Last night, gold prices once jumped to the highest level of the session around 5,032 USD/ounce but did not attract strong enough buying force, because the Chinese market was closed for a whole week to welcome the Lunar New Year.

This precious metal then underwent slight but continuous selling pressure since its overnight peak. Analysts did not expect major fluctuations on Monday, as the US market was on Presidents' Day holiday. The Toronto Stock Exchange (Canada) also closed due to Ontario celebrating Family Day.

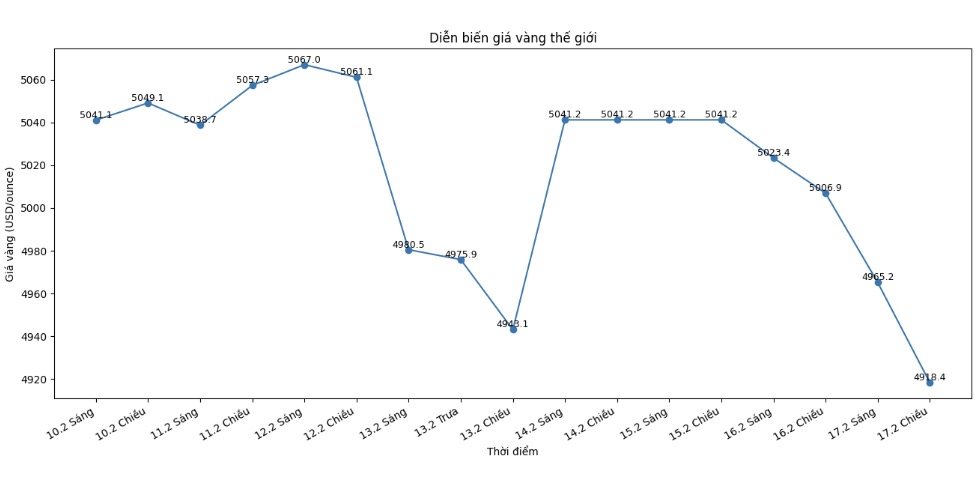

The nearest spot gold price (recorded at 4:35 PM on February 17 - Vietnam time) was at 4,918.4 USD/ounce.

The silver market also recorded similarly quiet trading. At the same time, spot silver price was at 74.53 USD/ounce. Silver is at a disadvantage compared to gold when it cannot hold the 80 USD/ounce mark and is still significantly lower than the peaks reached last month.

Although gold prices are forming a new trading channel around the 5,000 USD/ounce mark, experts warn that the market is still in the process of finding bottom, which may cause volatility to remain at a high level. However, most opinions believe that the final corrections will be bought, because fundamentals are still solid.

Talking to Kitco News, Elior Manier - market analyst at OANDA, said that gold prices are still well supported around the 5,000 USD/ounce range in the context of high geopolitical instability.

Gold can only be strongly adjusted if geopolitical risks cool down. In any case, at the current price level, the upward momentum may slow down," he said. "In my opinion, there is still room for reduction, but it depends on geopolitical developments.

David Morrison - senior analyst at Trade Nation, said gold still faces downward risk as momentum indicators continue to signal overbought.

The big question now is whether gold can rebound strongly from here to test a new historical peak, or whether another correction is needed to rebalance momentum. Although the MACD has fallen from the overbought zone, it is still significantly higher than the neutral line. At least, gold may need more accumulation time before continuing to rise. And there is always a possibility that the peak has been set" - he wrote in the report.

Morrison believes that gold and silver may continue to move sideways until there is a clear signal from the US Federal Reserve (Fed), which is expected to maintain a neutral monetary policy stance until at least June.

Daniel Hynes, senior commodity strategist at ANZ, said that after inflation data was lower than expected, expectations of the Fed having a third interest rate cut in December have increased.

The long-term story of gold is still positive. The macroeconomic environment is generally supportive. Geopolitical and economic instability is likely to last, especially as Donald Trump continues to use tariffs as a tool.

The market is gradually paying more attention to the potential impact of tariffs, a factor that does not fully reflect economic and inflation data. At the same time, doubts about the Fed's policy credibility still exist. This context could boost demand for real assets like gold," he said.