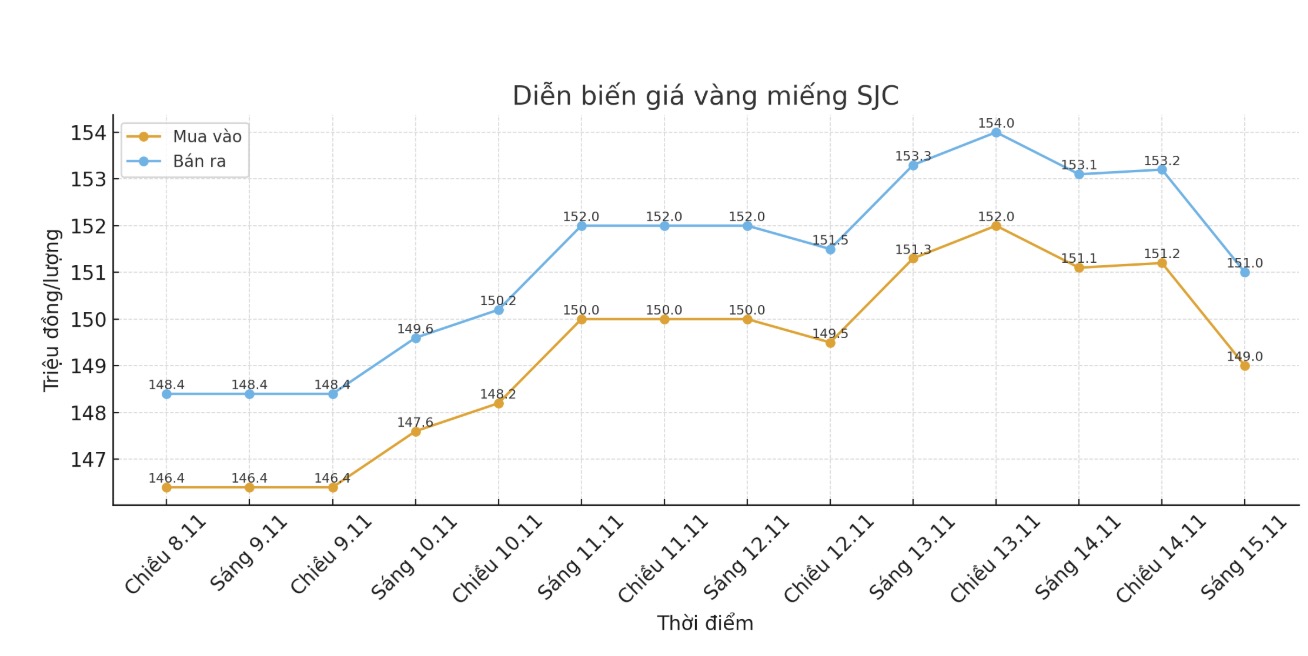

Updated SJC gold price

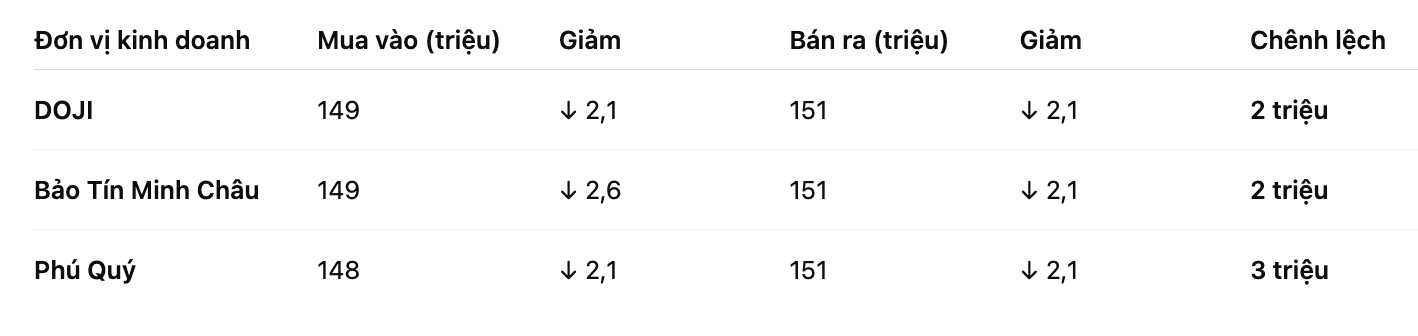

As of 10:00, the price of SJC gold bars was listed by DOJI Group at 149-151 million VND/tael (buy - sell), down 2.1 million VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 149-151 million VND/tael (buy - sell), down 2.6 million VND/tael for buying and down 2.1 million VND/tael for selling. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 148-151 million VND/tael (buy - sell), down 2.1 million VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

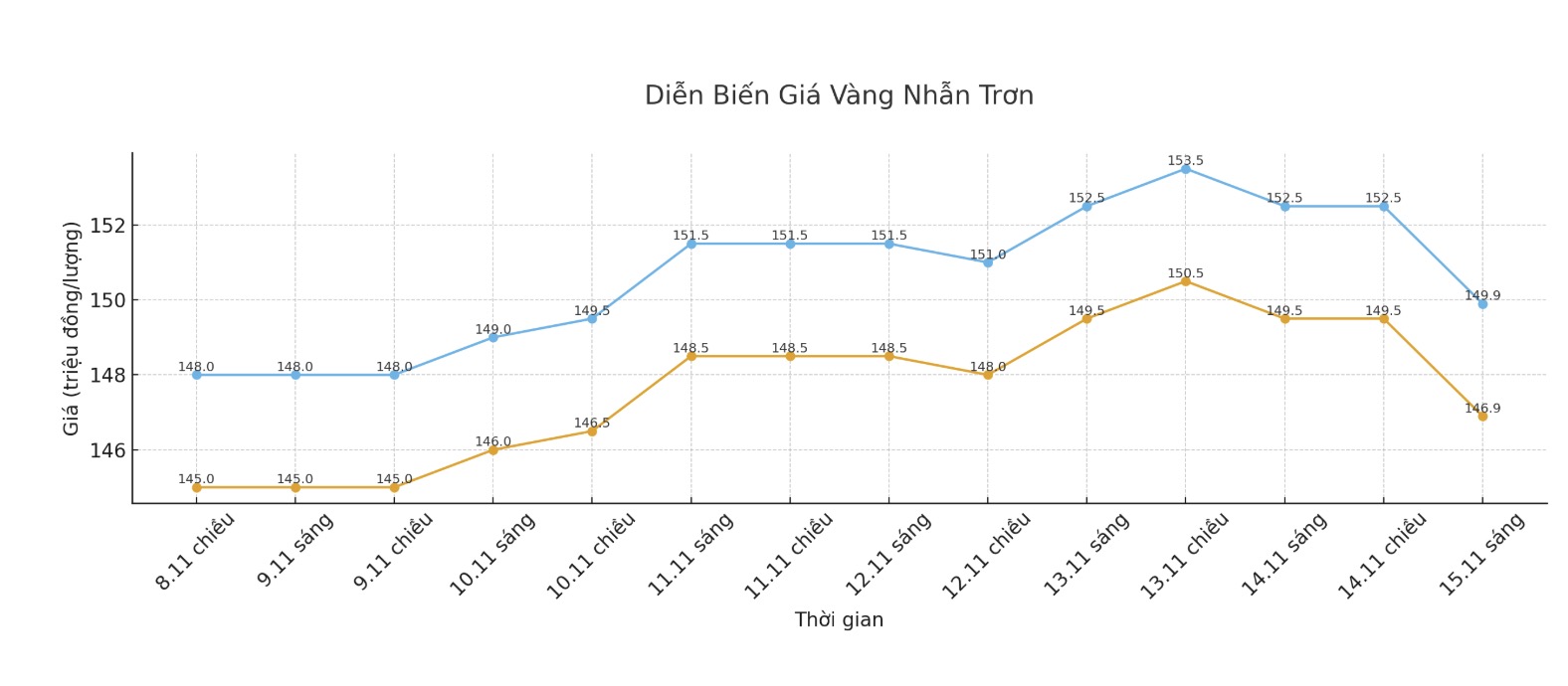

9999 round gold ring price

As of 10:00, DOJI Group listed the price of gold rings at 146.9-149.9 million VND/tael (buy - sell), down 2.6 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 147.8-150.8 million VND/tael (buy - sell), down 2.5 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 147.5-150.5 million VND/tael (buy - sell), down 2.3 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

The buying-selling gap is at a high level, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

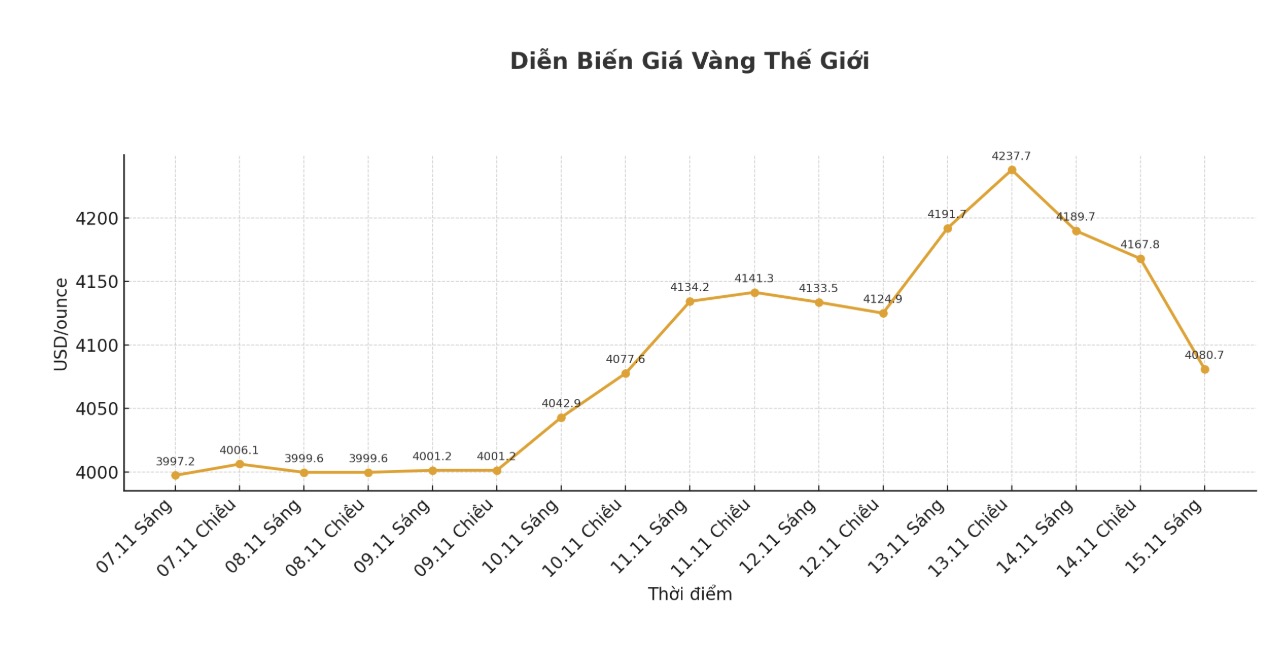

World gold price

At 10:00, the world gold price was listed around 4,080.7 USD/ounce, down 109 USD compared to a day ago.

Gold price forecast

Gold and silver prices fell sharply as market expectations of the possibility of the US Federal Reserve (FED) cutting interest rates in December weakened this weekend. The pressure to take profits from short-term futures traders also appeared in both metals, along with the selling pressure to liquidate buying positions.

Strong statements from Fed officials right before a series of important economic data have raised investors' concerns. As optimism about ending the US government's closure has been reflected in prices, concerns about stock valuations have returned, triggering a wave of sell-offs in technology groups.

Fed officials on Thursday expressed caution over the possibility of a rate cut in the coming time, causing the currency market to lower expectations for a December rate cut to below 50%, according to Bloomberg.

In separate statements, the Fed President of the St. Petersburg branch said. Louis, Alberto Musalem, said the Fed should take cautious action as inflation remains above target.

Fed Chairman Cleveland Beth Hammack stressed that monetary policy needs to maintain certain levels of tightening. Fed Fed Minneapolis Chairman Neel Kashkari said he did not support the latest cut and had not yet decided on December.

According to the CME FedWatch tool, investors are now predicting a 50% lower probability that the Fed will cut interest rates by 0.25% at its December meeting, lower than the 62.9% probability that the market had predicted earlier this week and the 95.5% probability 1 month ago.

Investors are expecting the Fed to cut interest rates again in December to restore the economy, as well as accept risks on Wall Street. However, some Fed members are increasingly concerned that inflation is too high to continue cutting interest rates this year.

"The market is betting lower on the US Federal Reserve (FED) cutting interest rates in December. This has slowed the rally in gold and silver, said David Meger, director of metals trading at High Ridge Futures.

Meanwhile, the stock market also plummeted after a wave of global sell-offs when the FED signaled a "hawl" policy, according to Reuters.

Technically, the next target for December gold futures buyers is to close above the strong resistance level at a record $4,398/ounce. The latest downside target for the bears is to push prices below the solid support level of $4,000/ounce.

The first resistance level was seen at $4,200/ounce, followed by an overnight peak of $4,215.1/ounce. First support was at 4,100 USD/ounce and then 4,050 USD/ounce.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...