The price increase of gold and silver is seen as a technical recovery after both precious metals fell in Tuesday's session, and the market also tends to balance positions before the minutes of the US Federal Reserve (FOMC) meeting are announced.

The focus of investors' attention during the day was the minutes of the FOMC meeting. Previously, at the January meeting, the Fed decided to keep interest rates unchanged. The market will carefully examine signals about the possibility of interest rate cuts in the near future, because expectations of monetary policy easing often support commodity groups, as it may stimulate demand.

Regarding policy views, Fed Governor Michael Barr said that interest rates need to be kept stable "for a while" until more evidence shows that inflation is approaching the central bank's 2% target.

Meanwhile, Chicago Fed Chairman Austin Goolsbee said that there is still a possibility of interest rate cuts this year if inflation continues to go in the right direction towards this target.

In geopolitical developments, nuclear negotiations between the US and Iran in Geneva on Tuesday were assessed by the US as "progressive", although there are still many detailed contents to be further discussed, according to Axios.

In another piece of information, Japan is said to be starting to deploy large-scale investments in the US. According to Bloomberg, Japan is expected to invest up to $36 billion in important oil and gas and mineral projects in the US, considered the first disbursement of the $550 billion commitment under the trade agreement with the administration of US President Donald Trump.

The projects mentioned include a natural gas facility in Ohio, a deep-water crude oil export facility in the Gulf of Mexico and a synthetic industrial diamond factory, aimed at strengthening the supply chain and creating bilateral benefits.

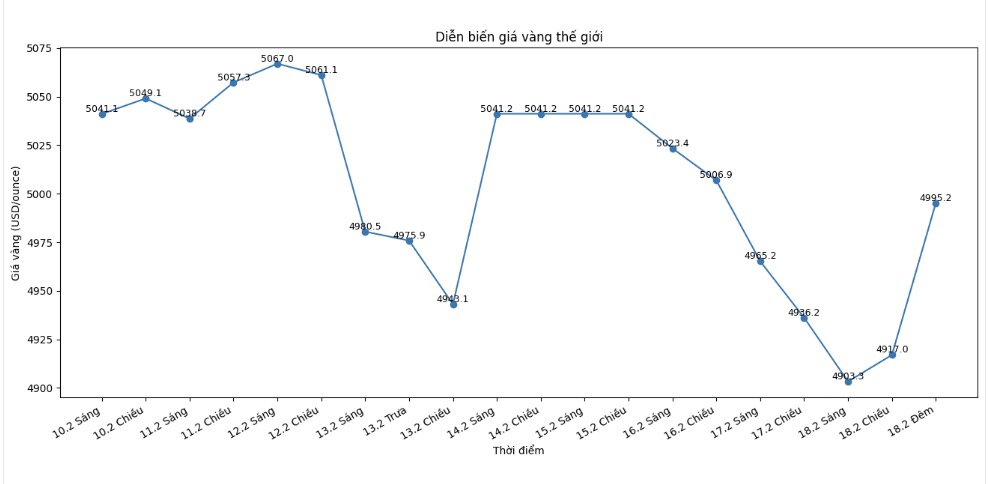

Technically, with gold for April delivery, buyers are aiming to close above the strong resistance zone of 5,250 USD/ounce; while sellers want to pull prices down below the important support zone around 4,670 USD/ounce. The near resistance level is at 5,000 USD/ounce and then 5,074.4 USD/ounce; near support is at 4,854.2 USD/ounce and then 4,800 USD/ounce.

For silver for March delivery, the upward target is to close above the strong resistance zone of 90 USD/ounce, and the downward target is to pull the price to close below the support zone of 63.90 USD/ounce. The near resistance of silver is 78.42 USD/ounce then 80 USD/ounce; near support is at 71.815 USD/ounce and then 71 USD/ounce.

On related markets, the USD index increased slightly. Crude oil prices went up, trading around 63.75 USD/barrel. The yield on 10-year US Treasury bonds was around 4.06%.