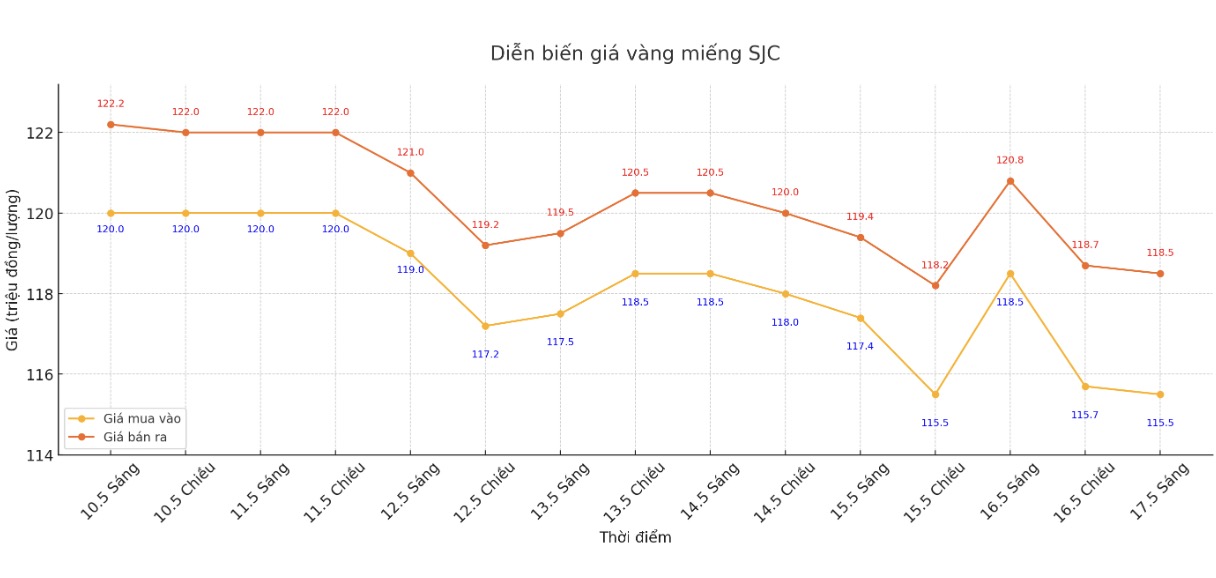

Updated SJC gold price

As of 9:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND115.5-118.5 million/tael (buy - sell), down VND3 million/tael for buying and down VND2.3 million/tael for selling. The difference between buying and selling prices is at 3 million VND/tael.

At the same time, DOJI Group listed the price of SJC gold bars at VND 115.5-118.5 million/tael (buy - sell), down VND 3 million/tael for buying and down VND 2.3 million/tael for selling. The difference between buying and selling prices is at 3 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 115.5-118.5 million VND/tael (buy - sell), down 3 million VND/tael for buying and down 2.3 million VND/tael for selling. The difference between buying and selling prices is at 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at VND115-118.5 million/tael (buy - sell), down VND2.5 million/tael for buying and down VND2.3 million/tael for selling. The difference between buying and selling prices is at 3 million VND/tael.

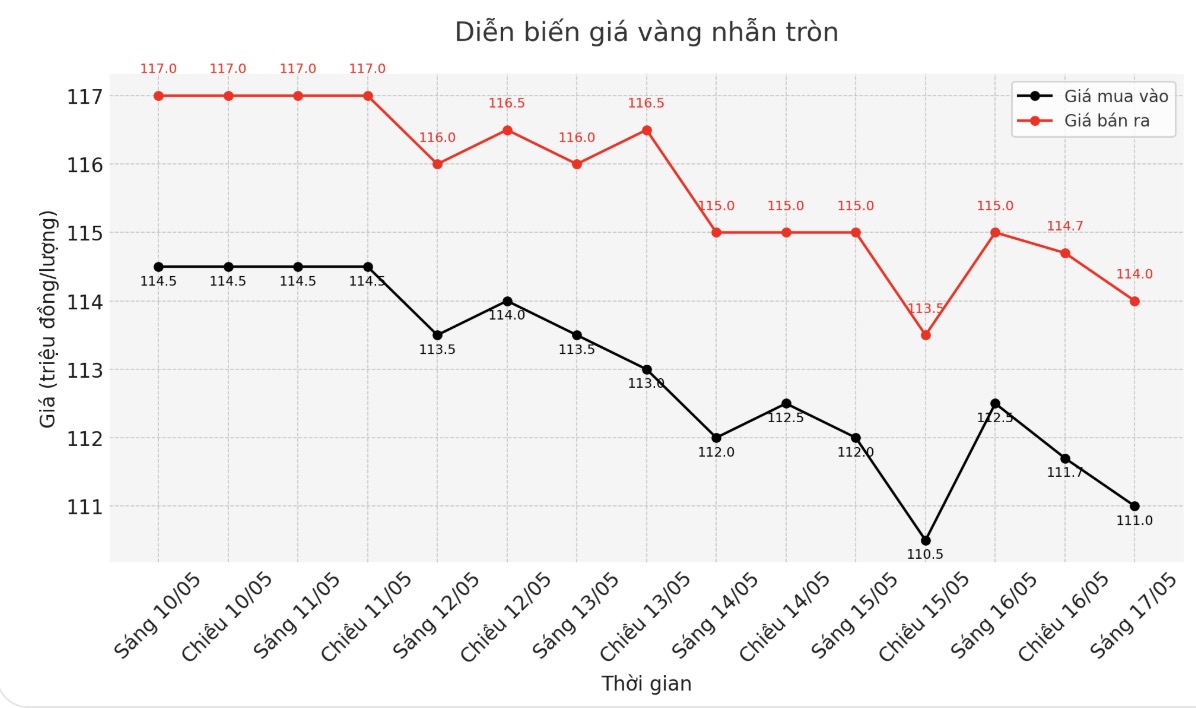

9999 round gold ring price

As of 9:00 a.m., the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at 111-114 million VND/tael (buy - sell), down 1.5 million VND/tael for buying and down 1.2 million VND/tael for selling. The difference between buying and selling prices is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 114-117 million VND/tael (buy - sell), down 500,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 111.8-124.8 million VND/tael (buy - sell), down 700,000 VND/tael in both directions, the difference between buying and selling is 3 million VND/tael.

In the context of strong fluctuations in domestic gold prices, the buying-selling gap is pushed too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

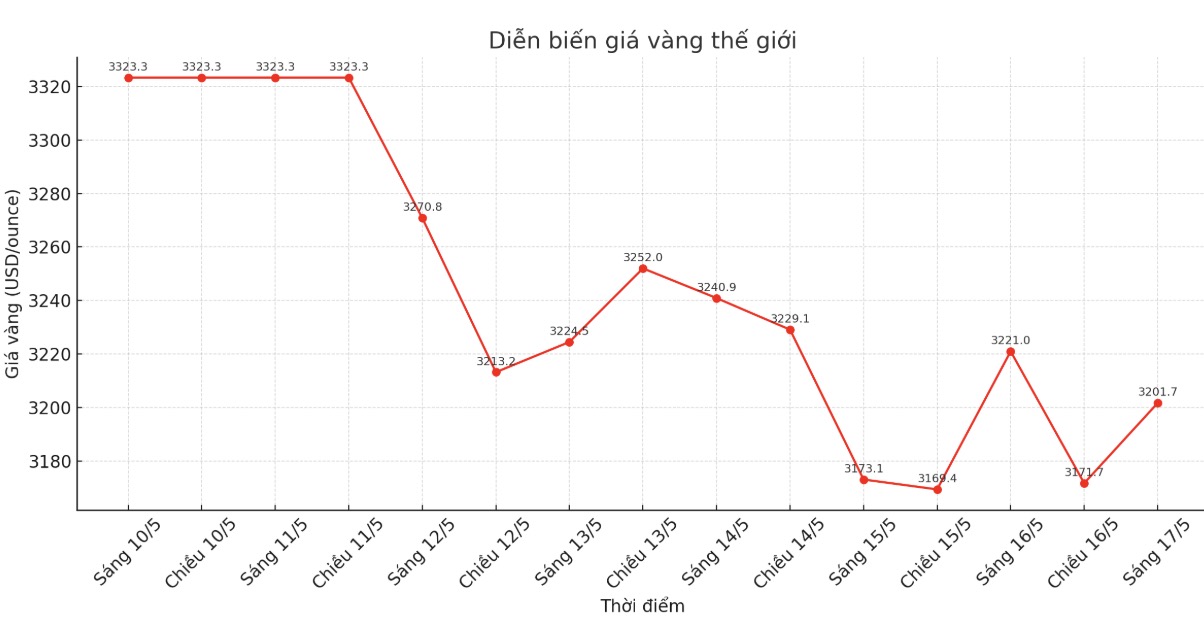

World gold price

At 9:12 a.m., the world gold price listed on Kitco was around 3,201.2 USD/ounce, down 19.3 USD/ounce.

Gold price forecast

According to Kitco - gold prices continued to slide as US consumer sentiment got worse than expected, while inflation expectations continued to increase.

The University of Michigan's Friday announcement showed that the US preliminary consumer sentiment index for May reached 50.8 points, down from 52.2 points in April. This result is better than analysts' expectations, with the index forecast to increase to 53.4 points.

The psychological index has remained almost unchanged this month, falling slightly by only 1.4 points after 4 consecutive months of sharp decline. From January 2025 to now, consumer sentiment has decreased by nearly 30%" - said Director of Consumer survey Joanne Hsu.

In another development, the US Commerce Department said that the number of housing projects started last month increased by 1.6%, reaching 1.361 million units at an annual rate, up from the adjustment of 1.339 million units in March. This result is in line with the experts' predictions.

However, compared to the same period last year, the number of houses under construction has decreased by 1.7%. In particular, the construction of houses for a household (single-parent houses) decreased by 2.1%, showing that this segment is still quite quiet.

Investors are still cautious as the number of construction permits - a clue for future construction activities - has decreased sharply compared to last month, lower than market expectations. In addition, the continued decline in the construction of single-member houses reflects weak demand due to high home loan interest rates. If this trend continues, the US economic outlook could deteriorate, thereby boosting demand for gold in the medium and long term as a safe-haven asset.

In the latest edition of the annual report In Gold We Trust, published on Thursday, the research team of fund management company Incrementum AG reaffirmed golds long-term bullish outlook, forecasting prices to reach $4,800/ounce by 2030.

According to Incrementum, central banks will find it difficult to control inflation in the context of rapidly increasing global public debt. Gold will reaffirm its role as an important monetary asset in the global financial system.

Long-term loose and low interest rate policies are eroding investor confidence, boosting demand for gold as a financial hedge.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...