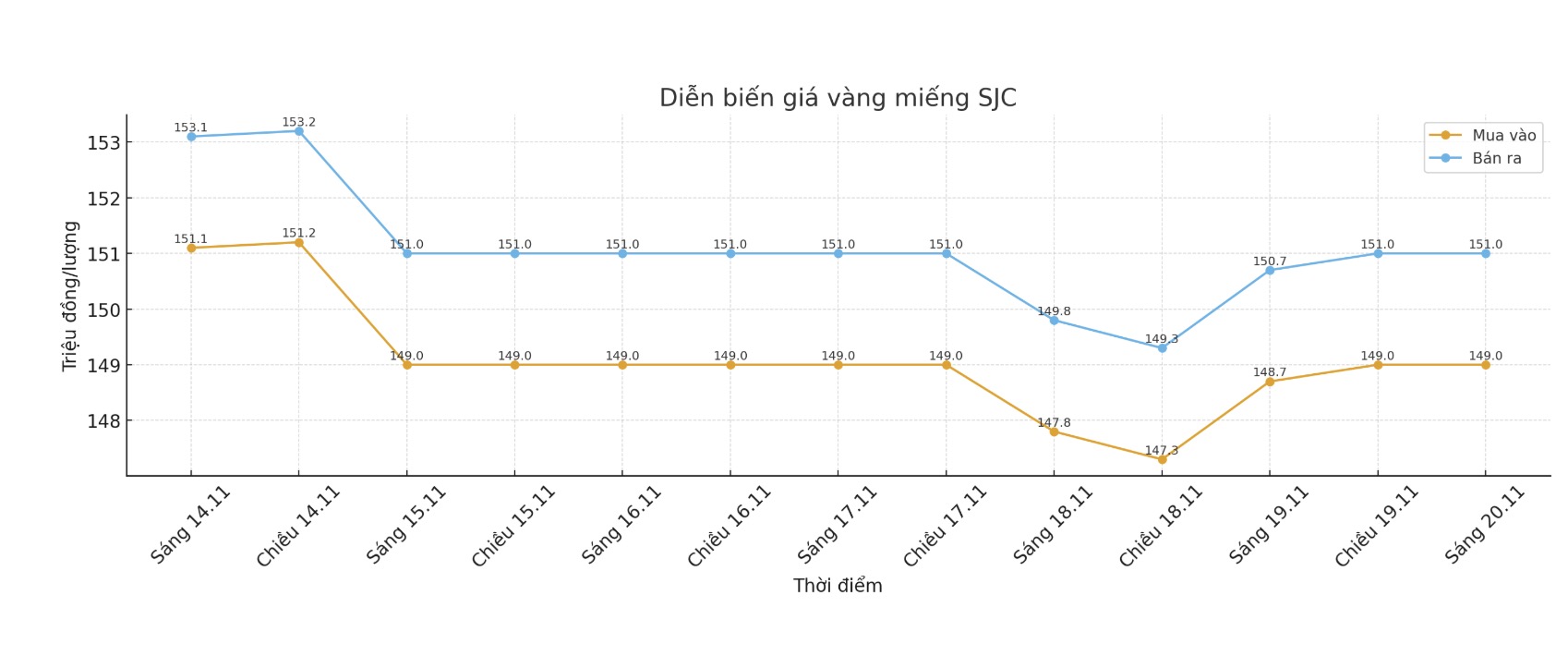

Updated SJC gold price

As of 9:00 a.m., DOJI Group listed the price of SJC gold bars at 149-151 million VND/tael (buy - sell), an increase of 300,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 149.5-151 million VND/tael (buy - sell), an increase of 300,000 VND/tael in both directions. The difference between buying and selling prices is at 1.5 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 148-151 million VND/tael (buy - sell), an increase of 300,000 VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

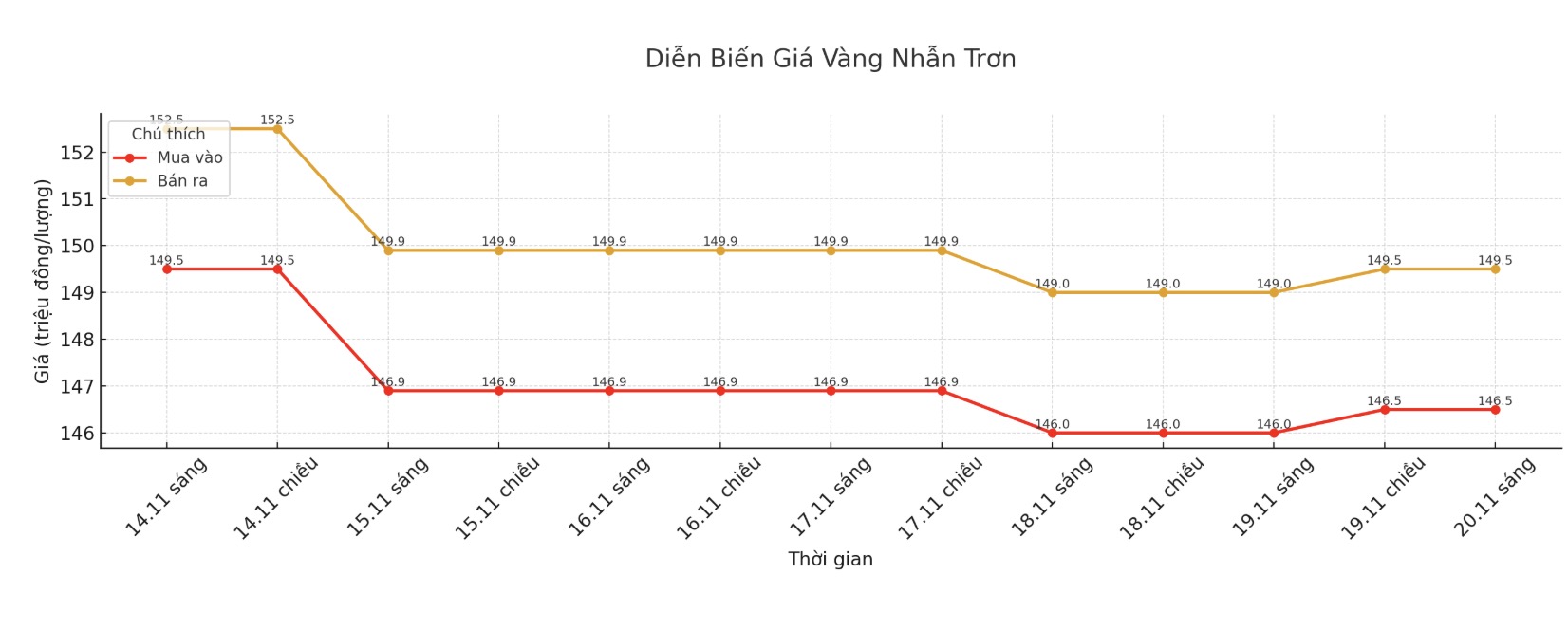

9999 round gold ring price

As of 9:00 a.m., DOJI Group listed the price of gold rings at 146.5-149.5 million VND/tael (buy in - sell out), an increase of 500,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 148.3-151.3 million VND/tael (buy - sell), an increase of 300,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 147.5-150.5 million VND/tael (buy - sell), an increase of 500,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

The buying-selling gap is at a high level, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

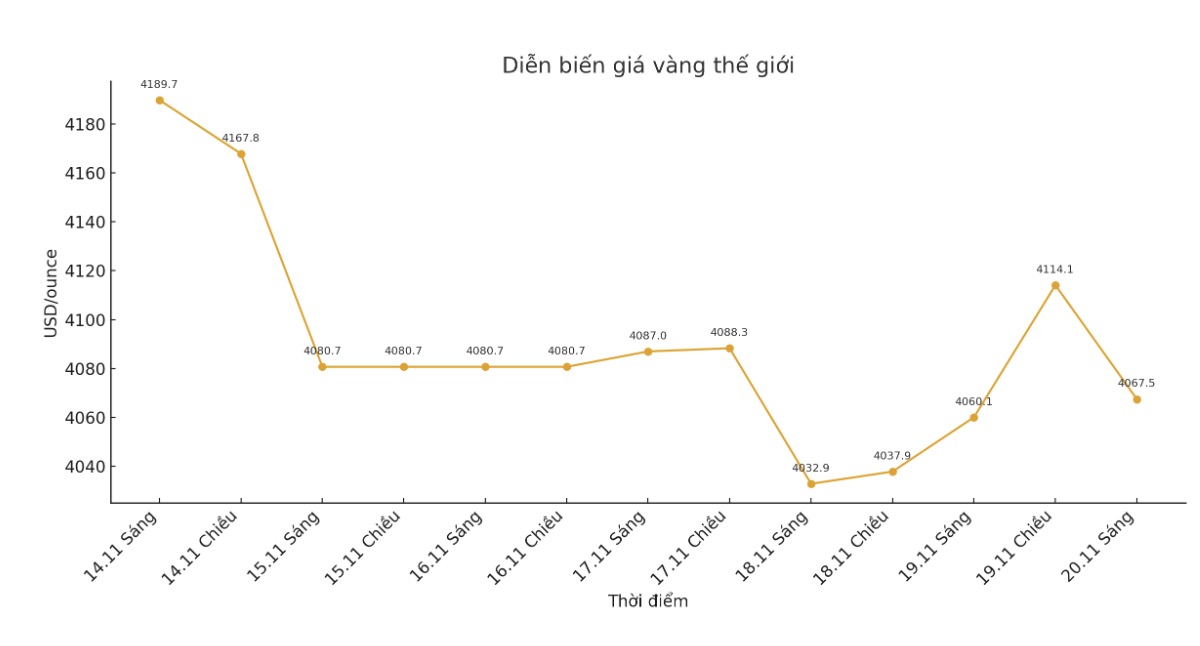

World gold price

At 9:06, the world gold price was listed around 4,067.5 USD/ounce, up 7.4 USD compared to a day ago.

Gold price forecast

The precious metal is struggling as investors await the minutes of the latest meeting of the US Federal Reserve (FED) and the US employment report is delayed in search of clues on the interest rate roadmap.

Investors are now waiting for the minutes of the latest FED meeting, due to be released on the same day, along with the September non-farm payrolls report due to delays due to the US government's temporary closure.

According to CME Group's FedWatch tool, traders are now assessing the possibility of the Fed cutting interest rates at its December 9-10 meeting at nearly 49%.

The gold rally has been partly held back by a stronger US dollar and doubts about when the Fed could cut rates further, said Tim Waterer, chief market analyst at Ho Chi Minh City Trade.

Amid the peak of gold prices, the Chinese market recorded unseasonal increased wholesale demand, gold ETFs attracted strong capital, transactions exploded and PBoC continued to buy.

Mr. Ray Jia - Head of China Market Research at the World Gold Council (WGC) said that the Chinese gold market in October grew much stronger than the usual at this time of year, and in November it still maintained its upward momentum.

At the same time, China's gold ETFs attracted a large amount of capital and the volume of gold futures also increased sharply.

In the latest updated report on the Chinese gold market, Jia commented that October is a "story of two halves". He said gold prices rose sharply in the first half of the month, continuously setting new highs due to increased risks and strong buying from ETFs, before cooling down at the end of the month as geopolitical tensions eased and profit-taking activities took place. At the end of October, both LBMA Gold Price PM and SHAUPM gold prices recorded positive increases, bringing the total increase since the beginning of the year to 44% and 42%, respectively.

Technically, the next upside target for December gold buyers is to get the closing price above the strong resistance level at a record high of $4,398/ounce. The nearest downside target for the bears is to pull prices below the solid support level of $4,000/ounce.

The first resistance level was at today's peak of 4,134.3 USD/ounce, followed by 4,200 USD/ounce. First support was at the bottom of the night at $4,056.1 an ounce, then $4,000 an ounce.

In the outside market, the USD index increased, crude oil prices decreased to around 69.5 USD/barrel. The yield on the 10-year US Treasury note is at 4.13%.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...