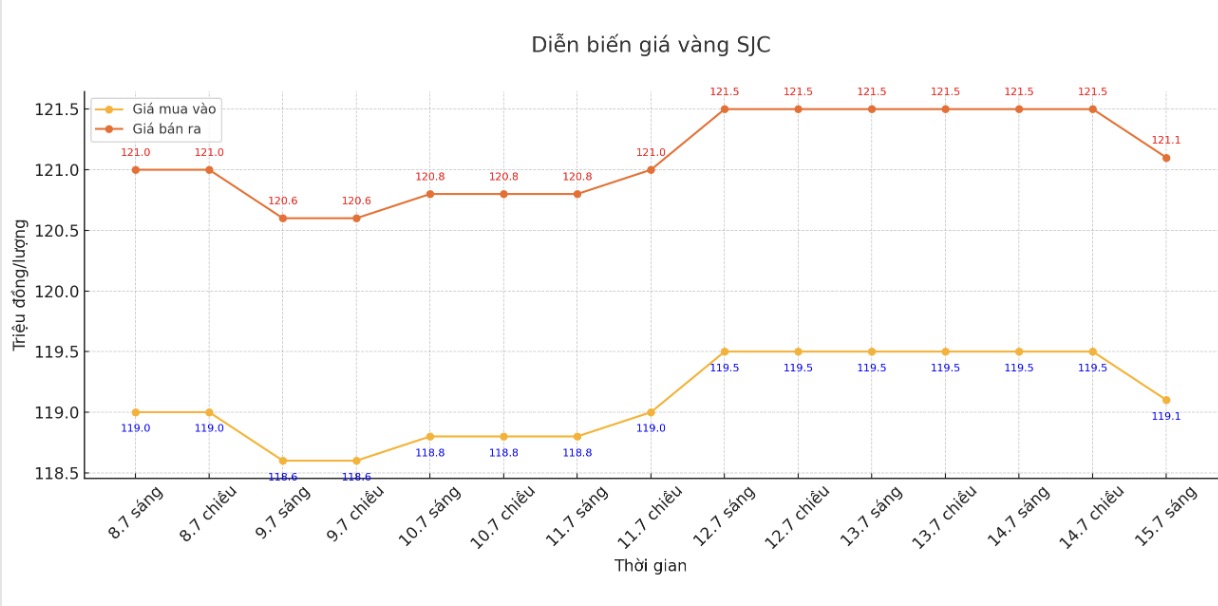

Updated SJC gold price

As of 9:40 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND 119.1-121.1 million/tael (buy in - sell out), down VND 400,000/tael. The difference between buying and selling prices is at 2 million VND/tael.

DOJI Group listed the price of SJC gold bars at VND 119.1-121.1 million/tael (buy in - sell out), down VND 400,000/tael. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at VND 119.1-121.1 million/tael (buy in - sell out), down VND 400,000/tael. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at VND 118.4-121.1 million/tael (buy in - sell out), down VND 400,000/tael. The difference between buying and selling prices is at 2.7 million VND/tael.

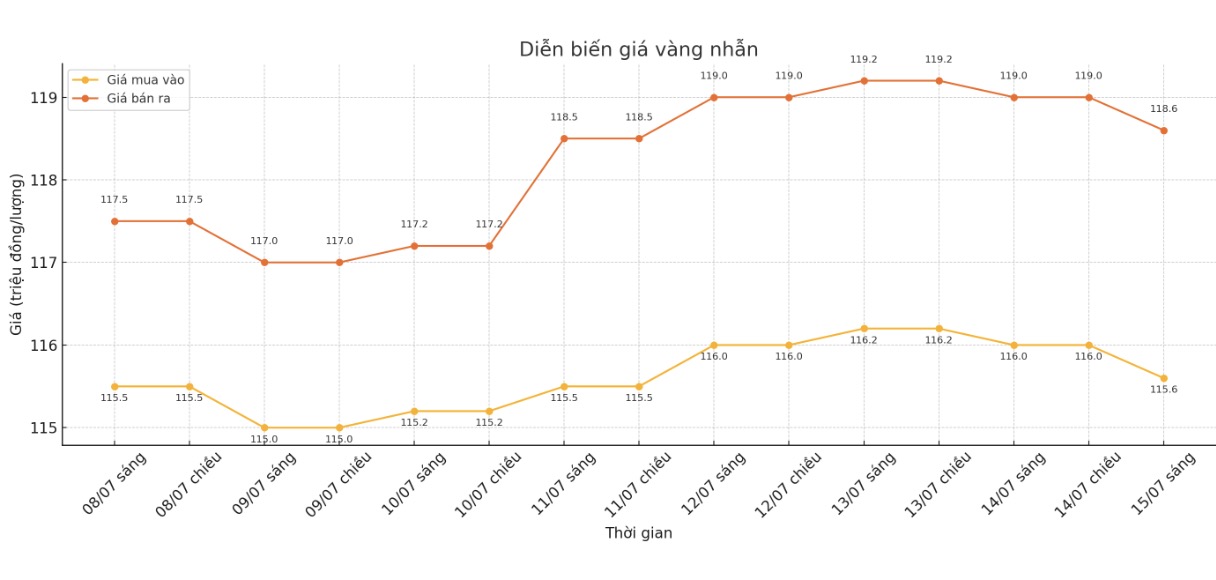

9999 round gold ring price

As of 9:40 a.m., DOJI Group listed the price of gold rings at 115.6-118.6 million VND/tael (buy in - sell out), down 400,000 VND/tael. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 115.8-118.8 million VND/tael (buy - sell), down 400,000 VND/tael. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 115-118 million VND/tael (buy in - sell out), down 300,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

The buying-selling gap is pushed up too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

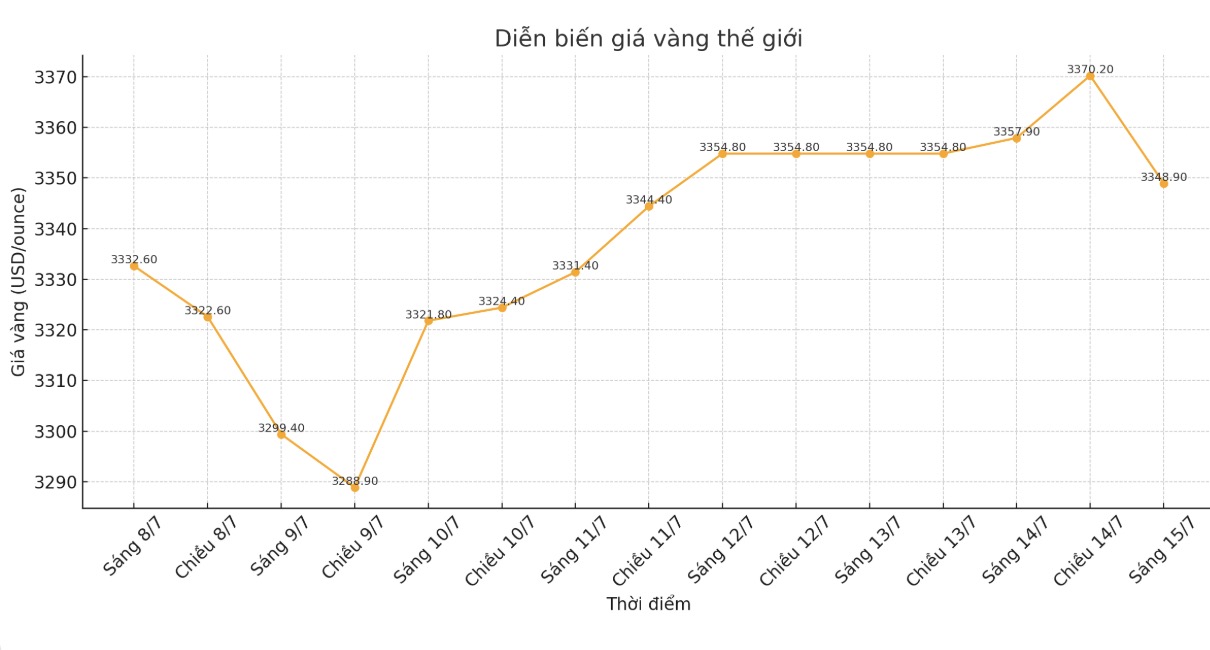

World gold price

At 9:45 a.m., the world gold price was listed around 3,348.9 USD/ounce, down 6 USD/ounce.

Gold price forecast

Last night, gold prices increased due to increased risk concerns in the market at the beginning of the week, boosting demand for safe-haven metals. However, prices quickly decreased after that due to investors' large profits.

Since April, the increase in gold prices has been held back by cash flow moving to the US stock market, especially the S&P 500 index. Analysts say the market is in the classic "coil" model (ie accumulation waiting for a breakthrough) and could fluctuate strongly if there are macro risks or changes in the interest rate policy of the US Federal Reserve (FED).

According to the World Gold Council, global central banks net bought 20 tonnes of gold in May, 27 tonnes below the 12-month average, but still showed a clear accumulation trend.

95% of central banks surveyed believe that official gold reserves will continue to increase next year, significantly higher than last year's 81%. Notably, 43% of central banks said they will increase gold reserves - a record high to date.

According to analysts at Heraeus, although gold prices have recently stagnated, a weakening USD could fuel the next rally. The consensus forecast for the fourth quarter of 2025 has fallen from 107.25 to 96.8, suggesting the USD could fall 1% by the end of the year and another 4% in 2026.

Heraeus said gold is still supported around $3,240/ounce. If the USD continues to weaken and investment demand remains strong, gold could surpass the $3,500/ounce threshold. Conversely, if the support threshold is lost, the increase may be delayed until the end of the year.

Strategist Joe Cavatoni from the World Gold Council said that the stable gold price around 3,300 USD/ounce is a clear sign that the market lacks clear interest rates and trade. The US's sudden imposition of a 50% tariff on imports is a warning for the possibility of a surprising policy on gold. If the Fed adjusts interest rates at the end of the year, falling opportunity costs could help gold prices increase in the short term.

Economic data to watch this week

Tuesday: US Consumer Price Index (CPI), Empire State manufacturing survey.

Wednesday: US Producer Price Index (PPI).

Thursday: Retail sales, Philly Fed manufacturing survey, US weekly jobless claims.

Friday: Newly started houses, University of Michigan preliminary consumer confidence index.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...