Gold prices are trading at a record high and approaching $3,000/ounce. While many are waiting for this milestone, Macquarie Bank believes that gold's rally will not stop even if it breaks this level.

Macquarie's commodity analysis team, led by Marcus Garvey, updated its 2025 gold price forecast on Thursday. They predict gold could reach $3,500/ounce by the third quarter of 2025, approaching an all-time high set by January 1980 inflationary adjustments.

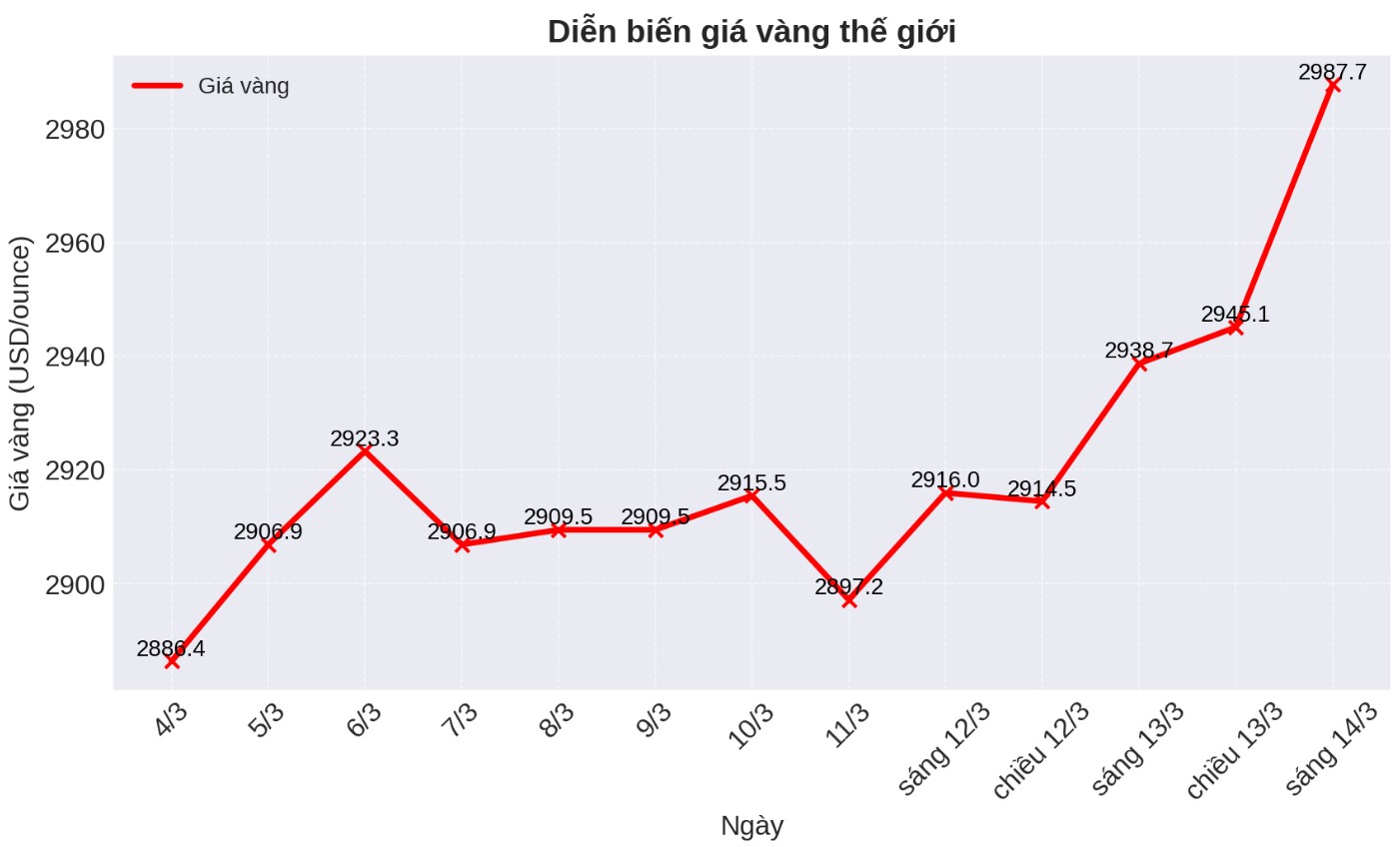

The new forecast comes as gold prices have reached the bank's target for the second quarter. Currently, spot gold prices are at 2,982.6 USD/ounce, up 1.62% on the day and have increased by more than 13% since the beginning of the year.

According to experts, gold is still an important safe haven asset as the bank's economists predict that global economic growth could decrease to only 0.3% in the third quarter of this year.

We see the strength of gold prices up to this point, as well as the prospect of continuing to increase, mainly because investors and institutions are willing to officially bid higher for the characteristics of no credit risks or partners of gold.

This was clearly demonstrated when gold prices hit a nominative record high of $2,956/ounce on February 24, although the opportunity cost of holding gold (not-yielding) remained high, the report wrote.

In addition to its safe-haven role, Macquarie found that gold was also supported by the US government's deteriorating financial outlook. The country continues to face the risk of a government shutdown as the National Assembly has yet to pass a new funding bill. In the future, experts do not expect the US to cut spending significantly.

While the outcome is still uncertain, we believe the US budget deficit will continue to deteriorate compared to current law. Taxes, savings from the Department of Government Efficiency (DOGE) and Medicaid cuts may not be enough to cover the extension of the Tax Cuts and Employment Act (TCJA), causing the deficit to increase by about 1.5 percentage points.

In this challenging fiscal context, along with the general situation of many developed economies, gold prices are likely to remain at historical highs, the analysis team said.

Garvey's team also predicted that gold prices will increase more strongly if there is pressure to affect the US Federal Reserve (FED) to promote interest rate cuts. Currently, the FED is still neutral, showing that it is not in a hurry to adjust interest rates because the US labor market remains stable and there are still inflation risks.

Although gold is about to reach an important milestone, Macquarie noted that the market has not shown any signs of "too hot". They pointed out that investment demand in gold ETFs is still 20% lower than the peak in 2020, showing that the market still has much room for growth.

Experts also believe that the risk of gold price reduction this year is very low.

For the environment to support gold prices to change, it may require a change in market expectations for US budget deficits or the emergence of positive factors that will keep real yields high in the long term.

For example, a sharp increase in labor productivity could boost long-term GDP growth. However, this is not our baseline scenario, the report said.

Although gold is expected to continue to lead the precious metals market, Macquarie is also optimistic about silver. They raised their silver price forecast to 33.5 USD/ounce in the third quarter of this year, higher than the previous forecast of 31 USD/ounce.

However, the bank still maintains that the gold- silwer ratio will be high, nearly 92 points. Macquarie predicts that silver supply and demand will continue to be unbalanced, supporting prices in 2024 and 2025.