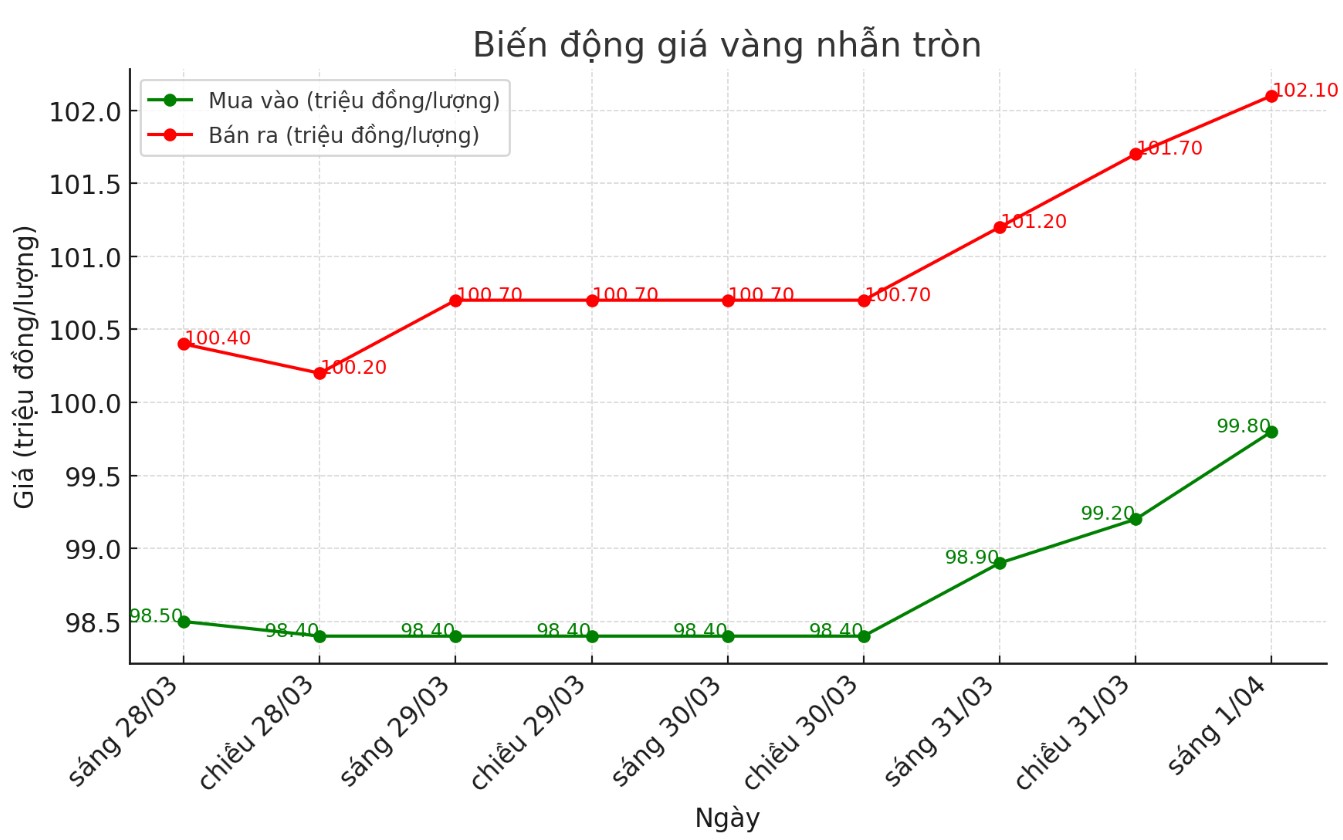

As of 9:00 a.m. today, the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at 99.8-102.1 million VND/tael (buy - sell), an increase of 900,000 VND/tael for both buying and selling. The difference between buying and selling is listed at 2.3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 99.8-102.1 million VND/tael (buy - sell), an increase of 500,000 VND/tael for buying and an increase of 800,000 VND/tael for selling. The difference between buying and selling is 2.3 million VND/tael.

World gold price

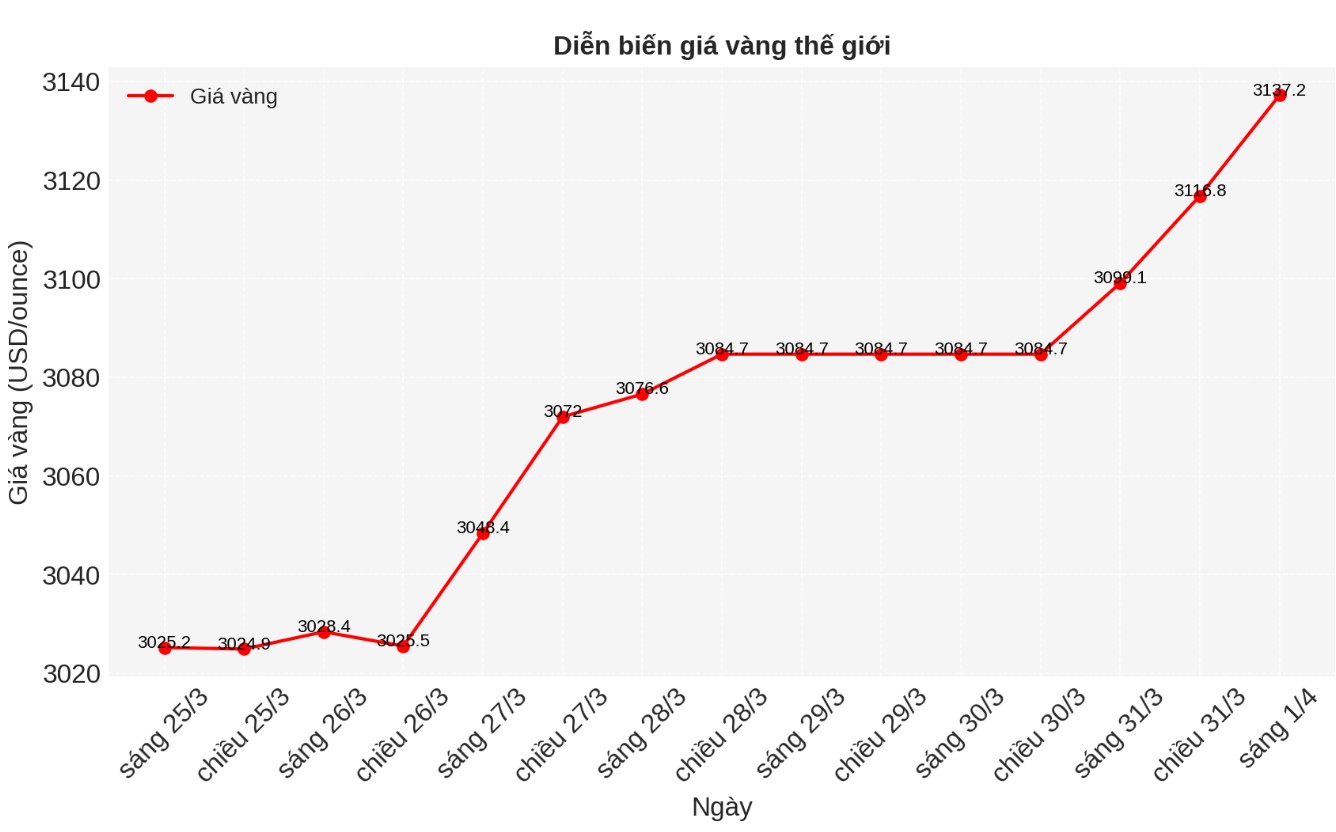

At 9:30 a.m. on March 31, the world gold price listed on Kitco was around 3,137.2 USD/ounce, up 38.1 USD/ounce compared to the beginning of the trading session yesterday morning.

Gold price forecast

Gold prices increased sharply as gold ETFs continued to record large capital flows in the context of concerns about trade tariffs. Meanwhile, investment in silver has not caught up, although the metal has a superior price increase than gold in the first quarter of 2025 - according to analysis by experts at Heraeus.

In the latest report, analysts noted that the People's Bank of China is slowing down the pace of gold purchases.

In February, the Peoples Bank of China reported adding 16,000 ounces of gold to its reserves. This is the fourth consecutive month that the bank has added gold since its buying activity resumed in November last year.

Previously, from November 2022 to March 2024, China bought more than 1 million ounces of gold, an average of 59,000 ounces/month. However, as gold prices increase, the scale of purchases decreases. Currently, with gold prices exceeding $3,000/ounce, the amount of gold purchased is only an average of 20,000 ounces/month since November 2024.

They emphasized that the buybacks are not necessarily related to current gold prices. However, central bank demand has supported gold prices over the past 24 months, and a decrease in purchases could undermine this momentum.

Meanwhile, institutional investors increased their allocation to gold as prices continued to increase: Gold ETFs have recorded strong capital flows in the past month. On March 21, these funds added about 23 tonnes of gold, their biggest one-day increase since 2022. In the first quarter of 2025, gold ETFs attracted about 152 tons of net, bringing their total holdings to their highest level since September 2023, said experts at Heraeus.

"The gold rally was driven by escalating geopolitical tensions, concerns about inflation and strong investor demand," said Heraeus Metals Germany's Alexander Zumpfe. In the current context of the macro economy - especially the instability of trade wars and central bank policies - this trend seems sustainable in the short term.

According to analysts from Capital Economics, banks' reduced exposure to the USD is not the main driver for central banks to seek gold. The company's experts say that the main driver for central banks to seek gold is their awareness of the precious metal's safe-haven role. This demand may support gold prices to rise above $3,300/ounce by the end of 2025.

In addition, investors' demand for gold is increasing strongly, reflected in the flow of money into exchange-traded funds increasing, with the largest weekly flow of money since March 2022, signaling the wave of money pouring into this precious metal.

Precious metals trader Alexander Zumpfe of Heraeus Metals Germany said that while North American funds have seen inflows, the general trend shows growing demand from European investors looking for safe-haven assets.

See more news related to gold prices HERE...